How to Allocate to Bitcoin Mining Over the Next 10 Years

The decision every investor must make

The market is being heavily steered by the macro environment.

Let’s step back and look at the big picture:

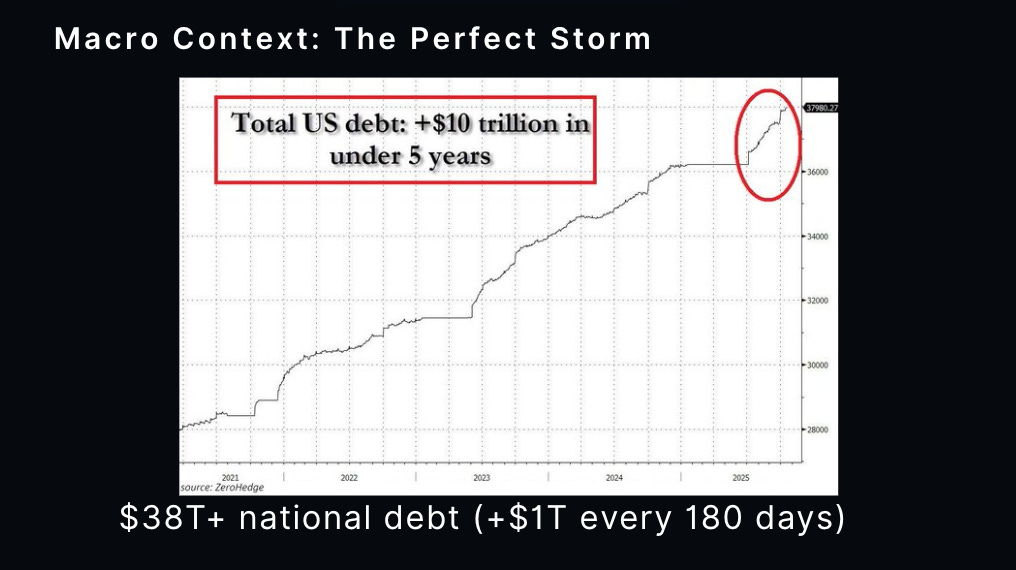

The headline number everyone’s heard is $38 trillion in U.S. national debt.

But the more important detail is the speed.

The U.S. has added $10 trillion in under 5 years.

And is now adding about $1 trillion every 180 days, blowing through every flimsy debt ceiling.

Yes, it’s true that the U.S. has ‘always been in debt’ and that the world reserve currency system is built on exporting Treasuries.

But there’s a problem:

The debt is growing faster than the economy, faster than tax revenue, and faster than the government can service it without creating more money.

The system is now structurally dependent on debasement.

This is what people mean by “fiscal dominance”

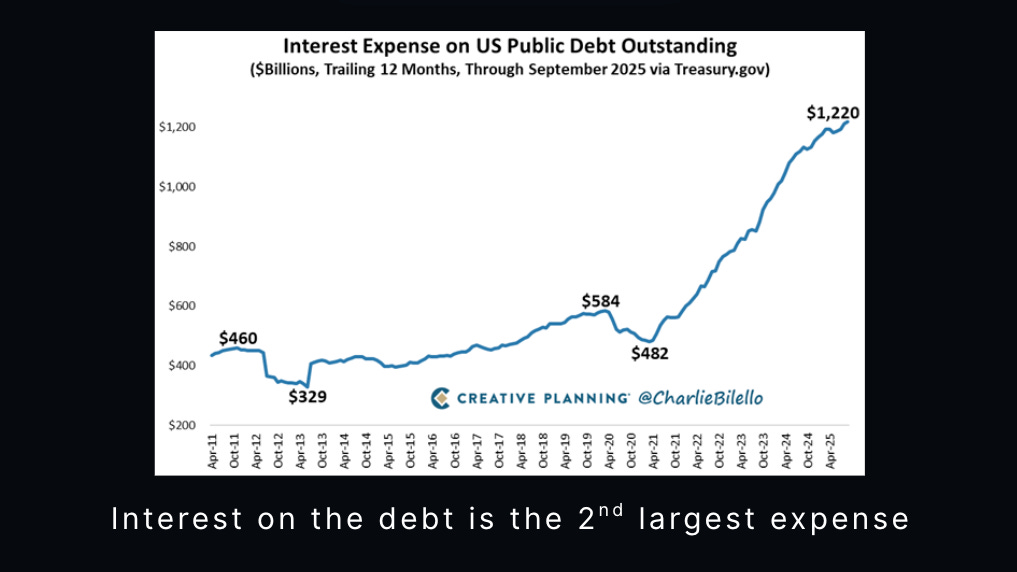

The U.S. government now spends more on interest payments than on national defense.

