Common Bitcoin Critics pt. III

Who owns all the Bitcoin?

Happy Thursday readers,

Simple Mining CEO Adam Haynes was recently on a podcast with the Bitcoin Way.

The episode covered the Simple Mining origin story, hosted mining business model, energy, infrastructure, and industry trends.

Check it out here:

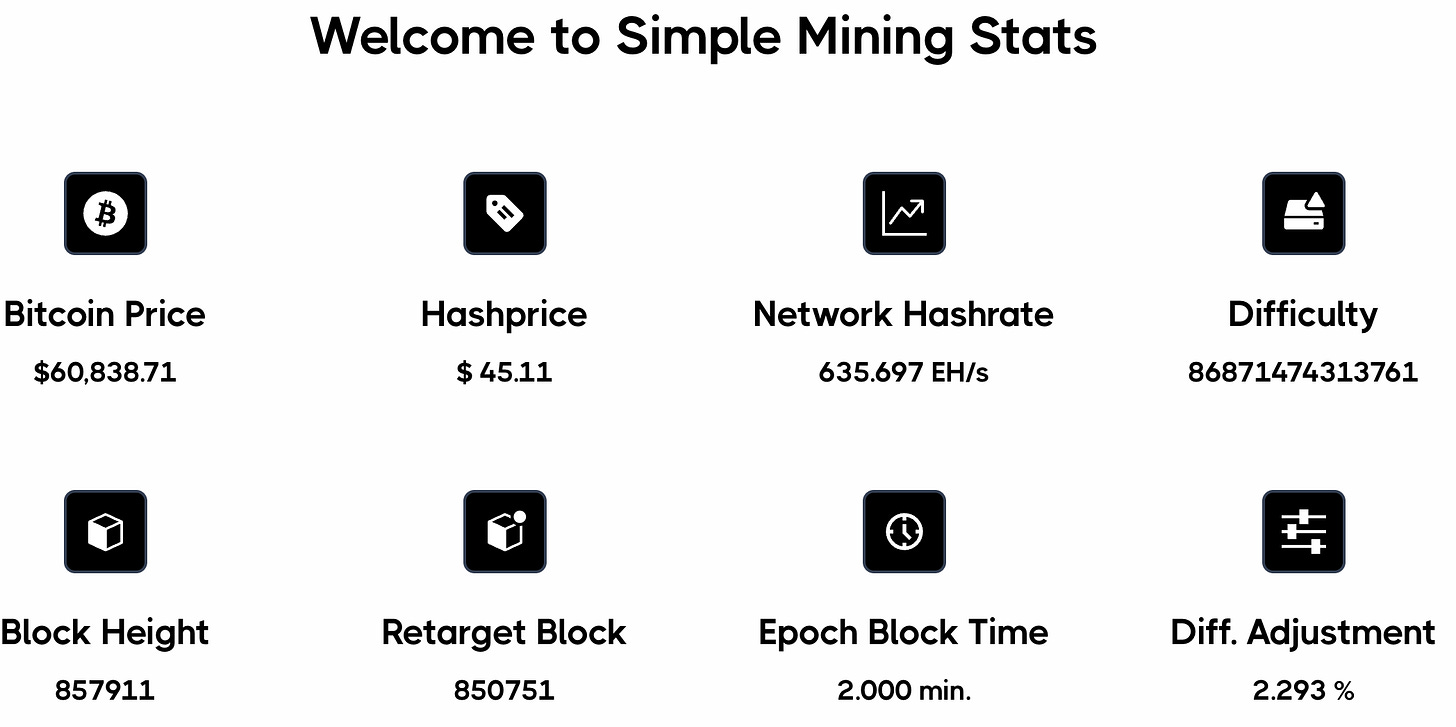

