Bullish Sentiment and Bearish Price Action?

Bitcoin momentum is teetering on the fence

Hope everyone is having a good start to their Thursday.

Michael Saylor sure is.

His company, Microstrategy ($MSTR), just bought an additional 11,931 bitcoin for $786 million.

“As of 6/20/24, $MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.”

Any day is a good day to convert notes & cash to increase your Bitcoin stash.

Hard money prevails on the balance sheet.

In the greater scheme of things the macroeconomic environment feels pleasantly bullish.

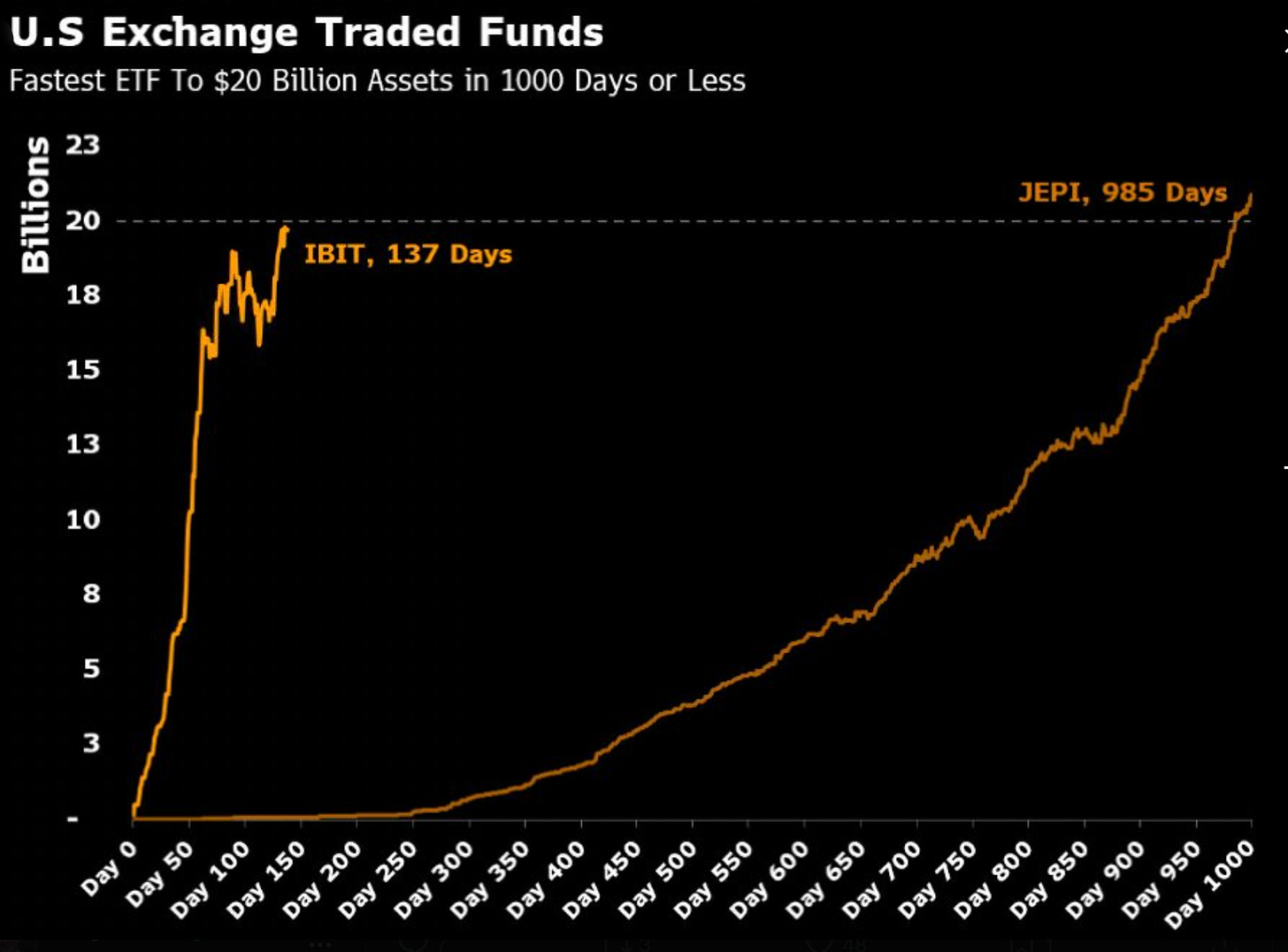

Blackrock’s IBIT is the fastest ETF to $20B in AUM. JP Morgan premium equity fund is the next closest and it took 848 days longer to reach the same amount.

