Mine vs Buy Bitcoin in 2026

Hashprice is at all-time lows. Here's what could happen next

This letter is now $21/month.

It will remain free for all active Simple Mining clients.

If that’s you, email me from the address you use for Substack and I’ll comp your subscription.Going forward, this publication will focus on capital allocation, timing, and risk in Bitcoin mining (and overall investing ideas I have about the sector).

The mission is to build a favorable position for what will be the greatest dual catalyst the market has ever seen:

Bitcoin & AI

So fewer broad educational topics (which will be published for free at Simple Mining Insights), and more direct content related to investing in Bitcoin mining.

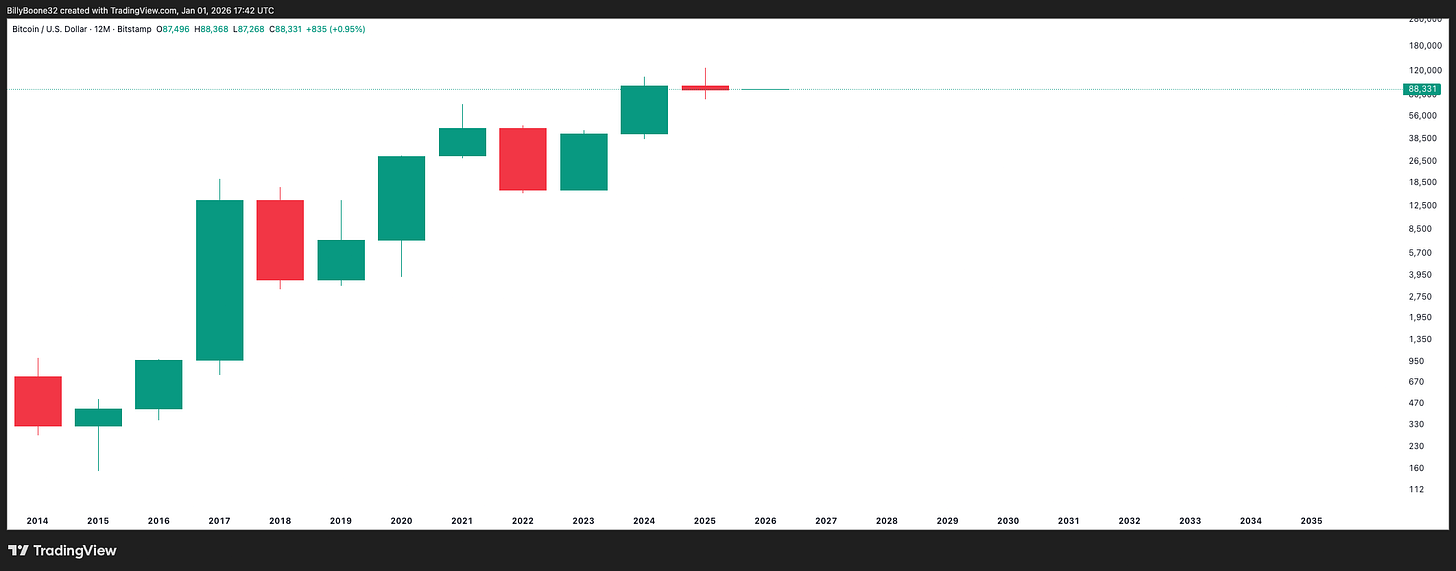

2026 is here, and Bitcoin has officially broken a strong trend it has been following since 2014: red candle (down year), following by three green candles (up years)

What does this mean?

Bitcoin is in uncharted territory.

More importantly for readers of this letter, what does this mean for Bitcoin mining?

