ASIC Lifespan

How long will my Bitcoin miner last?

This is the 52nd edition of this letter.

52 weeks of Bitcoin mining education content.

I appreciate all of the readers and will continue to improve the packaging and alpha. Feel free to comment if there are any specific topics you would like to learn about.

Here’s to another 52 letters.

You just spent $10,000 on a shiny new Bitcoin miner.

Now you're wondering: "How long until this thing becomes an expensive paperweight?"

The pressing question every miner asks: When will my ASIC stop being profitable?

Here's the uncomfortable truth: Your miner's lifespan isn't measured in years of operation.

It's measured in how long it stays competitive against newer, more efficient machines. And that timeline is shrinking.

What Determines ASIC Lifespan?

Let's clear up a common misconception. When miners ask about "lifespan," they're really asking three different questions:

Physical lifespan: How long until the hardware breaks?

Economic lifespan: How long until it's unprofitable to run?

Competitive lifespan: How long until newer models make it obsolete?

Physical lifespan is dictated by mining conditions and care. Are you running your miner in a hot humid Texas desert or in a cool container in Iowa? What is the cooling method? Are there experienced repair techs monitoring performance 24/7?

Economic lifespan is impacted by power cost, the Bitcoin halving, and the price of Bitcoin (if the price of Bitcoin does what Peter Schiff thinks it’s going to do, your ASIC would be scrap metal).

Competitive lifespan is impacted by difficulty/hashrate growth (how many people are mining Bitcoin?), chip innovation, and ASIC efficiency improvements (are manufacturers constantly making better tech?)

Your miner will likely become economically obsolete long before it physically fails.

NOTE: You could practically run a miner FOREVER with access to 0 cost of power. It would cost you nothing to run it, so you could run it and receive payouts based on its hashrate or solo mine (like what people do with Bitaxe mini miners).

For our purposes, and if you are a client of Simple Mining, your cost of power is $0.07-$0.08/kWh, so we will use this when determining lifespan.

The March of ASIC Evolution

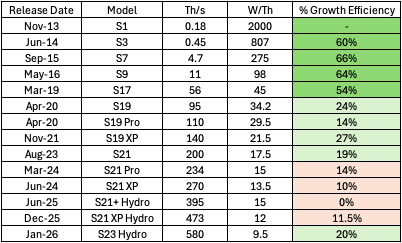

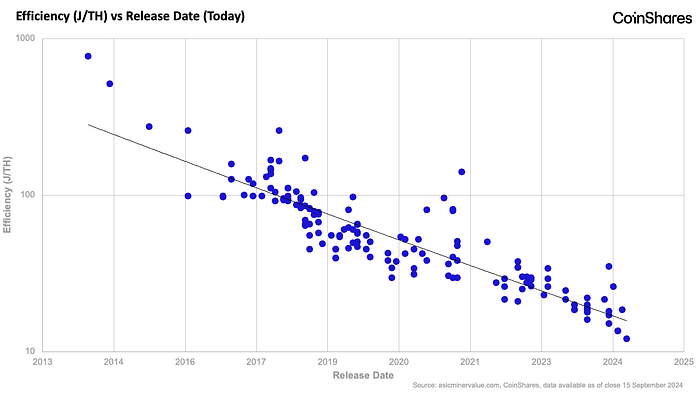

Let's look at how dramatically ASIC efficiency has improved since the beginning.

Here are 3 charts to tell the story:

Notice something?

