How To Profit From A Monetary Regime Change

2026 Trump Shock

Many investors chase Bitcoin as an emerging tech play.

They watch Cathie Wood. They watch ETF inflows. They buy when they see lines on a chart predicting $444k.

This perspective bleeds capital in sideways markets. You sell at the bottom when you need liquidity. You miss the regime-level moves because you’re watching the wrong indicators.

Watch sovereign nations instead.

Here is an interesting thesis to think about:

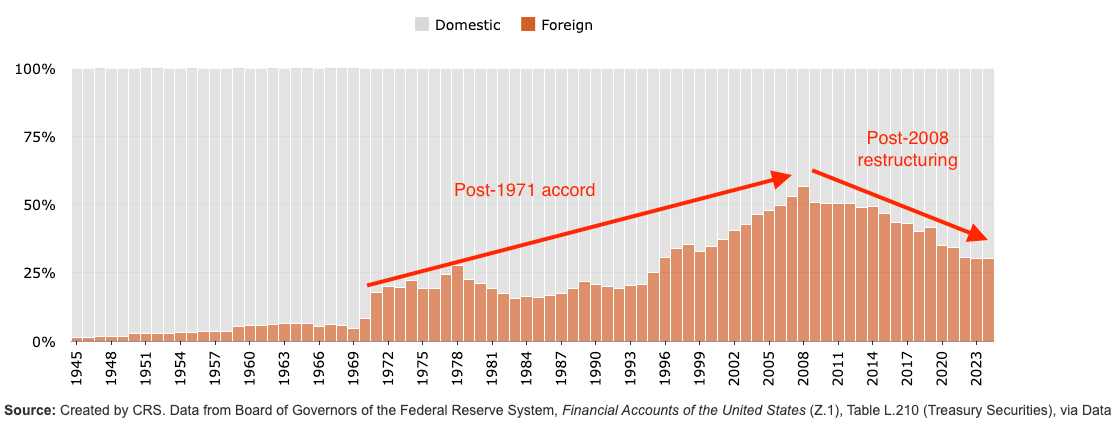

Foreign Holders of US Treasuries Just Hit a 25-Year Low

In the 2000s, foreign buyers held over 40% of US Treasuries. Today that number sits around 25%.

The bid is vanishing.

Central banks in China and Russia stopped funding US deficits and started stacking gold reserves.

This matters because for 50 years, Treasuries replaced gold as the world’s reserve anchor.

Here’s what comes next.

How to position for the biggest regime reset since 1971

You need to understand three moves happening right now:

The Treasury Peg Is Breaking. The US carries $37 trillion in debt against a $25 trillion gold market where most bars sit locked in vaults (allegedly).

We can’t collateralize our way out with an asset our rivals have been stacking for a decade. The gold card has already been played.

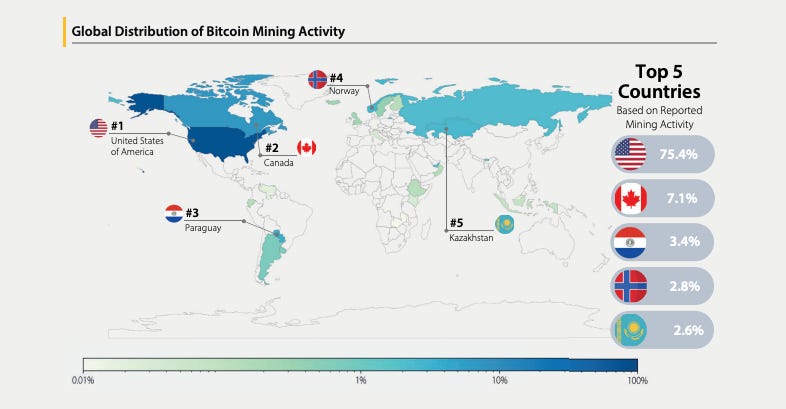

Bitcoin Becomes The Release Valve. America controls 50-70% of global hashrate. BlackRock’s Bitcoin ETF holds over 750,000 coins. Strategy operates as a proxy accumulator. This gives U.S. the auditability edge against BRICS gold narratives.

Miners Turn Into Infrastructure. MARA, RIOT, CLSK, IREN, CIFR aren’t speculative stocks anymore. They’re the strategic settlement layer. If tariffs force ASIC manufacturing onshore, the US locks the supply chain from chips to custody to blockspace.

This is when Bitcoin starts acting like sovereign collateral.

Here’s Why You Should Reframe Bitcoin As Monetary Policy

This is a rerun of the Nixon playbook.