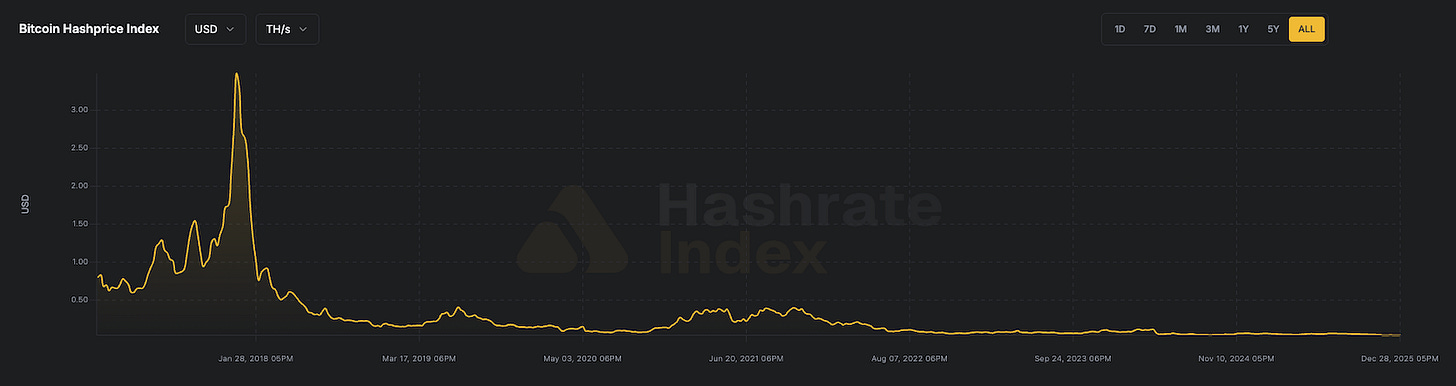

Most people look at hashprice and see a broken market:

They miss the signal hiding in plain sight.

Hashprice tells you when to enter.

Right now, we sit at levels we haven’t seen since ever.

The question is simple: does this mean mining is dead, or does this mean a unique opportunity is forming?

What separates miners who ROI from miners who bleed capital until they quit?

Timing.

And timing comes down to one relationship: price growth vs difficulty growth.

Let me show you the math:

The Mining Profitability Equation

Before we forecast 2026, we need a shared framework.

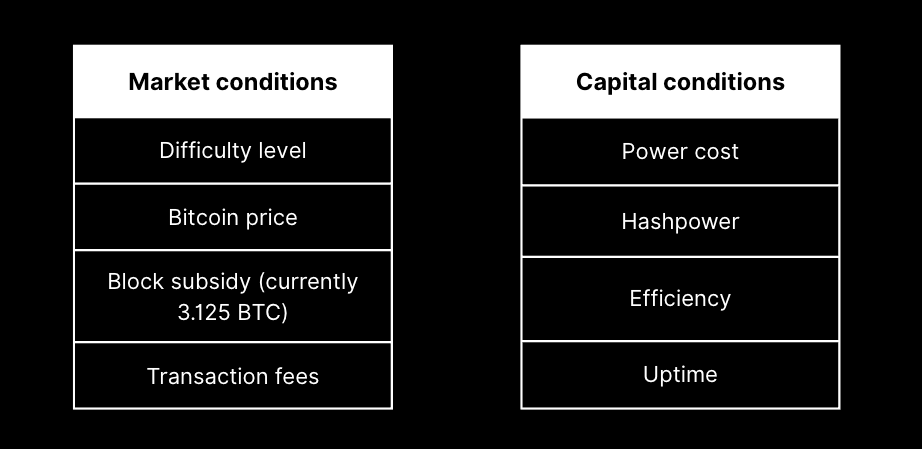

Mining profitability splits into two buckets: market conditions and capital conditions.

Market conditions (external, you have no control over these):

Difficulty (how many miners compete for the same pie)

Bitcoin price (what your mined BTC sells for in dollars)

Block subsidy (currently 3.125 BTC per block)

Transaction fees (the wildcard that spikes during network congestion)

These four variables combine into one metric:

Hashprice.

Hashprice tells you expected revenue per unit of hashpower.

It rolls everything together so you can compare apples to apples across time.

Capital conditions (internal, what you have more control over):

Power cost (the single most important variable)

Hashpower (hash output)

Machine efficiency (how well does the machine turn input joules into hash output)

Uptime (percentage of days your machines run)

