Ice Water Wakeup for Miners

What's next for hashrate?

Gm readers.

The club isn’t the only thing going up on a Tuesday.

Bitcoin exchange rate is 1.6% in the green this morning.

This is following a brutal -5% red candle yesterday.

Short-time frame chart analysis is of marginal benefit for Bitcoin hodlers as most activity/noise will become mere reference 6-12 months from now.

But if you are confused about why price action is currently in the “trenches” at 60k-70k consolidation, check out last week’s letter here.

The TLDR is leverage has its foot on the market’s neck.

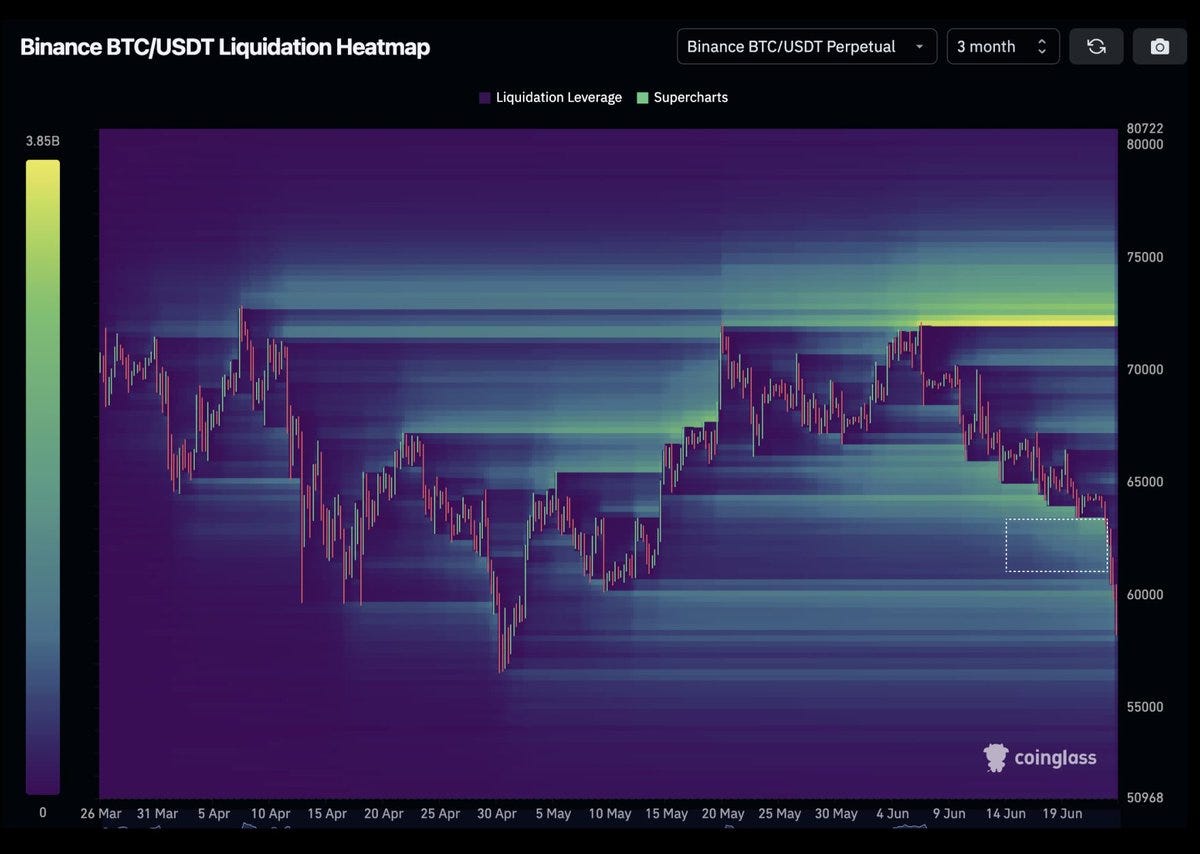

Binance is a crypto exchange with the highest futures trading volume.

This chart is supposed to hint at the price levels at which large-scale liquidation events may occur.

A liquidation event is when a trader's position is “liquidated” due to the price moving too far in the wrong direction relative to their entry and their margin account balance can no longer cover the position.

With speculators piling on new long positions, they act as fuel for more liquidations in a cascading long squeeze.

The next key resistance level is the 200-day moving average at $57,500.

What’s next from here?

Hashrate needs a clean slate.

A propped-up hashrate would involve inefficient miners running outdated hardware and high operating costs. The perfect recipe for bankruptcy.

The healthy miners who will carry the hashrate forward will be the ones prematurely upgrading and insulating weakness with efficiency.

The obvious move considering miner income recently got slashed in half.

Both scenarios involve a lighter Bitcoin balance to pay for either losses or upgrades.

And we can’t assess miner capitulation without the hash ribbons:

When the 30-day moving average of hashrate (green line) is less than the 60-day (blue line), it suggests miners are unplugging machines, either due to unprofitability or energy curtailments.

And we know unprofitable miners need to sell bitcoin to cover expenses.

The forced capitulation clears out selling pressure and is a good signal for the dust to settle.

It has taken 61 days since the halving for the miner’s day of reckoning:

This is good news for the non-weak miners.

We’re looking at an estimated 5% decrease in difficulty:

If you’re wondering if your machine is profitable, Simple Mining has a dashboard to get the latest rundown under the current BTC price and electricity cost of $0.080/kWh:

Satoshi never would have guessed people would be losing their minds over a $60k dip.

It’s times like these that make Bitcoin a hardened asset able to face whatever headwinds come its way.

Price is noise.

Principles are signal.