And unlike other spending categories, you can’t vote interest payments down.

They compound automatically.

Every dollar of new debt requires more interest, and that interest must be financed with even more debt.

This is the negative feedback loop.

Elon Musk has even said the U.S. either fixes this or goes bankrupt.

Historically this is how empires collapse.

Not from lack of power, but from a destruction of the currency.

Average lifespan of a fiat currency is about 35 years.

US Dollar is on year 54.

So how can the U.S. treasury escape bankruptcy?

There are really only four ways a government can service a debt this large:

1. Cut Spending: Politically impossible at scale. Entitlements are 70%+ of the budget. No politician gets re-elected by cutting them.

2. Taxes & Tariffs: Helps at the margin, but nowhere near enough to close a multi-trillion-dollar shortfall.

3. Grow the economy faster than the debt: Historically ideal, but mathematically unrealistic when debt growth is compounding faster than GDP.

4. Borrow More: Issue more Treasuries. This is easiest path, but it only works if interest rates stay low.

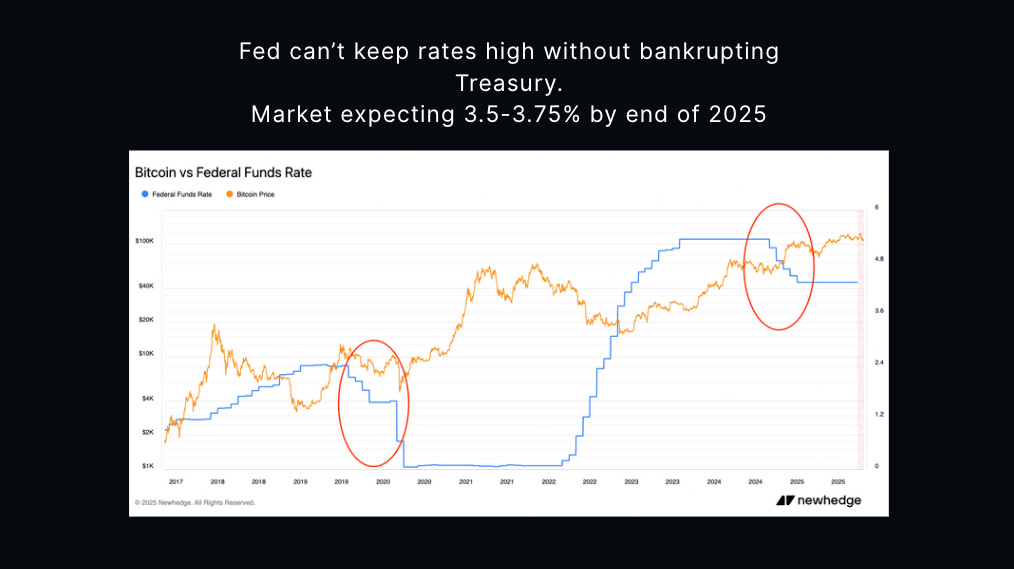

This requires cooperation with the Federal Reserve.

If the Federal Reserve can leverage monetary policy by lowering rates AND add treasuries to their balance sheet, the outstanding debt can effectively be devalued

The risk is hyperinflation, but there is no other choice given bankruptcy is the alternative.

This is what macroeconomists mean by “nothing stops this train”

When the Fed is forced to cut rates and expand M2, liquidity rises.

Every easing cycle since 2008 has sent hard assets higher: gold, Bitcoin, and blue-chip equities.

This is why Bitcoin doesn’t just go up randomly. You can see strength when rates fall.

At the same time, global trust in the dollar is weakening.

Central banks are exchanging Treasuries for gold.

This is what people now calling the “debasement trade.”

This is the macro picture.

It would paint a favorable performance for Bitcoin.

But what about mining specifically?