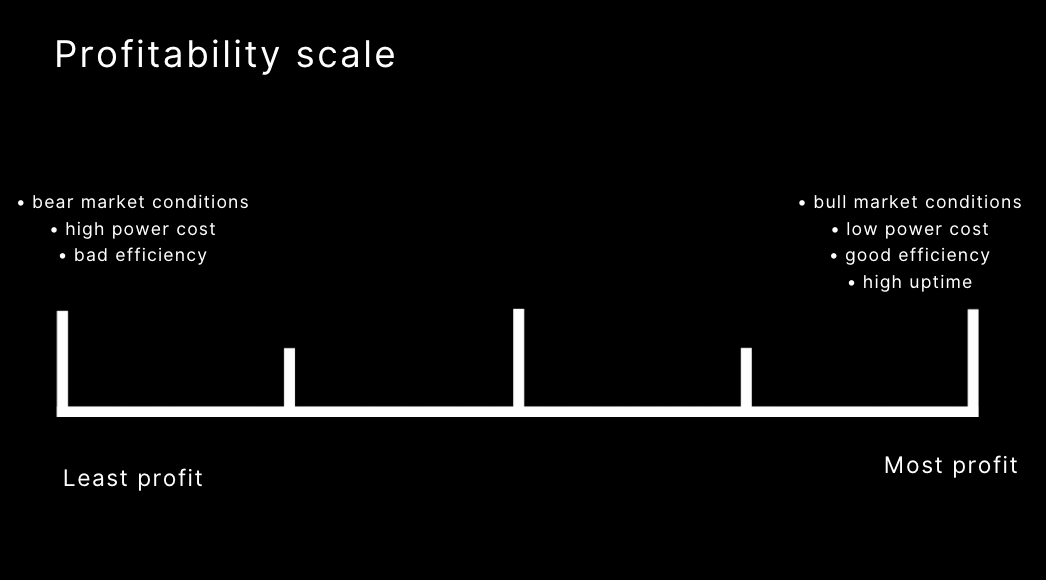

The formula is simple: Revenue minus Cost equals Profit.

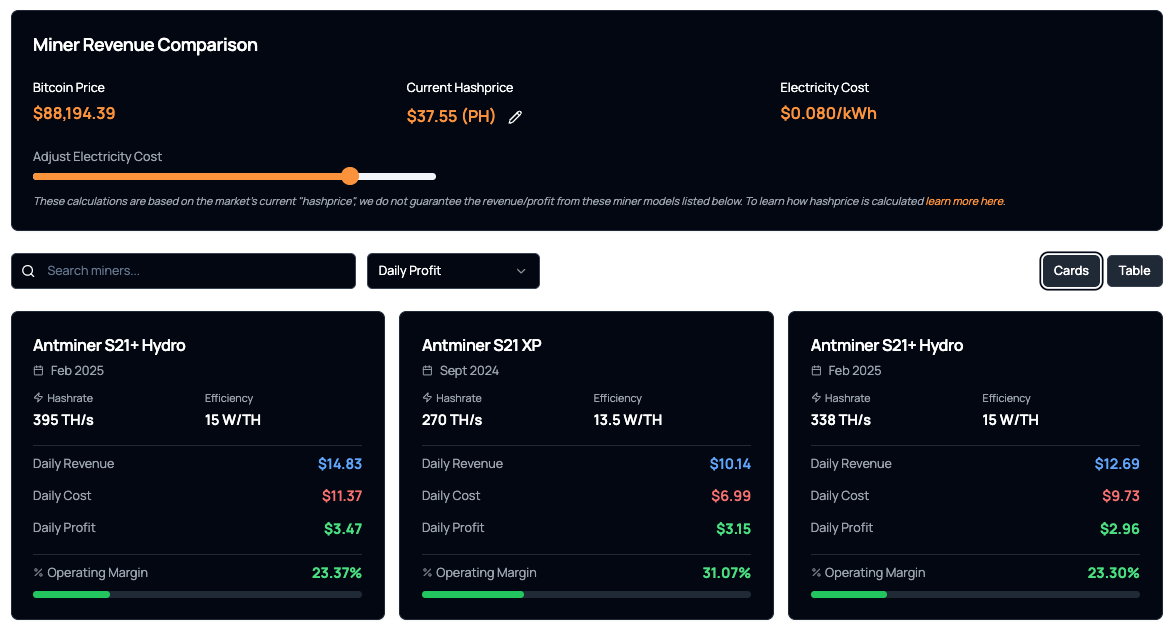

You can see there are still machines with Revenue > Cost at 8 cents per kilowatt hr:

But the timing of your entry changes everything.