“We must protect the position of the American dollar”

This is the goal.

In 1971, Nixon closed the gold peg to escape foreign claims on Fort Knox.

Today, Trump uses tariffs as deflationary policy while the Fed prepares to cut rates. Liquidity floods into assets, not groceries. This is how you weaponize monetary policy without triggering CPI inflation.

Normally, tariffs are inflationary (they make imported goods more expensive).

But if tariffs are structured and targeted in a way that reduces demand for foreign consumer goods and shifts production back domestically, they can act like a “consumption tax” that dampens spending on imported staples.

That has two effects:

Suppressed consumption in CPI basket (groceries, electronics, etc. may see less demand or substitution).

Relative disinflation in the reported CPI, even if asset prices are going up elsewhere.

In other words, tariffs shift the pressure point: they don’t flood everyday goods with money, they restrict them.

What This Means For Your Capital Allocation

The opportunity window is narrow. Hashrate consolidation accelerates as tariffs may force ASIC production onshore. Eyes are on Proto miners.

Trump has already said, “I want Bitcoin mined, minted, and made in USA”

Custody concentrates in US-regulated entities. The infrastructure builds in silence because monetary wars don’t announce themselves.

Here’s What Changes in Your Portfolio:

You allocate to Bitcoin as base layer collateral, not speculation.

It offers protection against sovereign debasement that shows up in asset prices, not CPI. You add exposure to US miners because they control the rails of the new regime.

