How to Buy a Bitcoin Miner With $0

Turn bank money into Bitcoin

Good afternoon miners,

Market sentiment noticeably shifted yesterday.

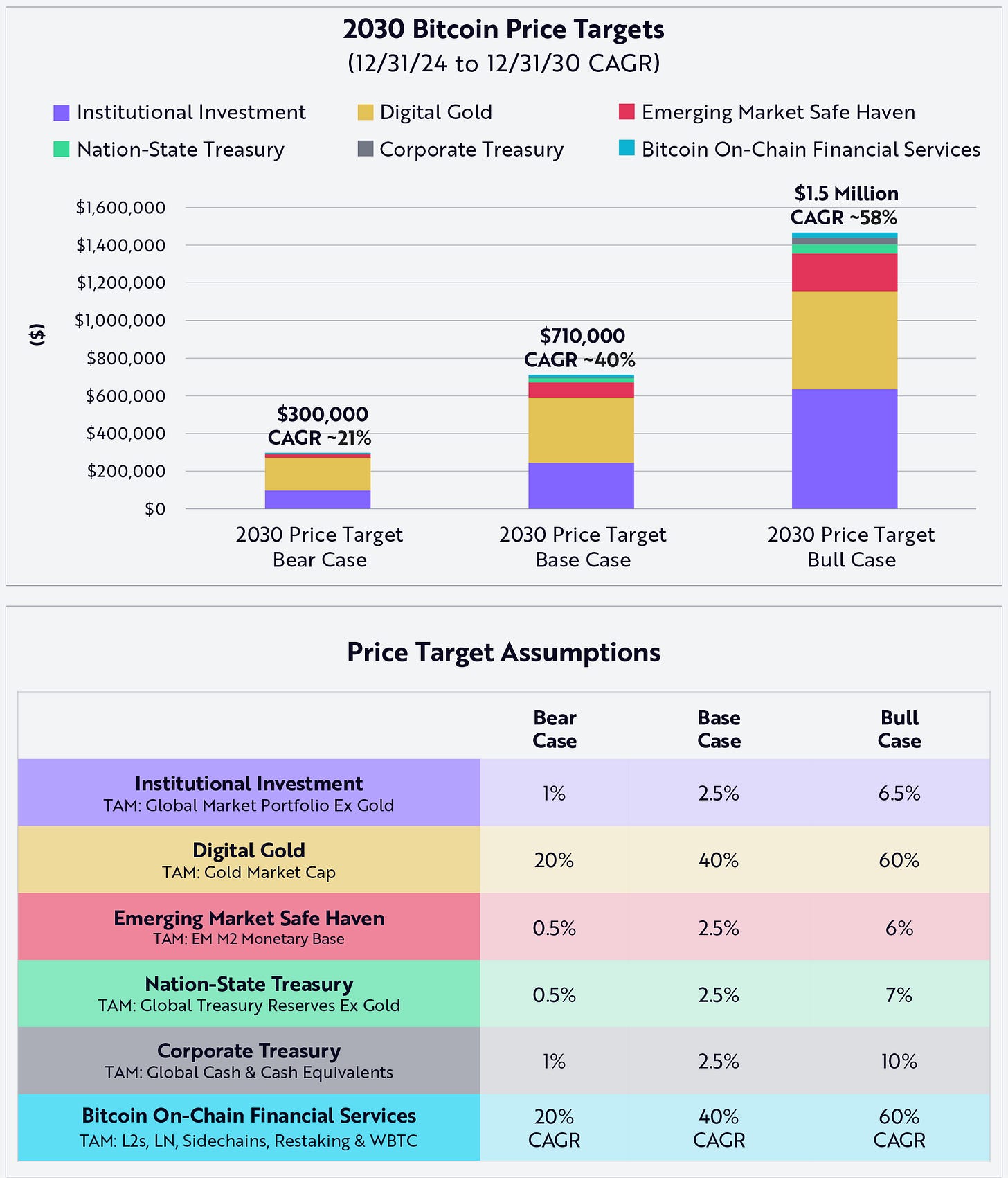

I had a conversation about $1 million Bitcoin price yesterday.

It made me think about the timeline.

I remembered this ARK report:

Food for thought.