Why Hashprice Looks “Bad” (And Why That Might Be Good)

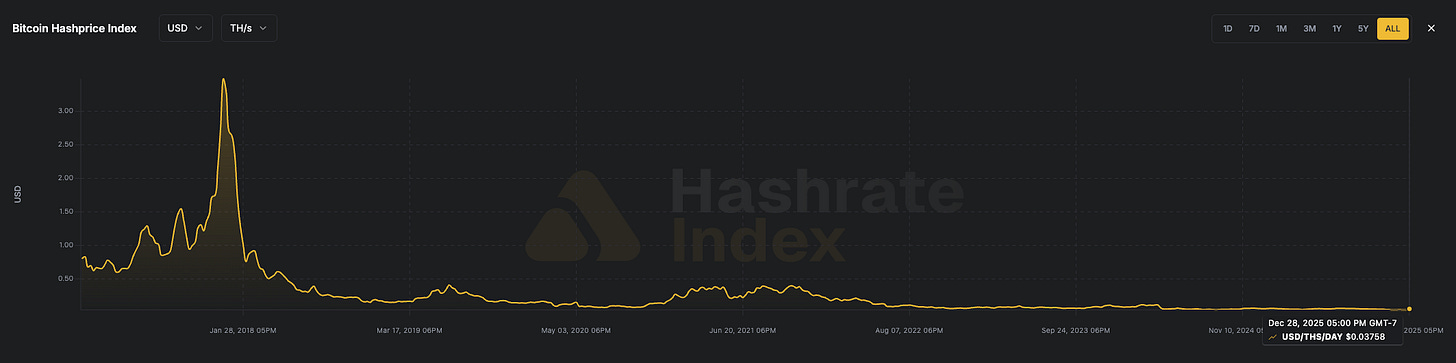

In 2017, miners earned over $3 per TH per day. Today, we hover around $0.03 to $0.04

Does this mean mining is a “bad investment?”

No.

It means the market matured.

Consider the context of 2017:

Bitcoin price rose over 2,000% in one year

Machines produced 10 TH (today’s produce 400 TH)

Block subsidy was 4x larger (12.5 BTC)

Difficulty was a fraction of today’s level

That was the perfect storm.

Massive price appreciation, low competition, high issuance.

Today’s lower hashprice reflects an industrialized market.

More miners. Better machines. Tighter margins.

But here is what matters: hashprice lows creates entry points.

And entry points determine ROI.