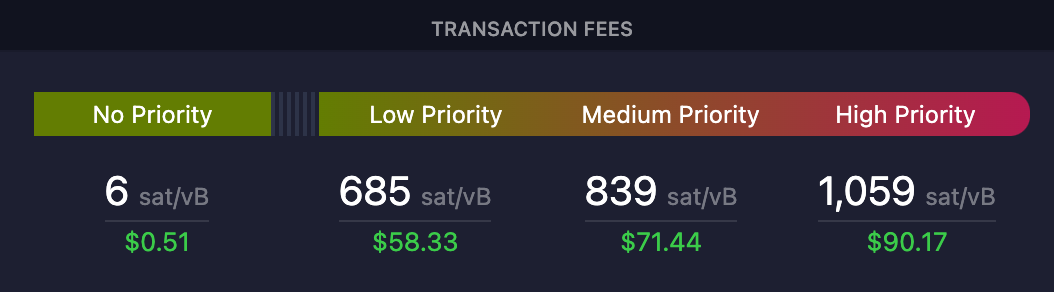

Last night fees:

This morning fees:

(People are paying higher fees for Bitcoin staking protocol)

Don’t forget to consolidate your UTXOs when fees are LOW.

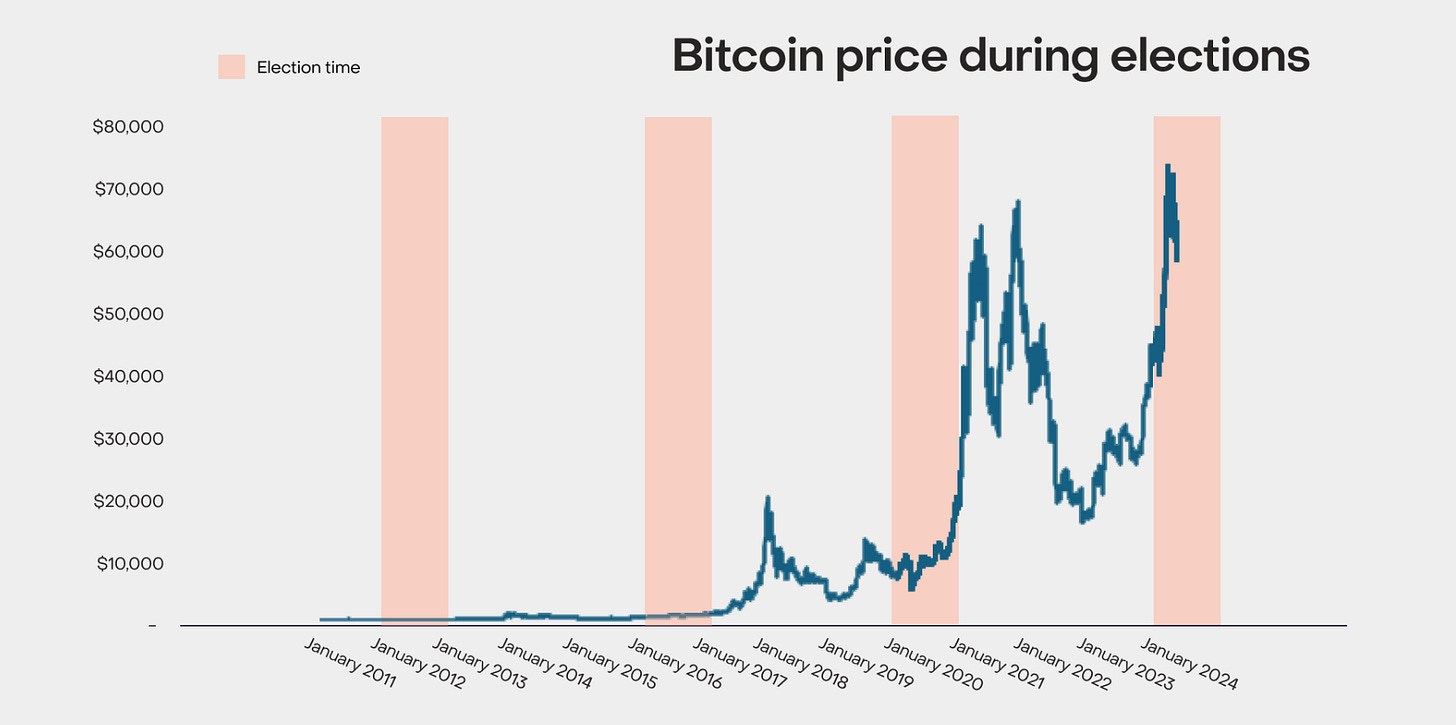

We are also coming up on a presidential election in the United States.