ETFs have otherwise started to find a base for demand.

ETFs have been stagnant for the past 3 months, jumping between $47 and $62 billion in total AUM.

Bitcoin is front and center of political talks, and presidential candidates are publicly acknowledging its merits.

Not to mention the heightened distrust in the security of the dollar as a safe haven asset.

Fiscal and deficit spending are spiraling out of control with ludicrous amounts of taxpayer money rushed to foreign conflict.

Seems like the perfect setup for a face-melting rip.

So why is Bitcoin price action in such a muffled and choppy state?

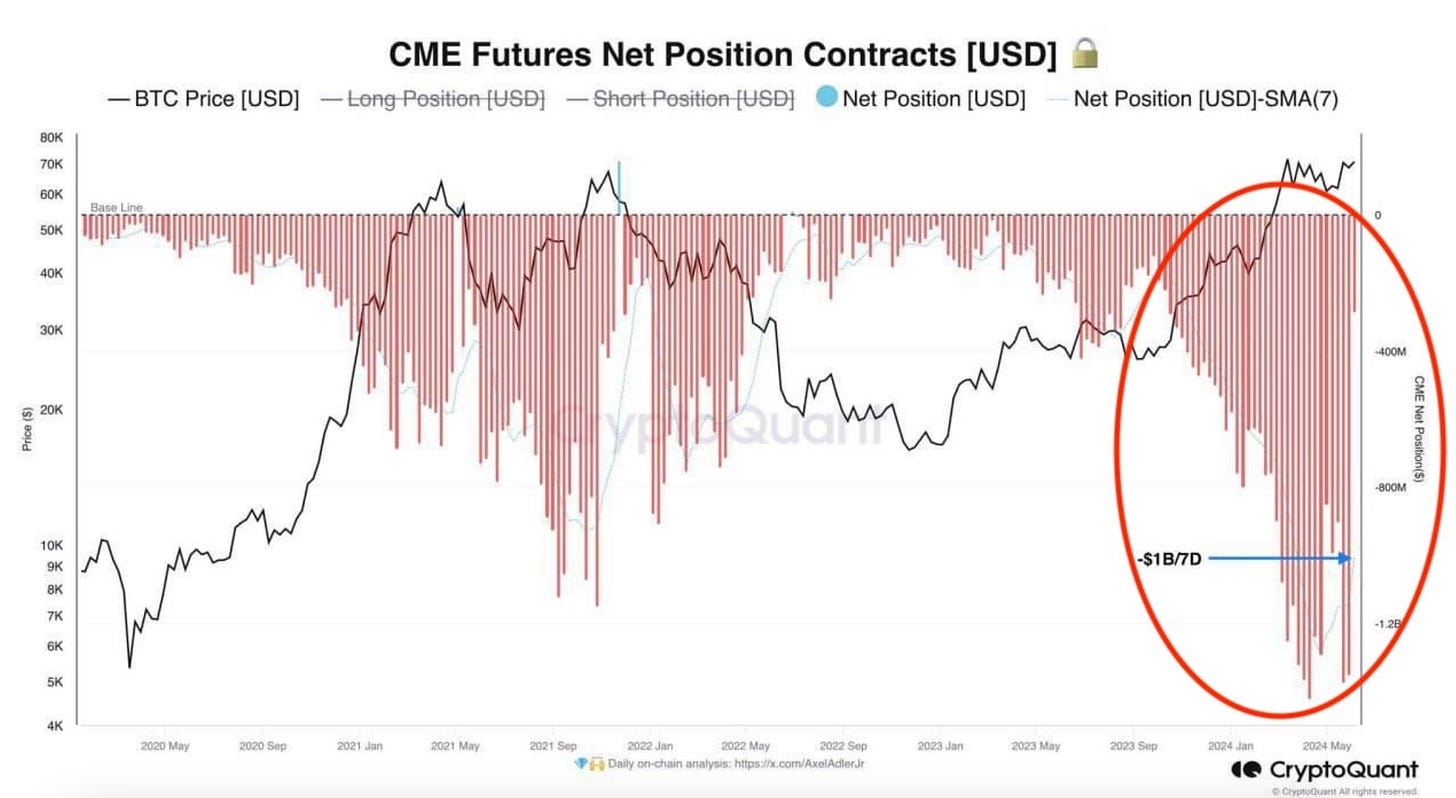

The bigger fish at fry is the -$1B in shorts sitting on the Chicago Mercantile Exchange(CME).

Paper Bitcoin is not real Bitcoin(Coinbase has the keys to most of these ETFs).

But it is for arbitrage traders, and price action shows it.

This is a classic game of cash & carry.

Traders want to profit by clipping the difference between a long Bitcoin position in an ETF, and a short position in a perpetual future swap contract.

Spot Bitcoin is “real” live price tracking Bitcoin where futures contracts are an agreement to buy/sell Bitcoin at a specific price in the future.

Cash in these hedge funds is being used to buy the spot ETF and at the same time purchase a short future contract against it, with interest paying out for the entire contract term(the carry part).

This is nice looking investment because the delta(volatility/spread) is essentially neutral.

If spot Bitcoin rises, so does the long position.

If spot falls, the shorts become more valuable.

The net difference between the positions is paid out in interest “perpetually”(a type of futures contract with no expiration date).

And it’s more than just a 1:1 ratio.

Spot can be hedged by multiple future contracts.

We can see this happening in the BTC Futures open interest chart:

In “short,” more short futures are being purchased than the spot ETF vehicle.

Participants in this strategy should do so with a grain of salt because trading cannot be halted nor shares diluted.

The train is coming down the tracks regardless and if tomorrow Nvidia adopts a Bitcoin treasury strategy and both presidents intend to implement a Bitcoin standard, any pessimistic position is getting utterly steamrolled.

The best traders in the history of Bitcoin’s price action were the ones who died or went to jail.

Buying Bitcoin and not selling Bitcoin has proven its merit as a strategy and will continue to do so.

If you wouldn’t hold an asset for 10 years, don’t even think about holding it for 10 minutes.

Warren Buffet may have said that.