Chart 1: % improvement in ASIC efficiency is declining

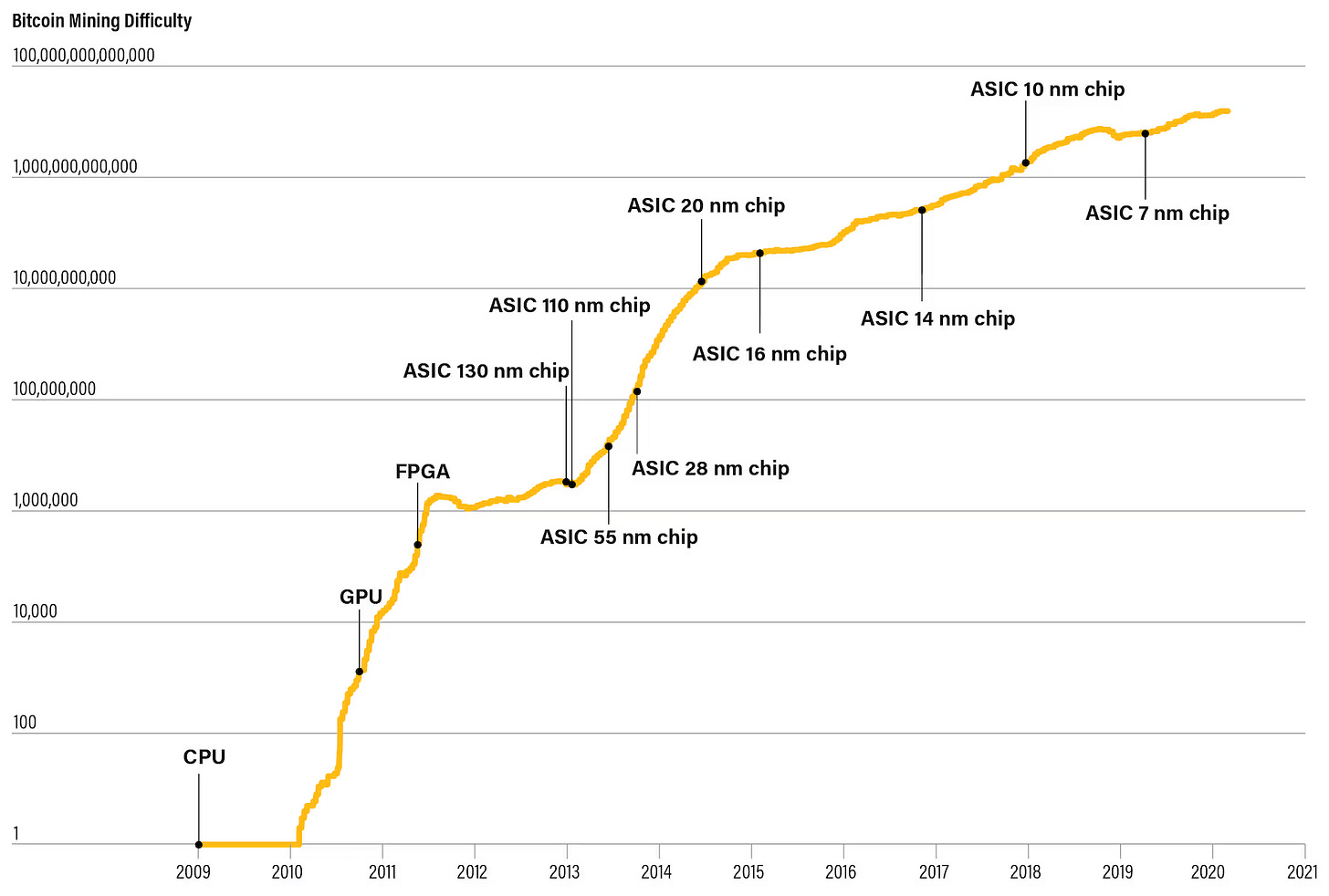

Chart 2: Chips are getting smaller, but at a slowing rate (supports Chart 1)

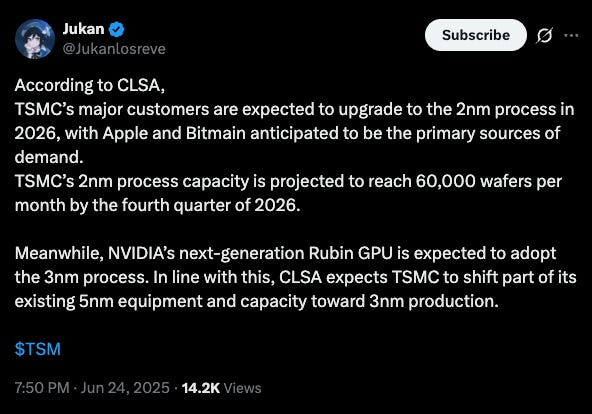

The chart is also outdated, 2nm chip may be available in 2026:

This is how small we are talking:

Chart 3: Efficiency is plotting towards 0 W/TH

Key point: Each generation brings smaller efficiency gains than the last.