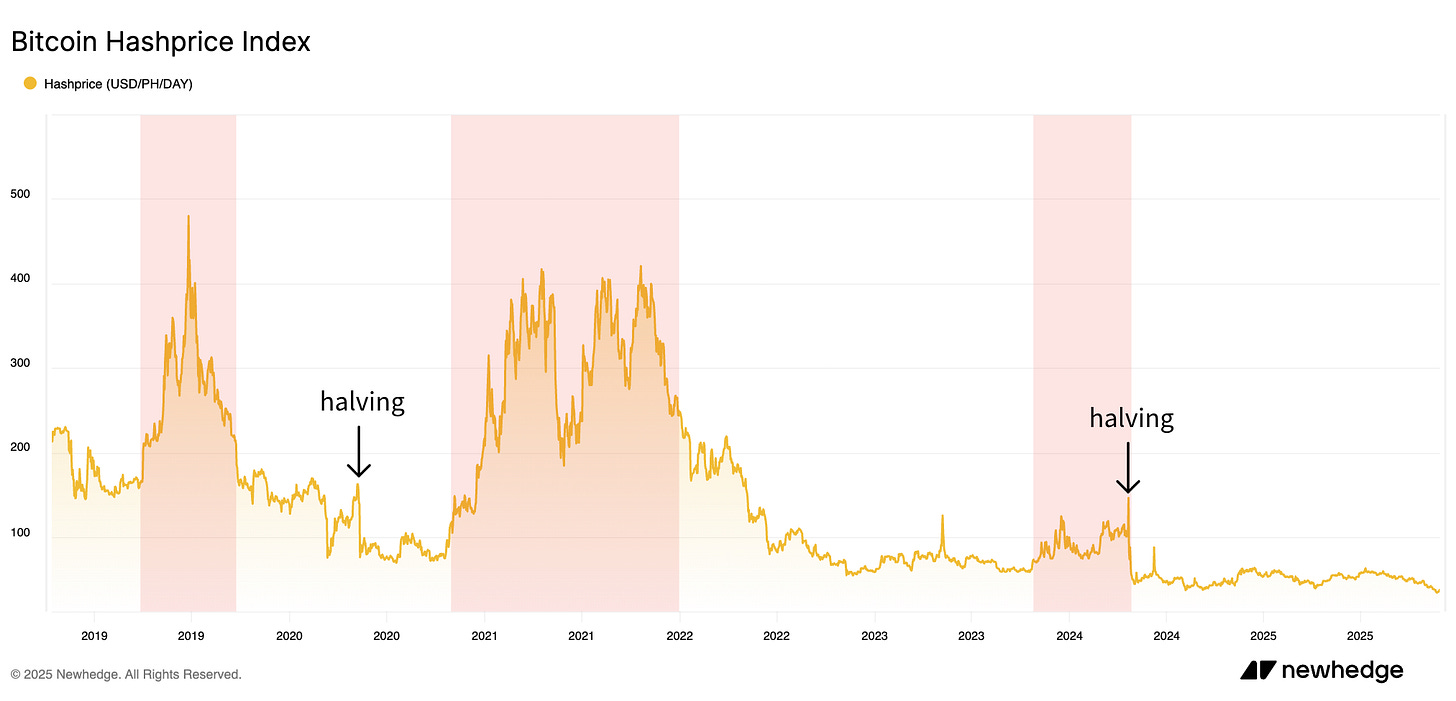

The Three Golden Windows

When we study history, three periods stand out where miners crushed it:

April 2019 to September 2019

Price: +100%

Difficulty: +68%

October 2020 to May 2022

Price: +230%

Difficulty: +55%

October 2023 to April 2024

Price: +130%

Difficulty: +46%

See the pattern?

When price growth exceeds difficulty growth, miners win.

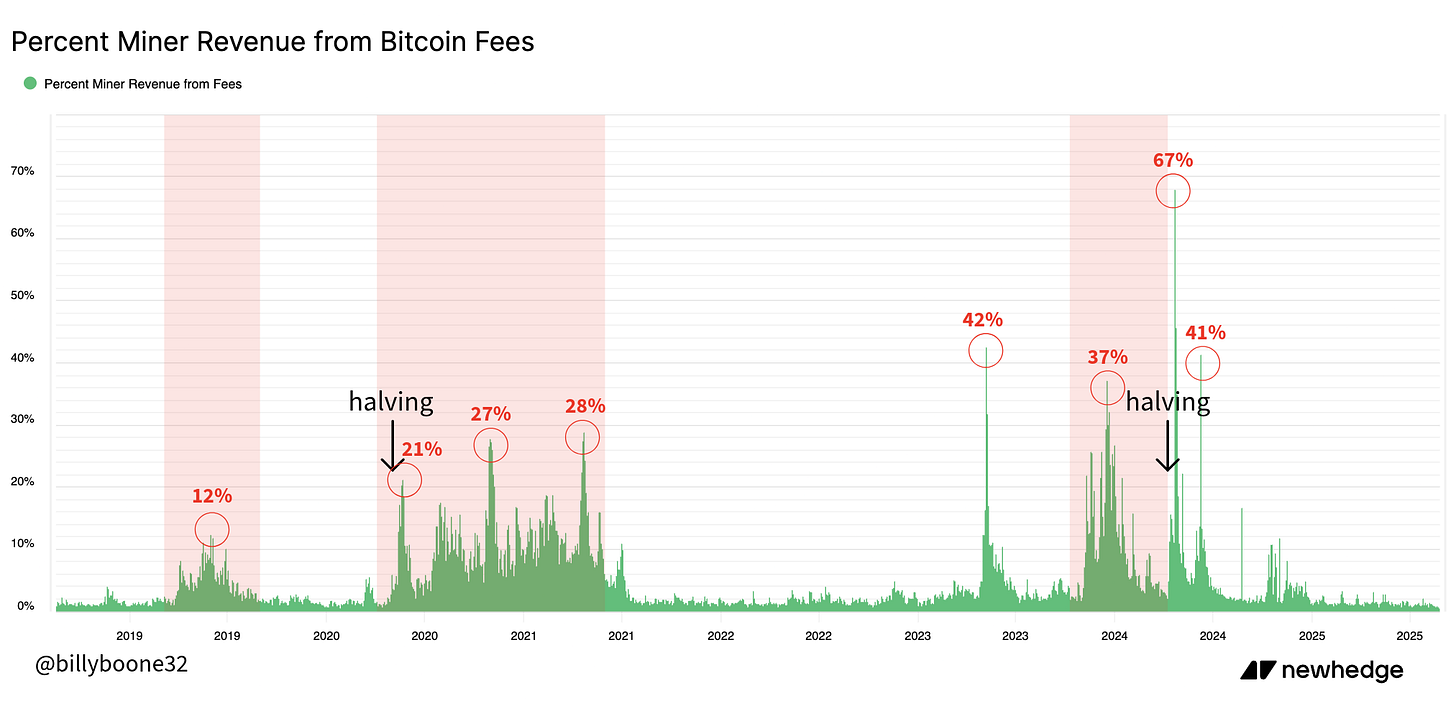

Transaction fees also spike during these windows (same period shaded red overlay)