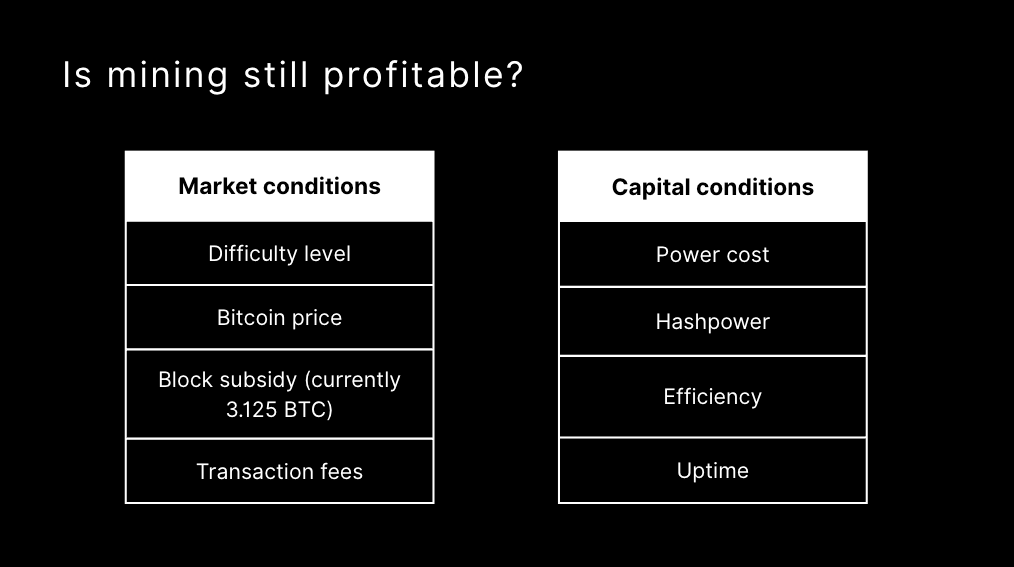

What will determine profitability?

Two sets of variables: market conditions and capital conditions.

Market conditions are external.

Capital conditions are internal.

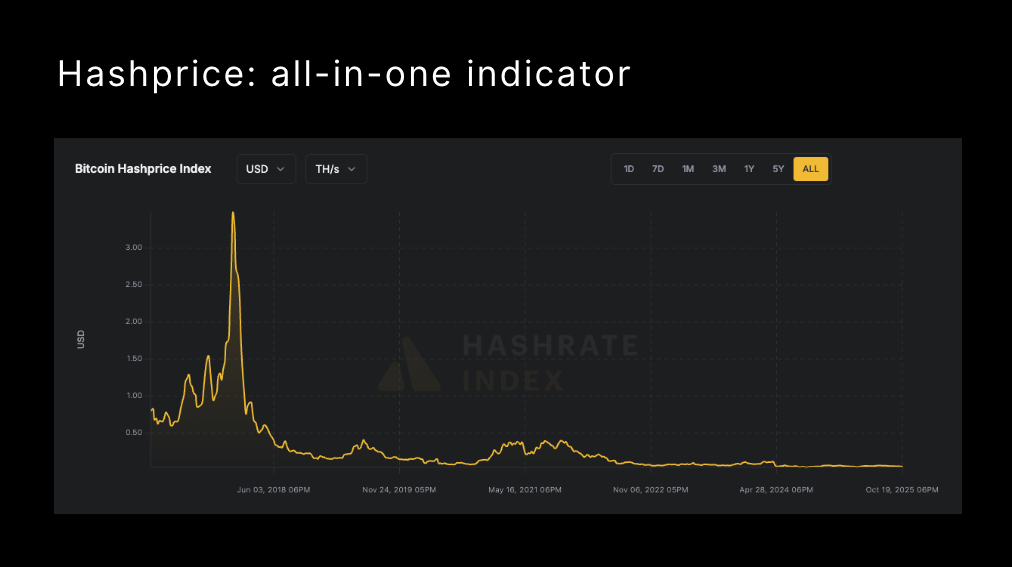

Market conditions can me summed up in one number: Hashprice

Hashprice tells you how much revenue a miner can expect per unit of hashpower.

Looking at this chart, you might think: ‘Profitability peaked in 2017 and has fallen ever since.’

And in nominal terms, that’s true.

Miners were earning over $3 per TH per day.

But the context matters:

• Bitcoin price went up over 1,500% in 2017 alone.

• 2017 machines were ~10 TH/s

• Today’s machines are ~ 400 TH/s

• The subsidy was 4x larger

• Competition (difficulty) was a fraction of today

It was the perfect profitability storm: massive price appreciation, low competition, and high issuance.

Hashprice today is lower because the market is more efficient and industrialized.

To see 2017 like movement again, price would need a very large move in a short period of time.