The percentage gains are clearly diminishing.

And this isn't a coincidence—it's physics.

Moore's Law Meets Mining Reality

You've probably heard of Moore's Law:

The number of transistors in an integrated circuit (IC) doubles about every two years.

This applies to Bitcoin mining chips, and we can even see outperformance (100%+ over 2 years)

BUT, two important macro factors:

“Moore’s Law originally predicted transistor doubling every two years, but progress has slowed to about every three to four years”

“Extreme ultraviolet (EUV) lithography is now required for nodes below 7nm, costing up to $150 million per EUV machine”

What does this mean?

We're hitting the physical limits of silicon, and it is getting more expensive to create these chips.

A circuit can only get so small.

Physical limits: We're approaching atomic scales (3nm is only about 15 silicon atoms wide)

Heat dissipation: Smaller chips generate more heat per square millimeter

Manufacturing complexity: Each smaller node costs exponentially more to produce

The width of the wiring will eventually become a SINGLE atom, and last time I checked, atoms cannot get any smaller, at least not in this dimension.

Even if you imagine a quantum mining reality using the smallest theoretical items that can carry a binary state (spin of a single electron for computation), there is also a theoretical limit to their density + more heat issues.

All this technical speak to say:

ASIC improvements are facing headwinds, and some level of ASIC commoditization may be on the horizon.

Why should miners care about ASIC commoditization (any one miner is roughly the same as any other miner in terms of efficiency)?

Because the fungibility of miners will extend the profitability window and competitive lifespan.

Forecasting the Next Decade of ASIC Development

Based on current trends and physical constraints, here's what we can reasonably expect:

2025-2030:

Efficiency improvements: 10-15% per generation

Focus shifts from node shrinking to architectural, cooling, and firmware optimization

2nm chips become standard for top-tier miners

Alternative materials (graphene, carbon nanotubes) enter testing

2030-2035:

Efficiency improvements: 5-10% per new model

Mature technology plateau similar to CPUs today

Competition shifts to electricity costs and operational efficiency

What does this mean for your S21 or similar current-generation miner? The relationship between Bitcoin price and network hashrate creates a complex dynamic where your miner's profitability depends on more than just efficiency.

Also, in the highly unlikely case that Moore’s Law holds perfectly, ASIC efficiency could reach ~0.24 W/TH by 2035.

Actionable Strategies for Maximizing ASIC Lifespan

For Current Miners:

Lock in profitable power cost: At $0.08/kWh, the S21+ Hydro is currently profiting ~ $12 per day and is water cooled, so plenty of margin.

Maintenance: Clean filters monthly, monitor temperatures, replace fans preemptively. Work with a hosted Bitcoin mining company that does this.

Plan your exit: Know your miner's efficiency threshold and plan upgrades.

For Prospective Buyers:

Buy efficiency, not hashrate: When choosing an ASIC, prioritize J/TH efficiency and cooling tech over raw TH/s

Don’t overpay for your machine: How can I tell if prices are overheated? Look at hashprice and miner capitulation.

Hashprice is the single best indicator of when a good time to get a miner is. The wrong time is when hashprice is high (2021 highs). The right time is when hashprice is low.

When are miners capitulating?