Past performance by no means indicates future results, but it’s interesting to see how the exchange rate responds after the election.

Only time will tell.

And if you’re reading this, you likely believe time will tell Bitcoin is going up and to the right in the long run.

This edition continues the breakdown of the TOP 10 BITCOIN CRITIC ARGUMENTS:

Bitcoin has no intrinsic value (it is not backed by anything)

Bitcoin is for criminals and money laundering

Bitcoin uses too much electricity

Bitcoin is too volatile

Bitcoin is bad for the environment

Bitcoin will get banned by the government

Bitcoin supply distribution is centralized

Bitcoin will be replaced

I can’t buy anything with Bitcoin

What if the internet goes down

Last week, we covered volatility, Bitcoin is bad for the environment, and the government ban critic arguments from this list.

Check it out here:

Today we’ll unravel supply distribution and if Bitcoin will be replaced.

“Bitcoin Supply is Centralized”

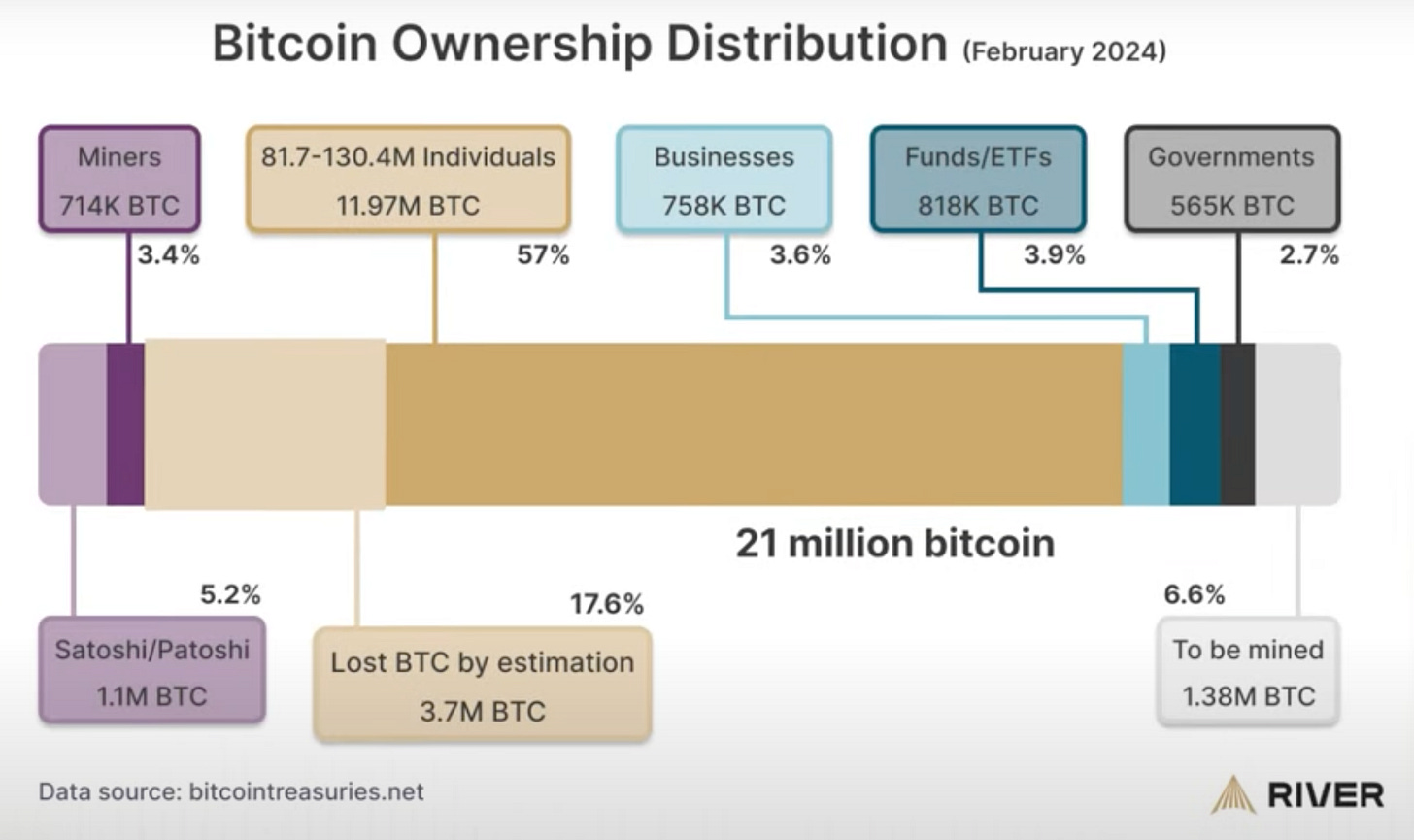

Here is a report from our partner, River, breaking down Bitcoin supply ownership:

*Edit: If you watched the video, you will see that Germany dropped the ball and no longer owns 50,000 BTC

At first glance, you can see that Individuals own most of the supply.

Also, another important fact is that Bitcoin was NOT premined.

By looking at the chart, you can see that “Satoshi” controls roughly 1.1 million coins.

These coins were fairly mined and not pre-issued.

This is believed to be Satoshi because the addresses tied to those coins are the same addresses that received the first block rewards.

When the mining hashrate started to grow, Satoshi quit mining.

The coins associated with those addresses have never been moved.

