Common Bitcoin Critics pt. II

Volatility != Bad

Gm simple miners,

The volatile exchange rate chop continues.

Sub $60k Bitcoin may be a sight for sore retail eyes,

But quite the opposite for the big hodlers:

AKA big wallets are sizing up:

This aligns with last weeks letter; the best investors know “buy when there’s blood in the streets.”

Speaking of the best investors,

Here is an interesting list of the top 10 Bitcoin holders:

It seems institutions are here to stay and this is just the game theory of who can gain first mover advantage.

Be sure to check out part 1 if you missed it:

We covered no intrinsic value, money laundering, and too much electricity critic arguments from this list.

TOP 10 BITCOIN CRITIC ARGUMENTS:

Bitcoin has no intrinsic value (it is not backed by anything)

Bitcoin is for criminals and money laundering

Bitcoin uses to much electricity

Bitcoin is too volatile

Bitcoin is bad for the environment

Bitcoin will get banned by the government

Bitcoin supply distribution is centralized

I can’t buy anything with Bitcoin

Bitcoin will be replaced

What if the internet goes down

Today we’ll dismantle volatility, Bitcoin bad for environment, and government ban misconceptions.

“Bitcoin is Too Volatile”

The definition of volatile:

liable to change rapidly and unpredictably, especially for the worse.

"the political situation was becoming more volatile"

This is ironic because anyone saying Bitcoin is too volatile either has high time preference, or they don’t like their purchasing power going up and to the right.

Bitcoin has arguably preserved and appreciated purchasing power better than any asset.

Ever.

Number go up requires rapid change.

Volatility != bad.

Growth is always accompanied with volatility, especially for any new and emerging technology.

Bitcoin is still in its early stages of adoption, and its market is relatively small compared to capital markets as whole.

Bitcoin can also be traded 24/7/365, so of course it will have volatility.

Critics saying Bitcoin is too volatile probably have the privilege of USD hegemony and convenience.

The U.S. has yet to significantly experience detrimental hyperinflationary volatility:

All fiat roads end the same.

Volatility to the infinite downside is fiat currency.

Volatility to the infinite upside is Bitcoin.

“Bitcoin is Bad for the Environment”

This is also implies that Bitcoin uses too much electricity and is “carbon intensive.”

One important aspect to note:

The cheapest electricity is usually sustainable energy or energy that would have otherwise been wasted.

Bitcoin miners are economically incentivized to seek out the cheapest energy available, which leads them to regions with abundant and inexpensive renewable energy.

Over 50% of Bitcoin’s energy consumption comes from renewable sources, and is increasingly searching for efficient energy sourcing and consumption.

No other industry is like this.

Bitcoin is far better for the environment than the fiat system it is meant to replace.

The energy costs associated with maintaining central banks, payment processors, ATMs, and physical fiat production cannot even be quantified.

Bitcoin, on the other hand, consolidates its energy use into a distributed secure network, offering a transparent and granular alternative to the sprawling and opaque energy consumption of the traditional financial system.

KPMG authored this report in 2023 to show the role that Bitcoin plays in the ESG imperative:

After a solid hour of focused research, critics can understand why “Bitcoin bad for environment” is a downright false MSM lie.