You know what keeps me up at night?

Watching investors dump $100K+ into miners while completely ignoring one of the most powerful financial tools:

Business credit.

But first,

This message, including any hypothetical scenarios described, is provided for informational and illustrative purposes only and does not constitute professional advice. These scenarios are hypothetical and are not indicative of any specific outcome or past performance. Results will vary based on individual efforts and external factors. I make no promises or guarantees regarding your investment success.

Please note that individual successes are influenced by personal abilities, market conditions, and other external factors. I, nor Simple Mining, assume no responsibility for decisions made or actions taken based on the content of this email. Always consult with qualified professionals before making significant business decisions.

Here's the question that changes everything:

What if you could mine Bitcoin using the bank's money at 0% interest, write off 100% of the purchase, and pocket all the Bitcoin?

Whatever the bank lends you at a favorable rate can be viewed as leverage.

More Bitcoin and more exposure than you could have otherwise achieved.

Sound too good to be true? It's not.

It's exactly what I have seen countless miners do.

They save millions in taxes while accumulating Bitcoin at a 50% discount to spot price.

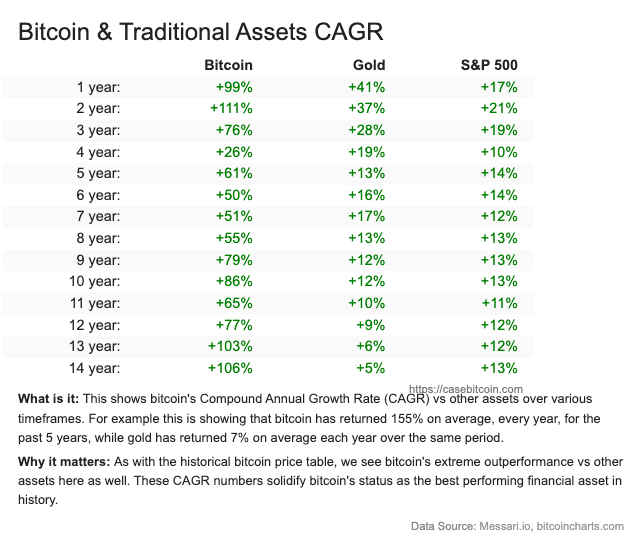

Plus, the mined Bitcoin has historically shown a favorable CAGR.

The longer the exposure, the better.

The Framework Nobody Talks About

Let's get one thing straight. Banks want to lend you money. They make billions doing it.

But most people approach credit wrong.

They apply randomly, they mix personal and business, and IF they do get approved, they purchase LIABILITIES.

Investing Rule:

The game is to have more assets than liabilities. Broke people have more liabilities than assets.

You want to fully bear the cost of assets today and spread the cost of liabilities across time.

You do not want to accelerate the cost of liabilities because then it hinders your contribution to assets today.

A liability spread across time can almost be viewed as an asset (under low interest terms) because it ACCELERATES asset accumulation.

Liabilities denominated in a fiat currency devalue over time due to money printing.

If you understand this, you understand the game all the millionaires and billionaires are playing.

The strategy is to build systematic credit stacks that unlock $100K+ at 0% APR.

Think of it like building a house. You need the foundation first. Then the frame. Then the walls. Skip steps, and the whole thing collapses.