Around halvings, fee revenue has hit almost 70% of total miner revenue.

These periods make up for all the bad days.

If you miss them, you struggle to ROI.

If you catch them, your investment compounds.

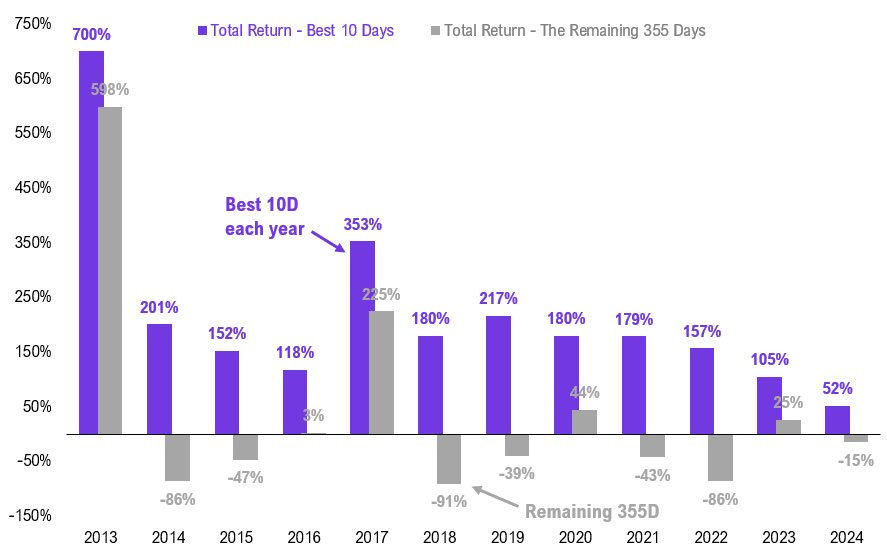

The same principle applies to Bitcoin itself.

Miss the best 10 trading days and you miss most of Bitcoin’s annual gains:

Favorable mining = price growth > difficulty growth + fee revenue spikes.

Now let’s look at 2025 and forecast 2026

2025: The Setup Year

Here is what number 2025 ended with:

Price: -6%

Difficulty: +36%

Difficulty crushes price. This is the opposite of our golden windows.