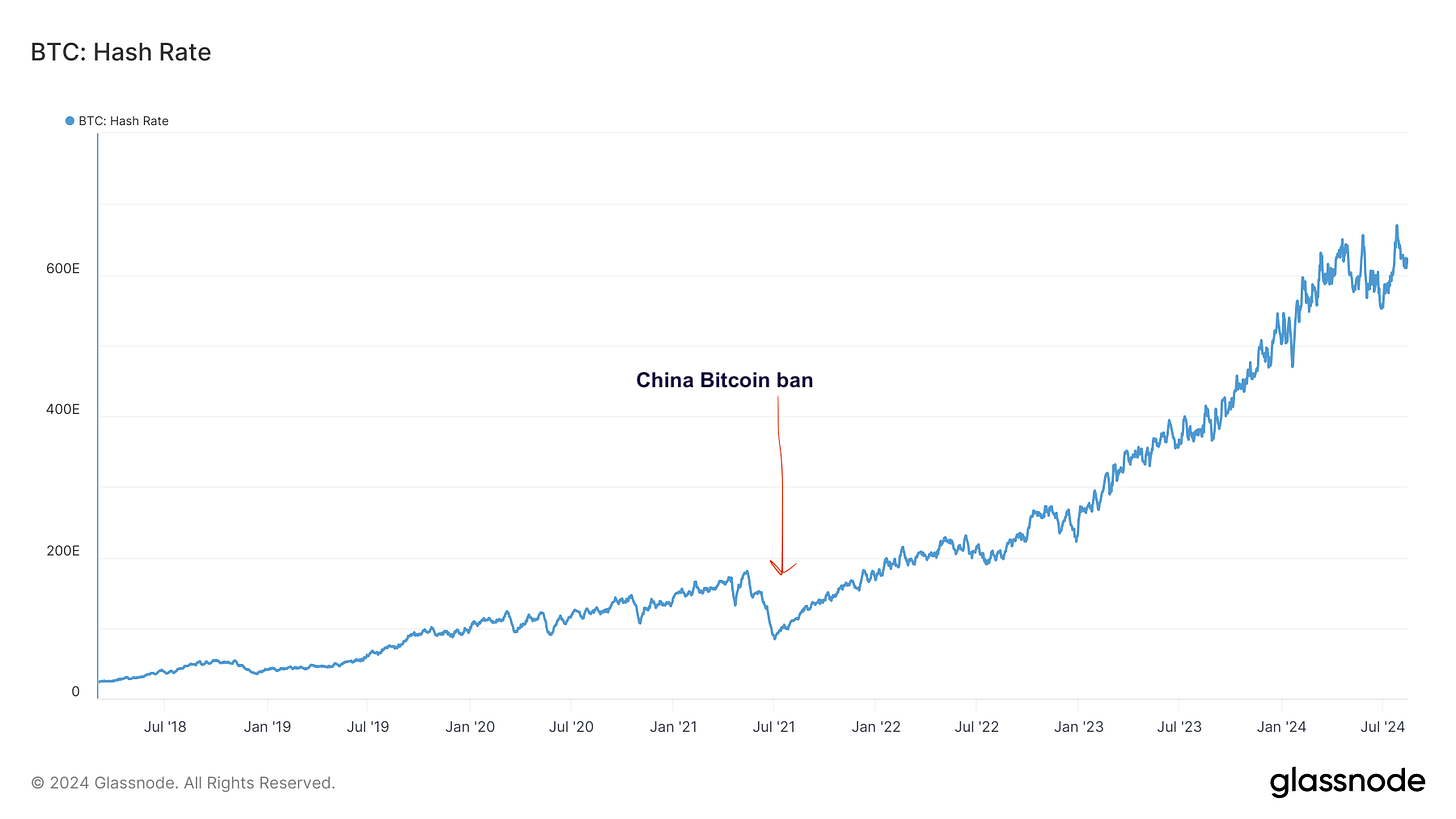

“Bitcoin Will Get Banned by the Government”

Banning Bitcoin does not work out well for authoritarian regimes.

Just look at when China issued a ban on Bitcoin mining in 2021:

The hashrate plummeted in the short term.

In the long term?

Hashrate hit an all-time high a year later as miners moved to more favorable jurisdictions.

China lost out on all the innovation benefits that could have been reaped.

Russia recently signed a bill to legalize Bitcoin mining:

This is game theory. Governments start to realize if they are not competing in the Bitcoin arms race, they are losing.

Countries that embrace Bitcoin can benefit economically by becoming hubs for cutting edge technology, attracting talent, capital, and entrepreneurship

Also, the government can only do so much to attack Bitcoin, and in most cases, hostility induces even more internal conflict.

If you have ever heard a logical analysis of a Bitcoin shortcoming, feel free to drop it in the comments or reply to this email.

Have a good rest of the week✌️

Stay tuned for future editions of the Common Bitcoin Critics👀

Game theory😱😱 ! Keep the great articles coming !