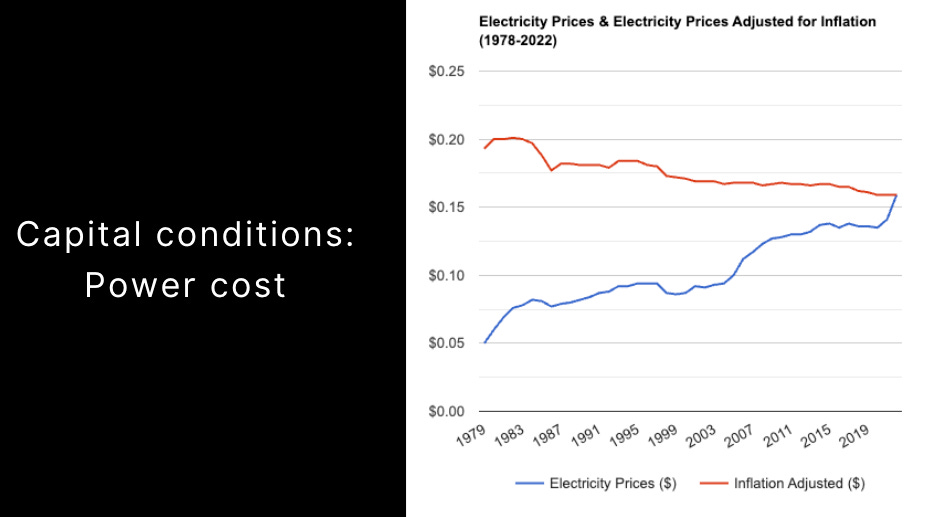

In terms of capital conditions, the single most important variable is power cost.

For example, if your power cost is 0, you can mine profitably forever.

U.S. electricity costs adjusted for inflation have trended down over decades.

(this could change with AI/HPC demand)

Industrial-scale miners typically pay much less than retail users.

Average industrial mining rate is around $0.05/kWh, compared to $0.15/kWh for residential users.

That spread is the difference between profitable and unprofitable mining.

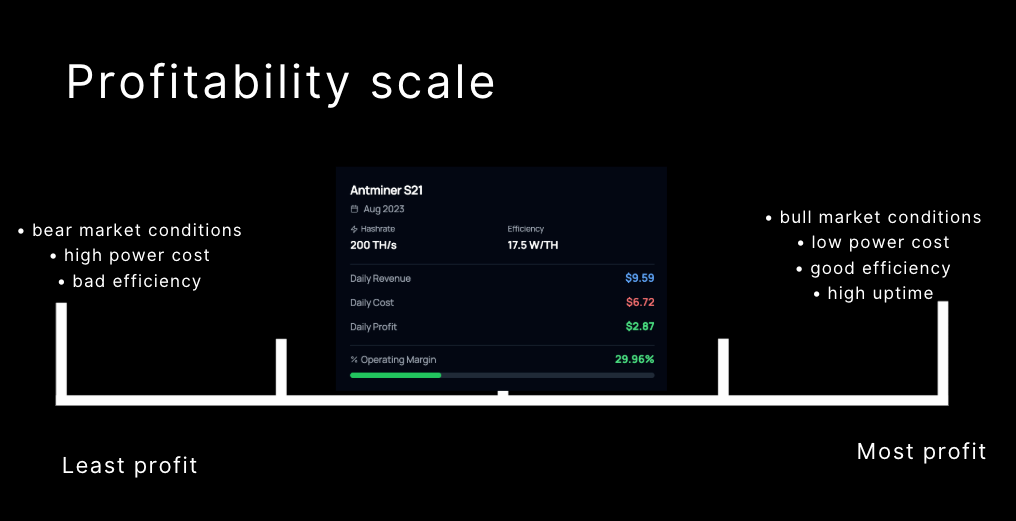

To put this on a scale, it would look something like this:

At one end, you’ve got bear-market conditions: high power costs, poor efficiency, and downtime.

At the other end, in bull-market conditions: low power cost, good efficiency, and high uptime

If we use current market conditions, and a mid tier miner like the S21, at $0.08/kWh, you are mining Bitcoin at a discount (pay $6 in electricity to get $9 of Bitcoin)

If this machine currently cost $3,000 and has a 95% uptime, fixed payback period will be a little less than 3 years.

Could be faster or slower depending on market conditions.