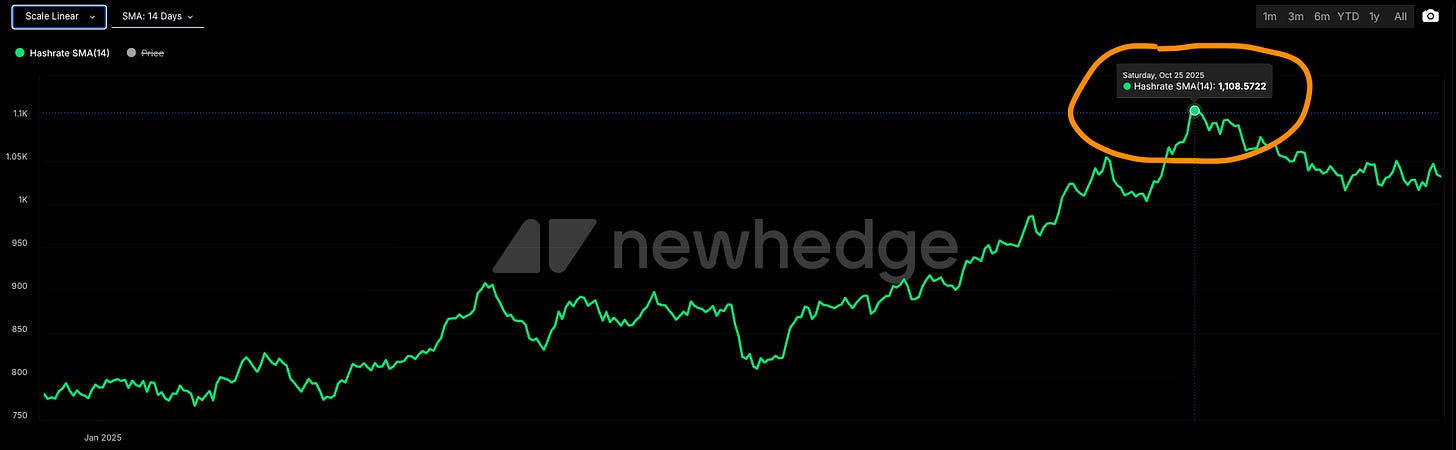

Why does difficulty keep climbing?

Miners ordered machines during the 2024 rally thinking 2025 would be an explosive year.

Those machines went online and pushed hashrate to an all-time high.

We then saw a hashrate correction (3 negative difficulty adjustments in a row).

Q4 BTC price didn’t play out according to many miner expectations, and those with fragile margins were forced to unplug.

This dynamic creates miner capitulation, BTC sell pressure, and only the best operators hold on.

But here is the key insight:

periods where difficulty outpaces price have historically preceded the opposite.

The rubber band stretches. Then it snaps back.

The 2026 Thesis

Three forces converge to make 2026 the “20% producing 80% of the return”