The Personal Credit Foundation

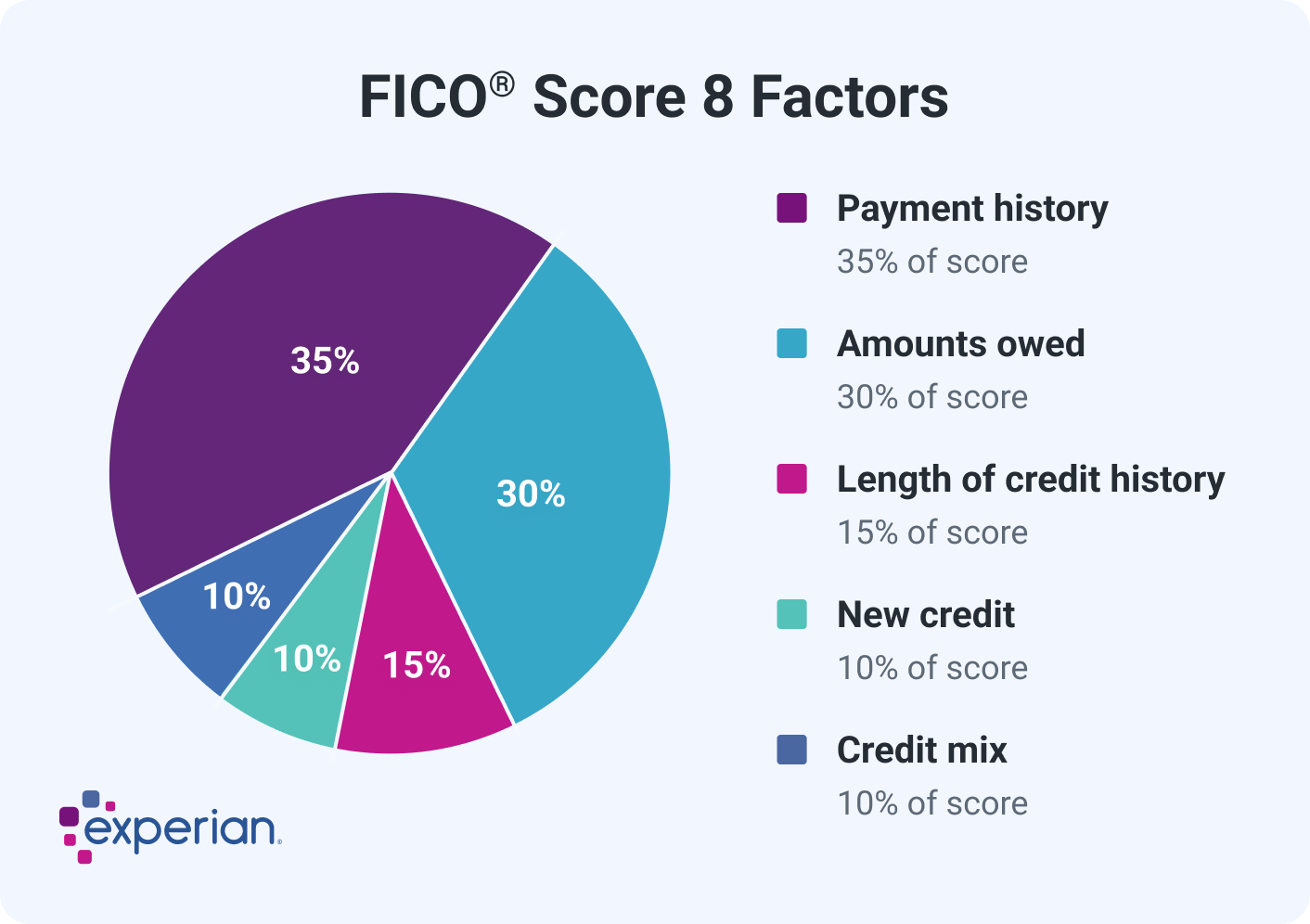

Your personal credit score is your ticket to the game. Banks won't touch your business applications without seeing 720+ on your personal file.

Here is what makes up your score:

Optimize these factors.

Here are a few tips:

1) The Authorized User Hack

Find a family member with stellar credit. Get added as an authorized user on their oldest card. You inherit their payment history instantly. No family? Rent a tradeline before application. Your score jumps 50-100 points overnight.

2) Create Your LLC Today

Register in your home state. Choose something like consulting as your business type. Your LLC needs history, so start it now, even while building personal credit.

3) Get Checking Accounts

Open personal and business checking accounts at each bluechip bank. Fund them with whatever you can. The more the better. Banks track your relationship length. Start the clock now.

This is where discipline pays off. You want to have several personal credit cards to show responsibility.

The easiest place to start is the bank you already use (you want one of the bluechip national banks: Chase, BofA, US Bank, Wells Fargo, etc.)

Use it for everything. Pay it off before the statement cuts. Your utilization reports at 0%. Your score climbs.

As your score increases, apply to more prestigious cards.

You want to have about four top-tier personal cards.

But no more than five card applications in 24 months.

The Business Credit Map

Your personal foundation is set. Multiple cards. $40k+ in limits. Perfect payment history. Now the secret sauce.