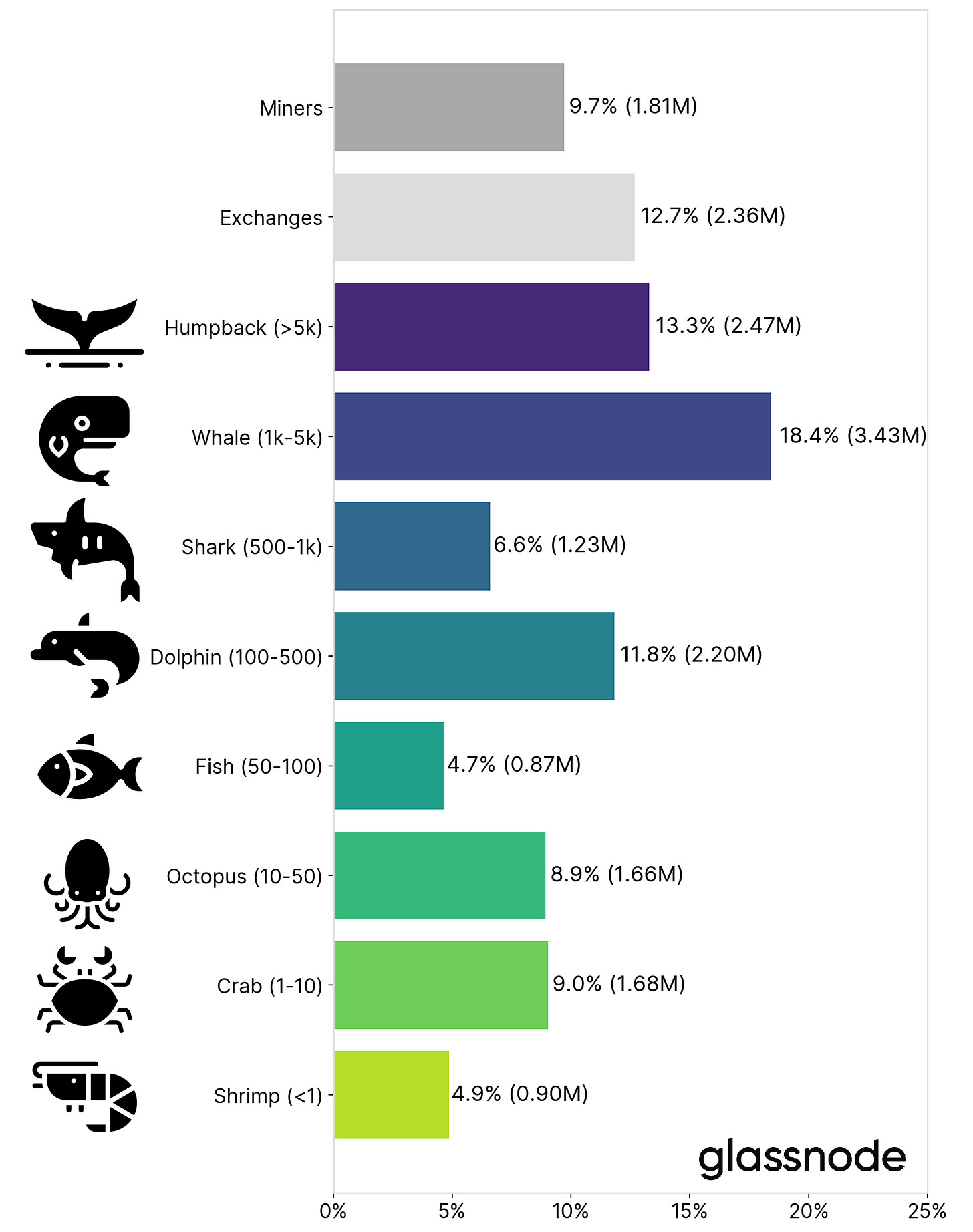

This chart entirely contradicts the notion that the Bitcoin supply is centralized.

And this is not just a guess.

This can be verified on-chain, unlike the supply distribution of the traditional fiat financial system.