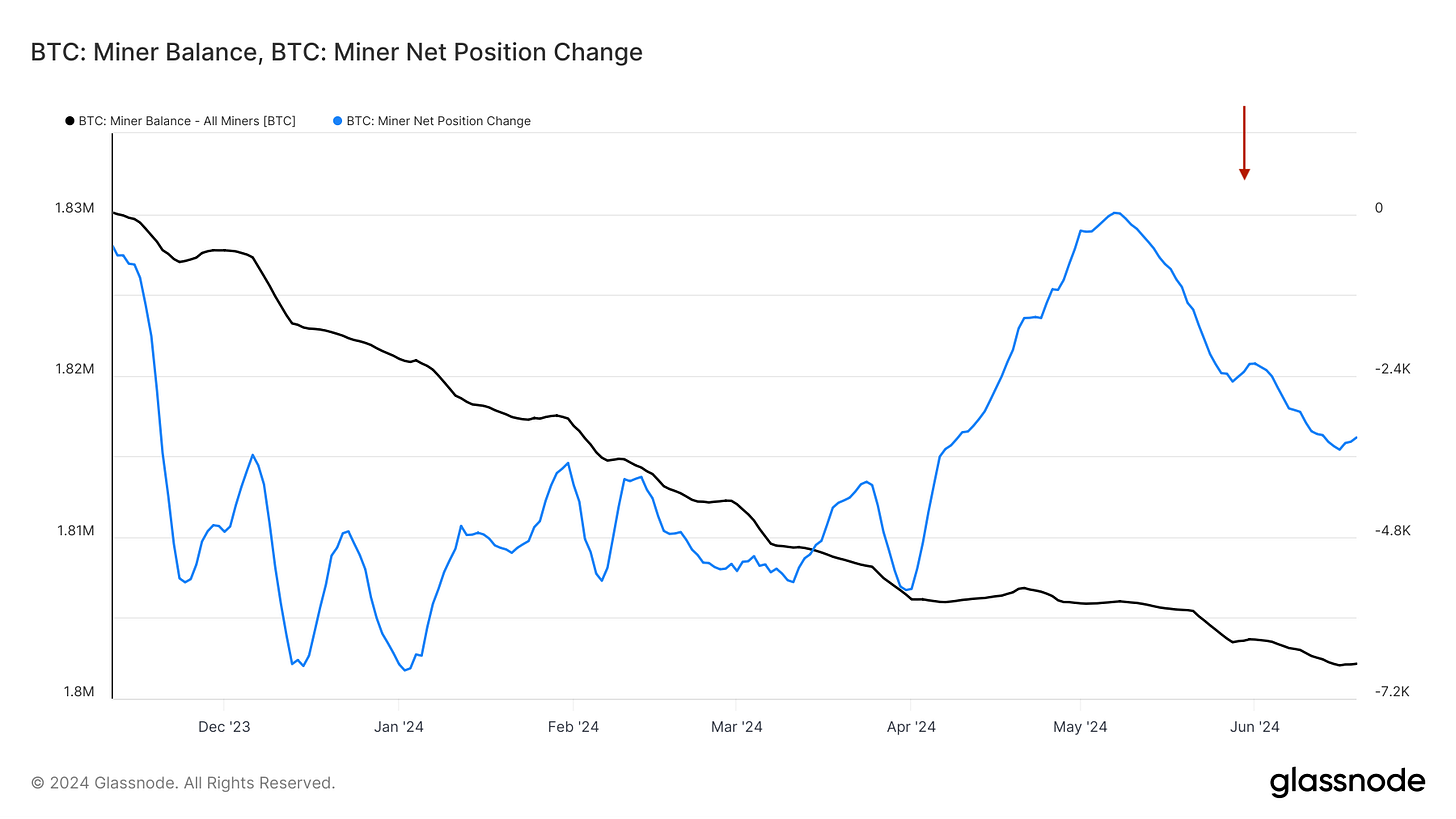

Miners also feel the pressure from an overnight 50% decrease in a major revenue stream.

This was probably not accompanied by a 50% decrease in power contracts. Hashprice hit an all-time low of $49/PH/Day on April 29, 2024.

It has since recovered to ~ $53/PH/Day.

Hashprice refers to the expected value of 1 Petahash/s of hashing power per day. The metric quantifies how much a miner can expect to earn from a specific quantity of hashrate. Hashprice is a function of four inputs: network difficulty, Bitcoin’s price, block subsidy and transaction fees. Bitcoin’s hashprice will change with every new block added to the blockchain.

Most of the major mining operations saw this coming and have been well prepared, but that doesn’t mean some of the smaller guys don’t have to tighten up the belt and trim off some reserves.

Miner balances are going sledding and net position is reeling it in.

Note this is to be expected, not a panic sell as the net position change is relatively steady over time.