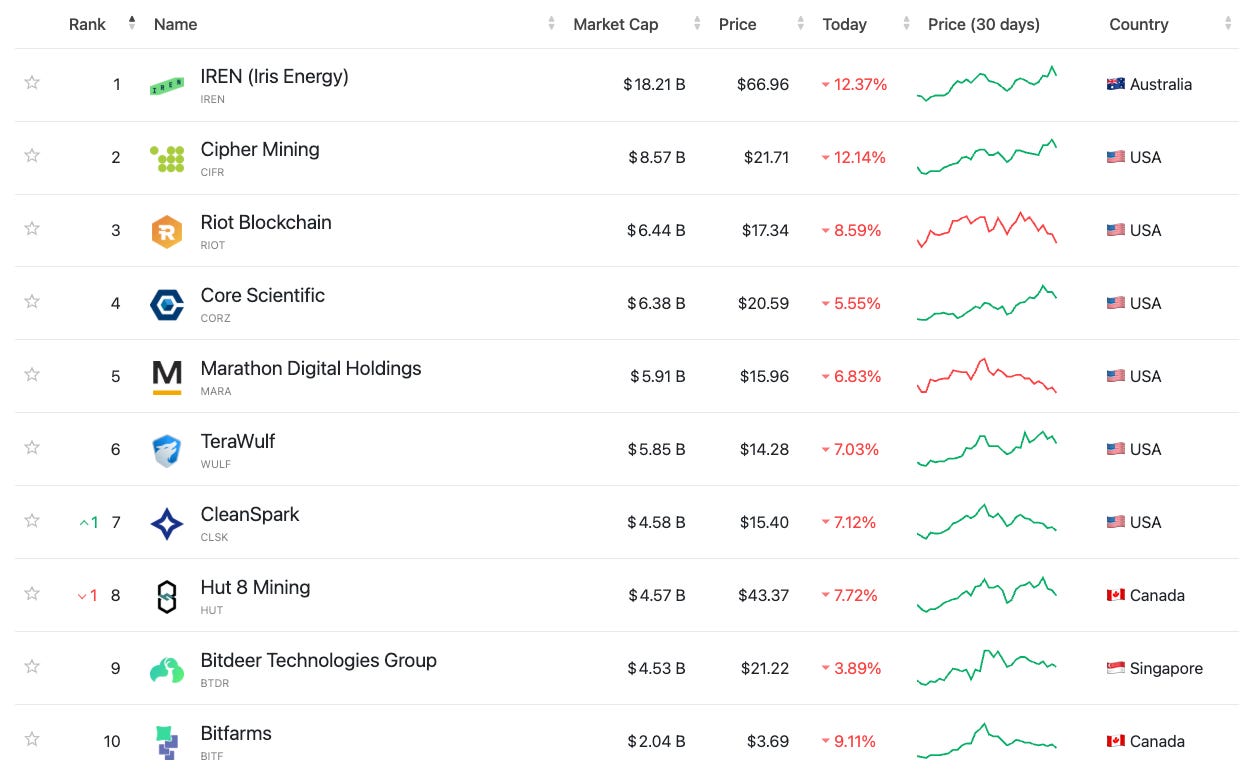

So we can see there are some profit incentives to Bitcoin mining. Who are the major miners taking advantage of this?

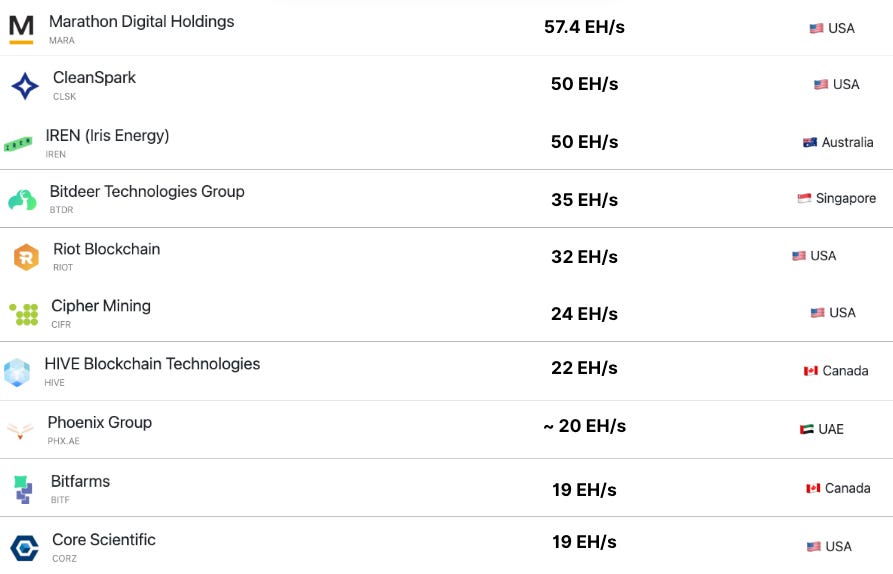

These are the top ten publicly traded Bitcoin mining companies in the world, ranked by market cap.

You’ll notice that 6/10 are USA, highlighting how it is the institutional hub of the mining industry.

Some of these firms are valued for their treasury strategies, growth prospects, or ai vision.

Not just the blocks they produce.

That said, market cap doesn’t always equal hashrate.

So here are top 10 mining companies based on hashrate:

We can see mining can be profitable, and who the key players are, but what does the future look like? (the framing question in the back of every investors mind)

Let’s look at the headwinds.