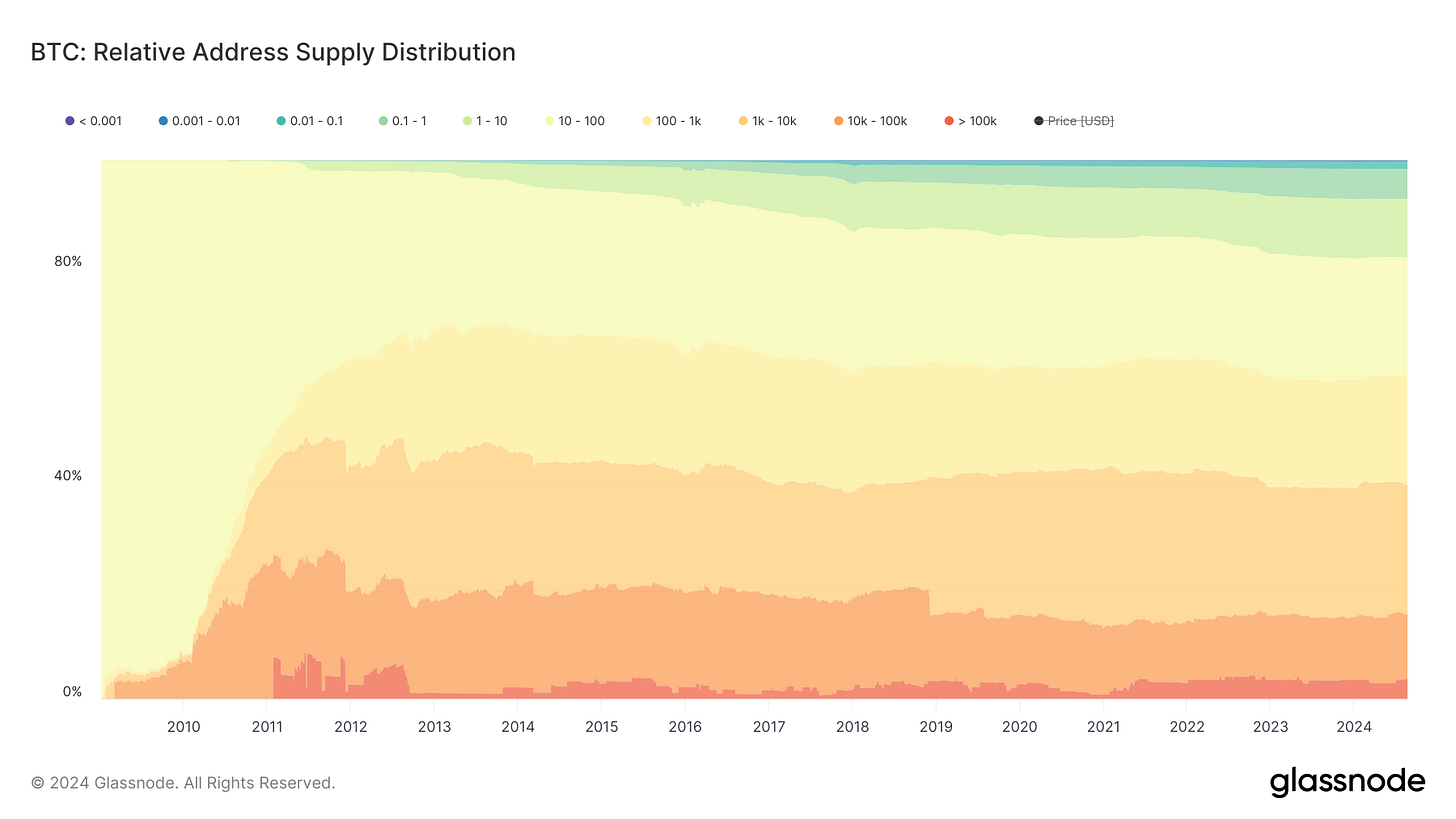

As of January 2021, the Bitcoin supply distribution across these cohorts looked like this:

As you can see, Bitcoin supply ownership is not at all centralized. It is a distributed monetary base owned by individuals, businesses, entrepreneurs, corporations, investors, governments, and nations.

In the United States specifically, the Nakamoto Project recently surveyed 3,538 adults in the US.

They found that most Americans who own Bitcoin are simply those who have taken the time to study the technology and formed positive attitudes about it.

The research aligns with this simple chart:

Bitcoin is gradually infiltrating the wallets of the global populace:

“Bitcoin Will Be Replaced”

Simple Mining has an article and video on this topic specifically:

www.insights.simplemining.io/will-bitcoin-be-replaced/

In theory, any technology can be replaced if something better comes along.

Although Bitcoin's innovation involves math and the laws of physics.

For Bitcoin to be replaced, a new form of money would need to have superior mathematical properties to Bitcoin and overcome Bitcoin's first mover advantage through hashrate.

It is currently impossible to one-up “perfect scarcity.”

Every other monetary media is trending to 0 against Bitcoin on a long enough time horizon.

There is no second-best money.

Bitcoin's current value is backed by the total energy invested over the last decade in mining.

For a competing timestamp server to come even close, it would need to invest a similar amount of energy.

I.e., redo the past 15 years of proof-of-work.

Bitcoin is an engineered solution to the utter floundering of fiat currencies.

(Gold cannot work in a digital economy).

If you’re enjoying the critic series, feel free to drop a like on this post.

If you would like to see a particular topic series in the future, reply to this email or drop a comment.

Hopefully a solid understanding of the frail foundation of these critic arguments will help you better articulate the truth about Bitcoin in casual conversations, as well as become a better economic thinker and investor.

Until next week✌️

If you haven’t already, check out Simple Mining on other content avenues:

YouTube