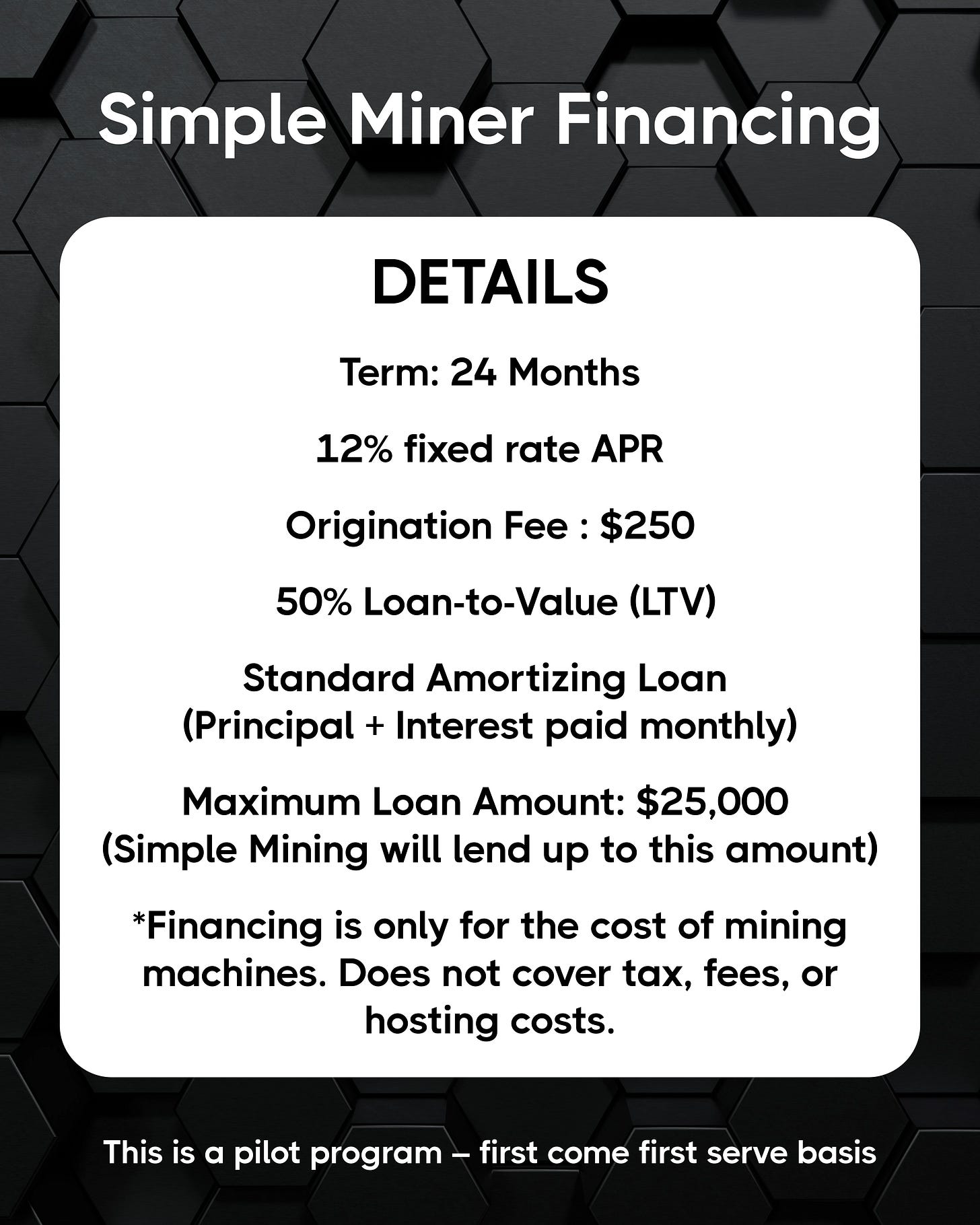

Better yet, you become the CEO of your own mining company with Simple Mining.

Cambridge hashrate data shows US dominance approaching 80%.

USA controls the settlement layer. Fed funds rate cuts become bullish instead of bearish because liquidity flows into asset repricing. Treasury auction results matter less than hashrate concentration.

Position Sizing By Conviction Level:

Conservative: 10% Bitcoin, tracking hashrate and custody metrics

Moderate: 10-40% Bitcoin plus 5% allocation to US mining

Aggressive: 50+% Bitcoin, 10+% miners, rebalancing as hashrate crosses 80%

The math supports larger ranges than traditional portfolios because it is more based on a black swan event.

If even 1-2% of the $300 trillion global collateral base migrates to Bitcoin, it’s $150k-$300k per coin.

If Bitcoin absorbs gold’s $25 trillion market cap, that’s $1.2 million per coin.

If it becomes 5-10% of sovereign reserves, $2-3 million becomes the baseline.

Food for thought.

The Pattern Playing Out In Real Time

Look what happened after China banned mining in 2021.

Hashrate migrated to the US.

Now we host 75% of global mining power.

Meanwhile, BlackRock accumulated over 750,000 BTC through ETF inflows in under two years.

Strategy operates as a public accumulation vehicle adding roughly 30,000 coins per quarter since 2020.

You see three parallel moves.

First: hashrate consolidation under US jurisdiction.

Second: custody concentration in regulated US entities.

Third: ASIC supply chain relocating onshore through tariff pressure.

Coincidence? Unlikely.

Powell’s term as Fed Chair ends May 2026.

Trump just nominated Stephen Miran to the Fed Board of Governors.

In his first vote, Miran dissented, arguing rates are 200 basis points too high.

This signals the composition shift. Trump wants dovish voices who frame Bitcoin as collateral infrastructure, not speculation.

This all shows up in asset repricing. Bitcoin. Miners. Real estate. Equities.

What Can Go Wrong

No strategy plays out perfectly. Here are some bottlenecks:

Political Risk: An opposing administration could slow the pace with climate regulations targeting miners or consumer protection rhetoric around Bitcoin. But they won’t dismantle custody infrastructure or hashrate concentration that preserves dollar dominance. The tools might get different labels, but the strategy continues.

Coordination Failure: If foreign rivals build their own Bitcoin mining infrastructure faster than expected, US dominance erodes. But the window for competitors is closing (if not already closed)

Adoption Resistance: If banks and institutions refuse to treat Bitcoin as tier-1 collateral, the transition stalls. But we’re already seeing Basel III/SAB 122 evolve to accommodate digital assets. The banking system adapts or gets replaced by stablecoin settlement rails.

Geopolitical Escalation: If BRICS countries accelerate their gold-backed settlement systems, it creates a parallel monetary structure. But gold loses to Bitcoin in a digital-centric economy.

The risk isn’t owning Bitcoin, it’s not owning any.

The Bottom Line

The new system is already building around Bitcoin infrastructure under US control.

You’re watching the biggest monetary shift since 1971 unfold in real time. The market won’t price this in advance because markets don’t price regime change.

They price business cycles, earnings, and sentiment. They don’t price sovereign nations restructuring the entire collateral base of global finance.

Here’s a question: Do you position for the world as it was, or the one that will be?

The old system is failing. The hashrate consolidation tells you what replaces it.

Everything else is noise.

P.S.

Simple Mining rolled out miner financing yesterday:

Email sales@simplemining.io if you’re interested.

P.P.S.

We’re doing the largest Bitcoin mining giveaway of all time.

S21+ hydro AND S21+ air cooled.

$20,000 value.

Two winners.

Refer a winner, you also win.

And if you don’t win either, everyone who enters will win a bonus gift after giveaway ends (7 days from now).

Here is the link to enter

Have a good weekend.