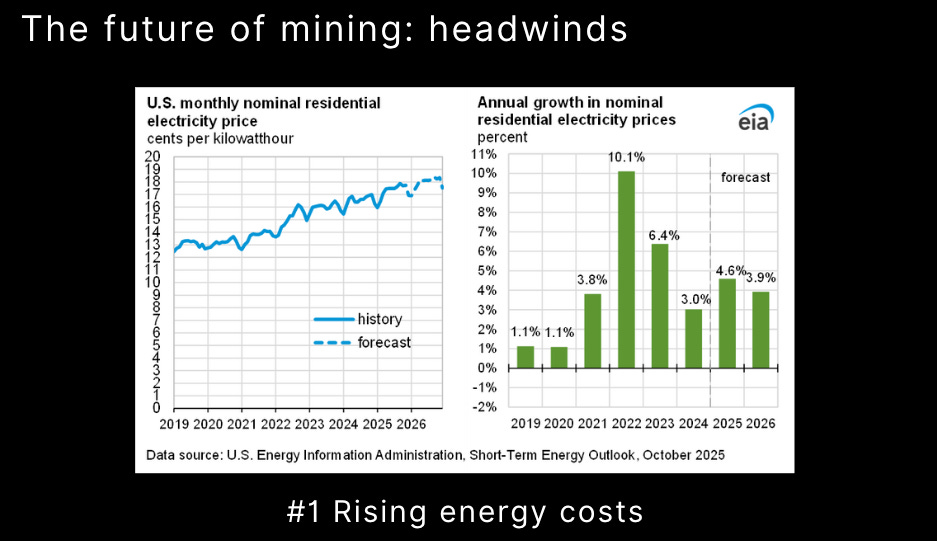

One of main areas of resistance is going to be rising energy costs.

According to the U.S. Energy Information Administration, electricity prices are expected to outpace inflation through 2026.

At the same time, demand from AI/HPC is accelerating.

Projected to 3.5x by 2030:

For many miners, this can create higher average power prices, tighter grid supply, and more competition for affordable energy.

Here is an interesting example

This could be good for suppressing difficulty, but not so good for miner operational expenditures.

And since power cost is the #1 driver of profitability, this dynamic could separate efficient operators from everyone else.

In the case of Simple Mining, this risk is minimal due to vertical integration (PPA leverage) and integration with renewables (65% wind power), which somewhat need miners.

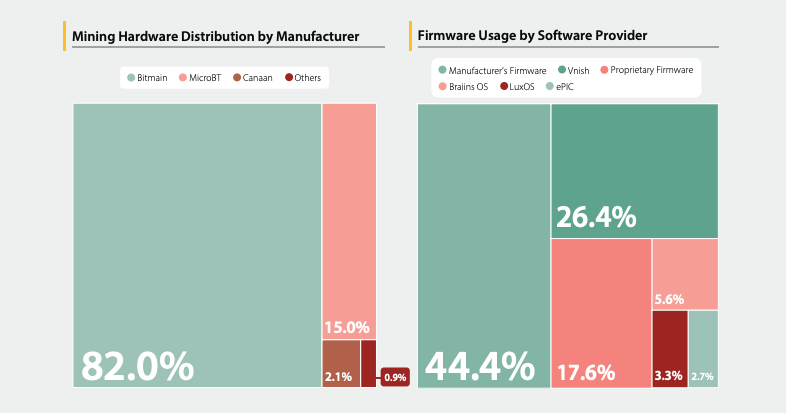

Headwind #2: Tariffs and Logistics

Since nearly all mining hardware is imported, U.S. miners are exposed to tariffs, export restrictions, and shipping risk.

Most ASIC supply is concentrated in China, Taiwan, and South Korea.

You can see the geopolitical bottleneck in this chart:

Bitmain is practically a single point of failure for any companies sourcing all machines through them.

This could directly raise CAPEX per terahash, making it harder for U.S. miners to expand or replace fleets.

And unlike other industries, miners can’t just raise prices or produce more Bitcoin

So when hardware costs rise, margins get squeezed.