You can start with any bluchip bank you already have personal + business checking with, but American Express is usually the best place to start.

Business Platinum (charge card, no limit)

Business Cash (0% for 12 months)

Business Plus (0% for 12 months)

Apply same day. One inquiry. Three cards.

If you wanted to get more cards from another bank like Chase (if you already have personal + business checking with them), you would need to get your hard inquiries removed first.

You can call them and ask to remove.

Pro Tip: Submit application through a human. Your relationship manager submits applications directly to underwriting.

So now you have ~$50k+ for free for 12 months.

You can’t buy Bitcoin directly on an exchange with a credit card.

But you can buy a miner, plus you can write off the whole thing.

The Mining Math

We will use the new hydro-cooled miner at Simple Mining as an example.

Here are the details under current market conditions:

This machine costs about $11,000 currently.

So the new line of credit could purchase ~ 4 machines after sales tax.

Section 179 bonus depreciation means 100% write-off year one. So your effective cost is lower because you can now pay $50,000 less in year-end taxes.

Under current market conditions, if nothing changed for a year, these 4 hydro miners would produce ~ $13,000 worth of Bitcoin (conservative 90% uptime).

The catch is you need to pay back the $50k in 12 months.

You do not want to be investing in something earning 30% ARR while paying 30% APR.

This is how the bank would win.

The Balance Transfer

Those 0% periods end eventually. But new offers never stop coming.

After 12 months, your past applications for the first round of funding have aged.

If they haven’t, you can call and ask for them to be removed.

You need a new round of funding to float the rate.

This is where the balance transfer comes in.

There are several options and promotions top-tier banks offer.

For example:

“Transfer AMEX balances to new Citi cards (0% for 21 months)”

“Transfer Chase balances to new Capital One cards (0% for 18 months)”

This allows you to move anything outstanding at the end of 12 months to a fresh line with 0% APR for another 12+ months.

Some miners have rolled balances for 5+ years. Never paid a dime in interest.

The banks keep sending offers.

You can, in theory, “kick the can down” the road forever.

The LLC Factory:

Create multiple LLCs. Each gets its own EIN. Each builds its own credit. LLC #1 mines Bitcoin. LLC #2 mines Bitcoin. LLC #3 mines Bitcoin.

You get the idea. It’s the ultimate mining flywheel.

But what about the risks?

The nice thing about business credit vs personal credit is that it doesn’t impact your personal credit score.

You can apply to as many cards as you’d like, and those hard inquiries won’t negatively impact your score.

Also, business credit has no credit utilization, which makes up 30% of personal score.

The ultimate risk is the mining investment imploding.

Deep bear market. A massive natural disaster destroys your capital with no insurance. Bitcoin fails.

That is the biggest risk. Then your mining business has to file for bankruptcy.

Remember, you’re earning in Bitcoin terms.

If you can make minimum payments out of pocket for 12-36 months (1% of outstanding balance, so $500/mo on $50k), you keep exposure to Bitcoin’s CAGR, and the mined Bitcoin alone could eventually outpace the debt burden.

Ultimately, it depends on if you are bullish on Bitcoin.

Leveraging fiat-denominated debt to go long Bitcoin is the trade of the century.

This is how Saylor brought Strategy from a $1B company in 2020 to a $93B company in 2025.

Your Hypothetical Action Plan

Week 1-4:

Get personal credit 700+

Create LLC

Open personal + business checking with all bluechip banks (add funds)

Months 2-3:

Apply for 0% APR business credit

Apply with human account manager for best results

Receive first round of funding

Months 4-12:

Use funding to purchase Bitcoin miners

Write off 100% of purchase to capture bonus depreciation

After 12 months, balance transfer to new round of funding.

The banks give you the money. The government gives you the write-off. Bitcoin gives you the upside.

This should not be taken as investment advice or associated with the views of Simple Mining.

This is a thought experiment and includes hypothetical scenarios.

Any actions taken as a result of this information will vary and can result in serious loss.

There are no promises or guarantees.

This is purely educational information I found interesting.

Have a good weekend✌️

Would it be better to split that $100k into

33k for miners

33k for minimum payments

33k for hosting fees?