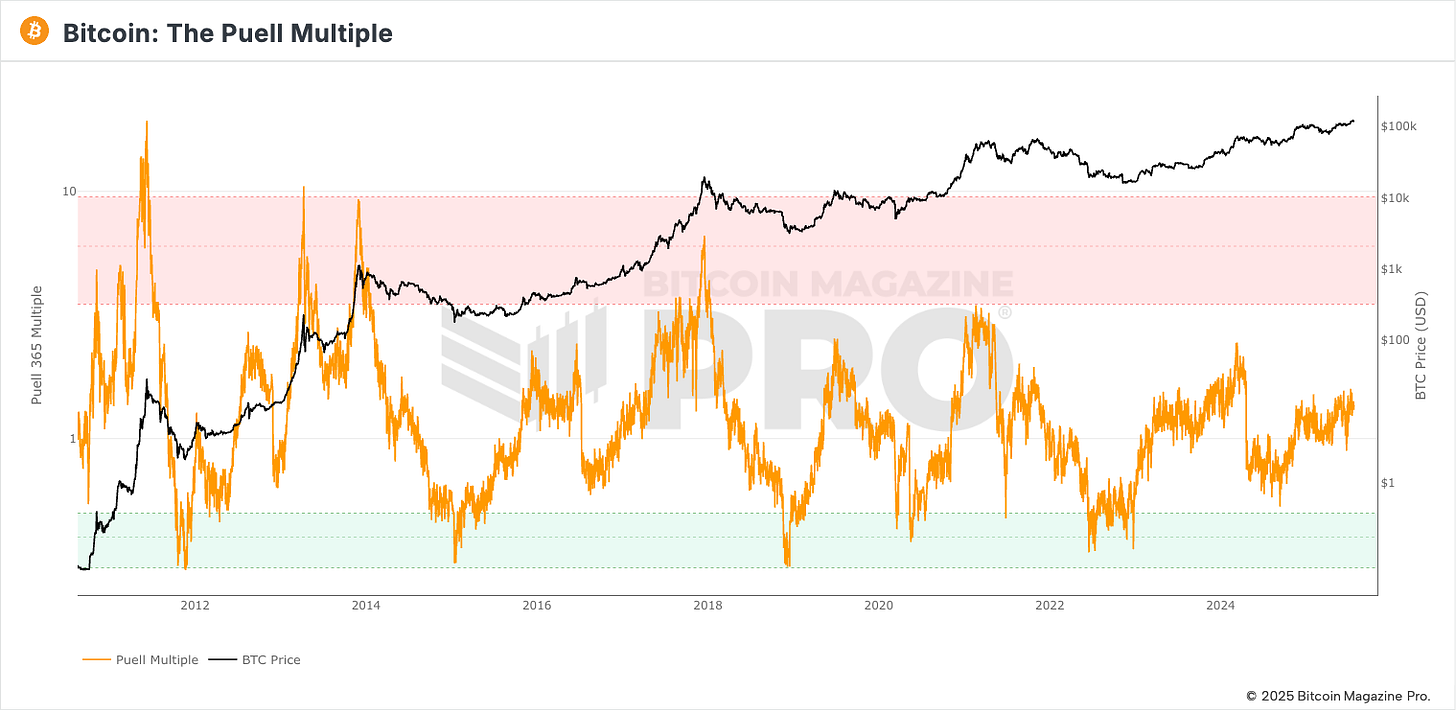

The Puell Multiple is the ratio of the daily miner income (in USD) to the yearly average.

When miners are earning less than 60% of their yearly average (the green zone), hashprice is likely low, and the overall sentiment is capitulation (unplug).

The best time to deploy capital is during periods of low profitability, when inefficient miners face problems and exit the market.

Another VERY IMPORTANT point I should make.

actual ASIC depreciation vs book ASIC depreciation.

Meaning, at what rate is your ASIC actually depreciating (10-20% per year, for example) vs at what rate is your ASIC depreciation on the books? (from a tax perspective)

The difference between the two can significantly accelerate payback period.

For example, 100% bonus depreciation is back. Meaning your machine may only lose 10-20% of its market value each year, but you can write off 100% of its value in year 1.

This is a huge value prop for many investors.

TLDR: Key Takeaways

Physical lifespan: 5-7 years (but rarely relevant)

Economic lifespan: 2-7 years depending on entry and market

Efficiency gains are slowing: From 80%+ to under 20% per model

Moore's Law is hitting limits: We're approaching atomic scales

Next decade forecast: 3-15% efficiency gains per generation, diminishing over time

Current-gen miners (S21/M50S): Expect 3-4 years of competitive operation with good power rates

Monitor hashprice and miner capitulation: aim for < 24 month ROI to succeed in BTC terms

100% BONUS DEPRECIATE

Also, in mining, as in investing, the machine that lasts is the one you upgrade before it quits on you. Let the winners ride, cut the losers.

Have a good weekend✌️

Hi Billy,

I bought a S21+ Hydro from SimpleMining that I'm expecting will be up and running in Mid September...

How long would you say I would want to ride that ASIC until looking to upgrade it?

Thanks