Headwind #3: Negative market/migration conditions

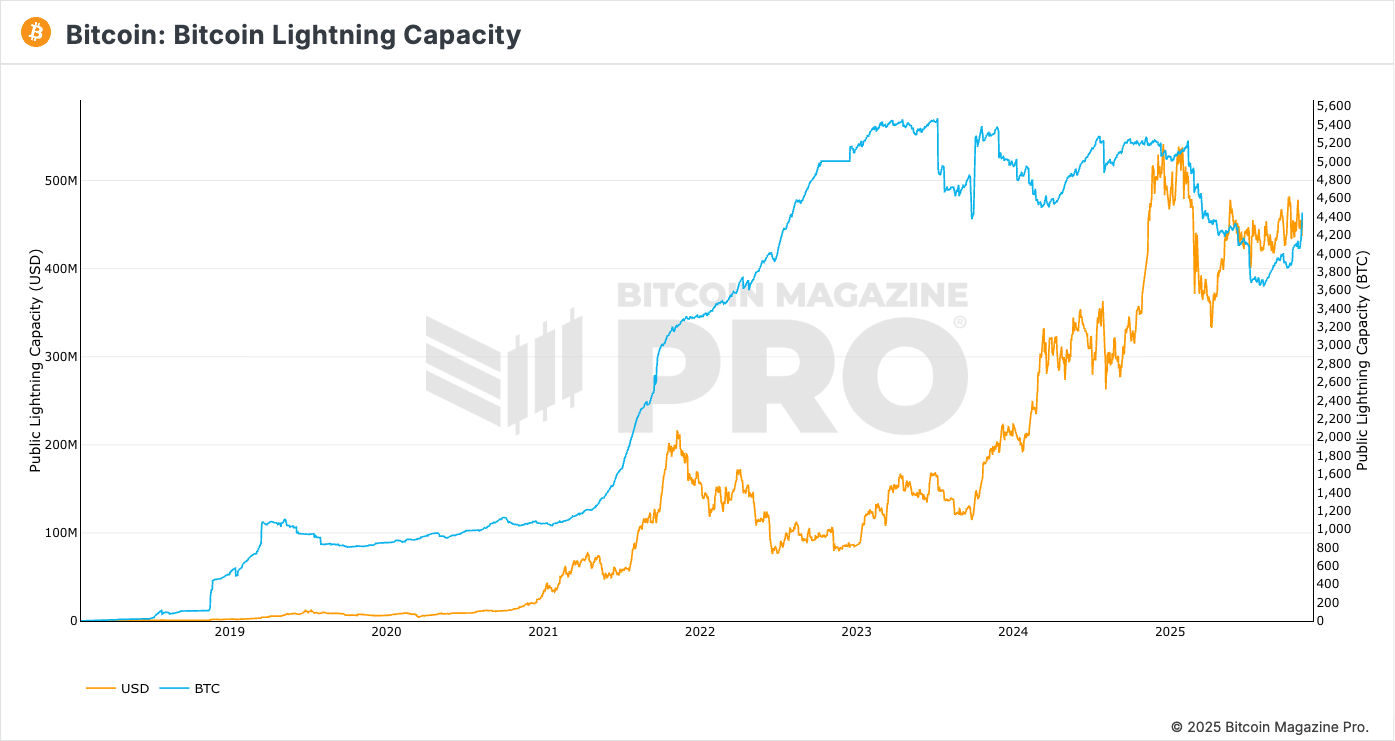

This chart shows Lightning Network capacity, which represents Bitcoin’s Layer 2 transaction volume.

If Lightning and similar scaling solutions continue to grow, fewer transactions might settle on the base layer, which means lower fee revenue for miners.

At the same time, the block subsidy (currently 98% of miner income) will drop another 50% in 2028.

If Bitcoin’s price doesn’t appreciate to offset that decline, weak miners will be flushed out.

In that environment, the strategic edge will belong to miners who control their own power, energy delivery, and policy outcomes.

And that’s exactly what we’re already seeing among the best-performing public mining equities today.

Now this headwind could also turn itself into a tailwind, depending on how demand for final settlement on Bitcoin’s base layer changes in the coming years.

When most people think about Bitcoin’s value, they think about the coins themselves.

But there’s a second form of scarcity that will become just as important:

Blockspace

Or the limited room inside each block where transactions are permanently settled.

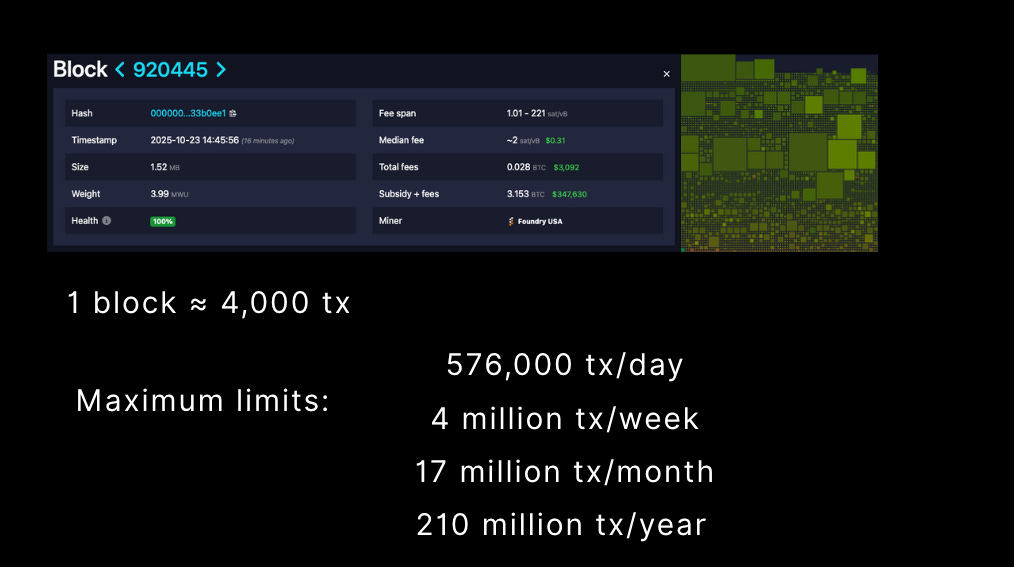

Roughly one block every 10 minutes, about 4,000 transactions per block, which means the absolute ceiling is only ~210 million transactions per year.