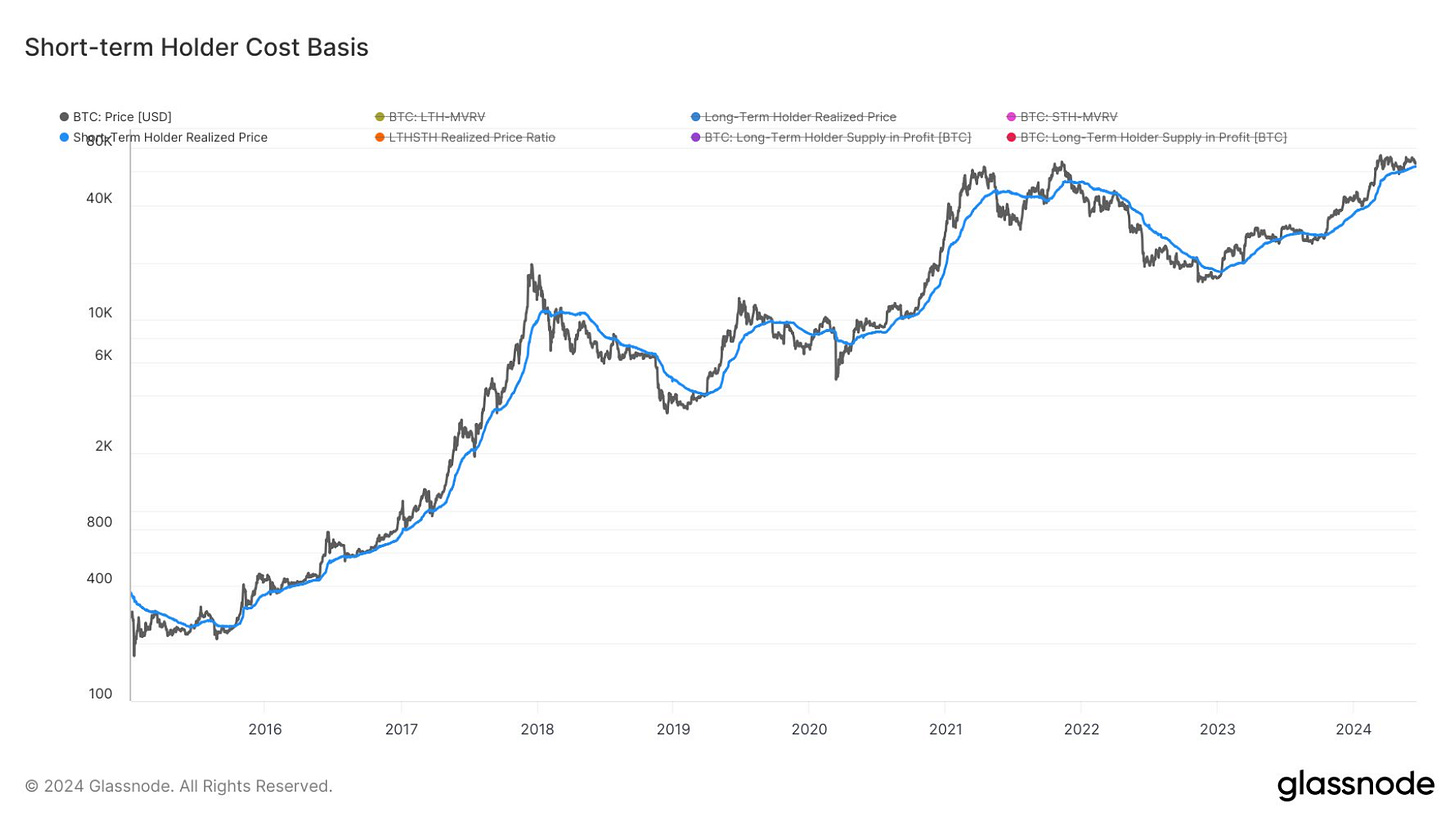

With the exchange rate facing so much resistance, it’s also important to take into account the short-term holder realized price, or the average price/cost basis of buyers in the short term.

This has historically served as a footing for price momentum because when the price falls below this, it causes a panic sell for all failed pump hunting traders looking to cut their losses (assuming they do not ascribe to the sunk cost fallacy).

So when the price reaches their original entry point, they do the obvious thing and double down to strengthen their entry point.

This is far from hinting at a capitulation as ~ 90% of supply is in the green.

The future is bright orange.

All price action needs is some breathing room post halving.

History is no prediction machine but it sure likes to rhyme.

This party is just getting started.

That’s all I got.

Feel free to drop a comment if you like this type of content and if you have any suggestions for what you would like to see in future editions.

Have a blessed rest of the week✌️