So If all 8 billion people on Earth wanted to make a single base-layer transaction, it would take almost 40 years.

And when demand for settlement exceeds supply, fees rise and accrue to miners.

But it’s hard to model any meaningful transaction revenue into future miner profitability given how event driven it is.

So just something to keep in mind.

But what about the tailwinds?

Historically, a nice tailwinds for miners is always price significantly outpacing difficulty:

But this knife can cut both ways. YTD it’s been a headwind. Difficulty is up OVER 40% YTD

Meanwhile, price is up 8% YTD

This is why hashprice is in the gutter.

But, if we see something similar to 2017 and 2021 take shape in 2026, then this is a major tailwind.

And as AI/HPC projects compete for data center capacity, new mining site development could slow further, putting a lid on difficulty growth.

The other future tailwind, and a wild card, is the sovereign bid.

President Trump has said he wants America to become the ‘Bitcoin mining superpower of the world.’

and that he wants Bitcoin ‘mined, minted, and made in the USA.’

His sons, Eric and Donald Trump Jr., founded American Bitcoin: a strategic mining company with the mission of ‘building America’s Bitcoin infrastructure backbone.’

In other words, own block production and the settlement rails bitcoin moves on.

And if the U.S. begins to nationalize hashrate to maintain currency dominance in a post-Petrodollar world, mining would be treated as a strategic imperative rather than a private enterprise.

You would certainly want to have some exposure to mining in this case.

Given all of this information, every investor must decide how to strategically fit Bitcoin mining in their portfolio.

There are 3 primary methods:

Mining equities

Hosted mining

DIY mining

On the equity side, performance has been explosive.

Several are up over 100% YTD ($IREN, $CIFR, $BITF)

Or diversified exposure through a mining ETF like WGMI, which is up 158% year-to-date.

The CoinShares $ WGMI mining ETF is up over 150% YTD.

On the hosted mining side, you get direct exposure to the hashing machines themselves.

Direct transaction fee exposure, difficulty-price dynamic exposure, ASIC equipment exposure, Bitcoin mining pool vote, potential privacy benefits, etc.

Think of it as becoming the CEO of your own mining company.

You purchase the hardware and run it at a professional hosting facility.

The host manages power delivery, uptime, maintenance, and repairs, while you retain ownership of the machines and the mined Bitcoin.

At Simple Mining, for example, clients run machines at an all-in rate of 7 to 8 cents per kilowatt-hour, which as we mentioned previously, is currently profitable.

Hosted mining also opens the door to financing and tax advantages like 100% bonus depreciation, which can dramatically improve after-tax returns.

The final path is DIY mining. Either running a few machines at home or building your own industrial site.

For most people, home mining isn’t doesn’t make any sense from a profit perspective due to high residential power rates and scaling limitations.

If you go bigger and want to build your own site, the capital expenditure can reach $2 million per megawatt once you factor in infrastructure, transformers, containers, and permitting (also something Simple Mining offers).

So there you have it: macro environment, Bitcoin mining profitability, competitive landscape, future headwinds + tailwinds, and the allocation methods.

This letter is the cornerstone for readers: you, as a capital allocator, have to decide how to allocate. This should give you some food for thought.

Personal, as a Bitcoin mining investor, I have exposure to all 3 methods.

Hope this helps.

P.S.

I am doing a weekly tax Q/A with Bitcoin mining tax expert Mike LaLuna.

If you have any specific mining tax related questions, reply to this email, and we can cover it.

P.P.S

I am planning on paywalling this newsletter in 2026 (It will be free for Simple Mining clients) and the focus will be similar to what was covered in this letter.

So fewer broad educational topics (which I will publish on Simple Mining Insights), and more direct content related to investing in the Bitcoin mining sector.

Have a good weekend✌️

- Billy Boone

When Block’s Proto Rig becomes more widely available, does Simple Mining have plans to offer them to clients with hosting service?

The tariff point is intresting especially with CAN positioning themselves as an alternative to Bitmain's dominace. Their AvalonMiners have been gaining traction with smaller operators who want to diversfy away from single supplier risk. Culd be a smart play if tarifs really start sqeezing margins on Chinese imports.