Force #1: Price Projections

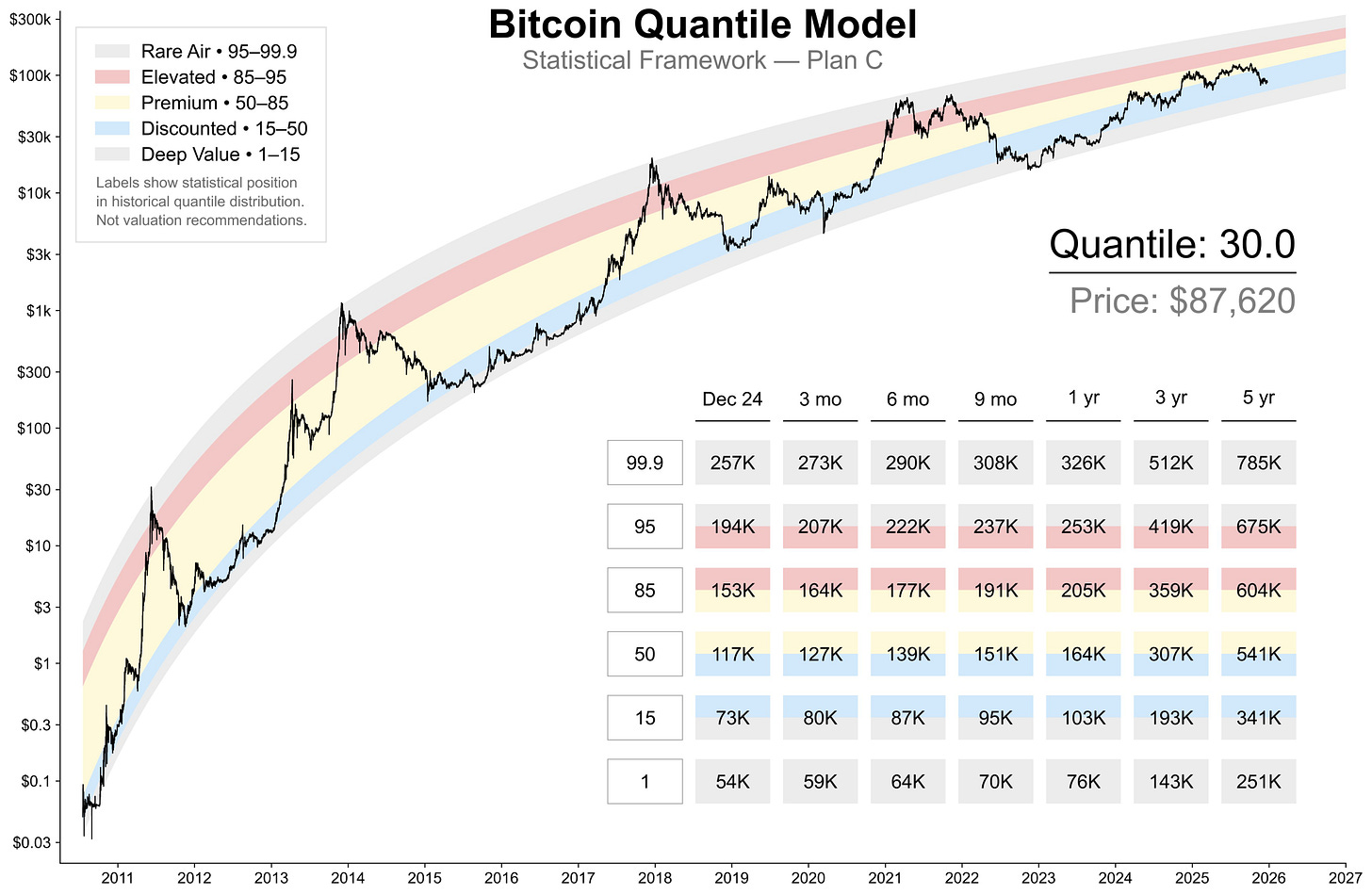

Quantile models based on historical distribution put 2026 Bitcoin price between $164,000 and $205,000 (discounted to premium).

That represents 86% to 133% growth from current levels.

This aligns with prior bull phase magnitudes. We see similar percentage moves in each of our three golden windows.

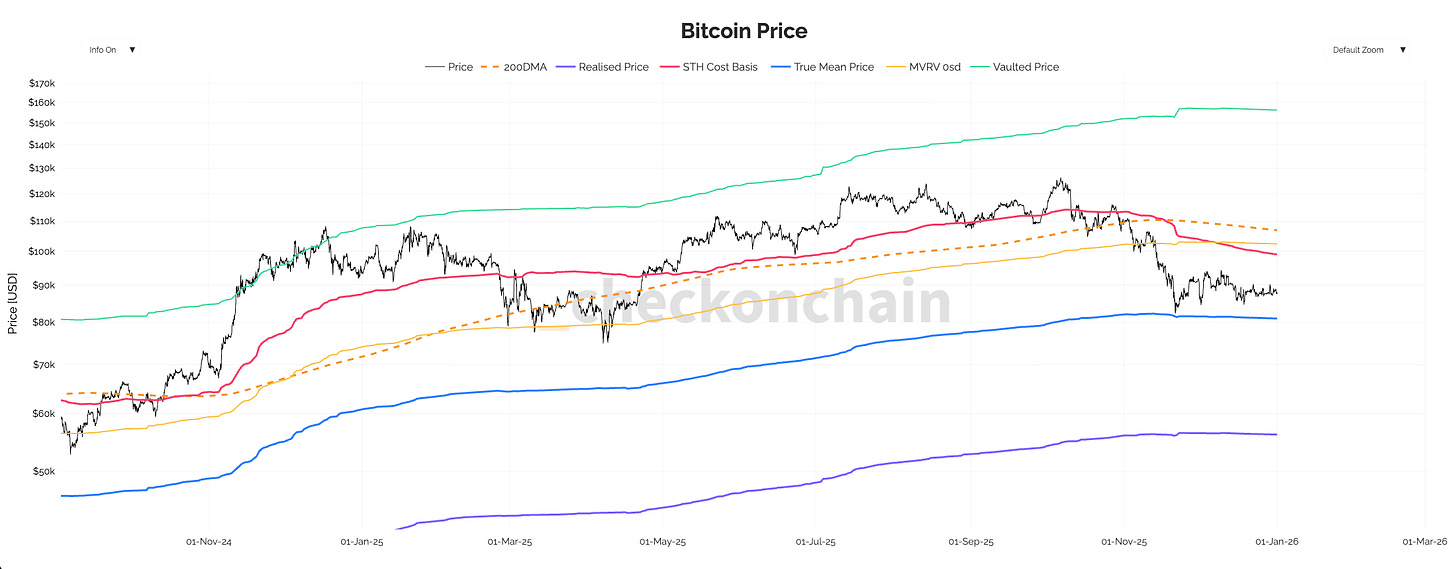

Bitcoin also sits in “discounted territory” relative to its historical quantile distribution (getting close to deep value)

Quantile 30 meaning Bitcoin has been higher 70.0% of the time historically and lower 30.0%.

The 2024-2025 rally never hit a euphoric peak (especially in hard money terms, and is actually break-even over 5 years)

Force #2: Difficulty Growth Is Slowing

This one surprises people.

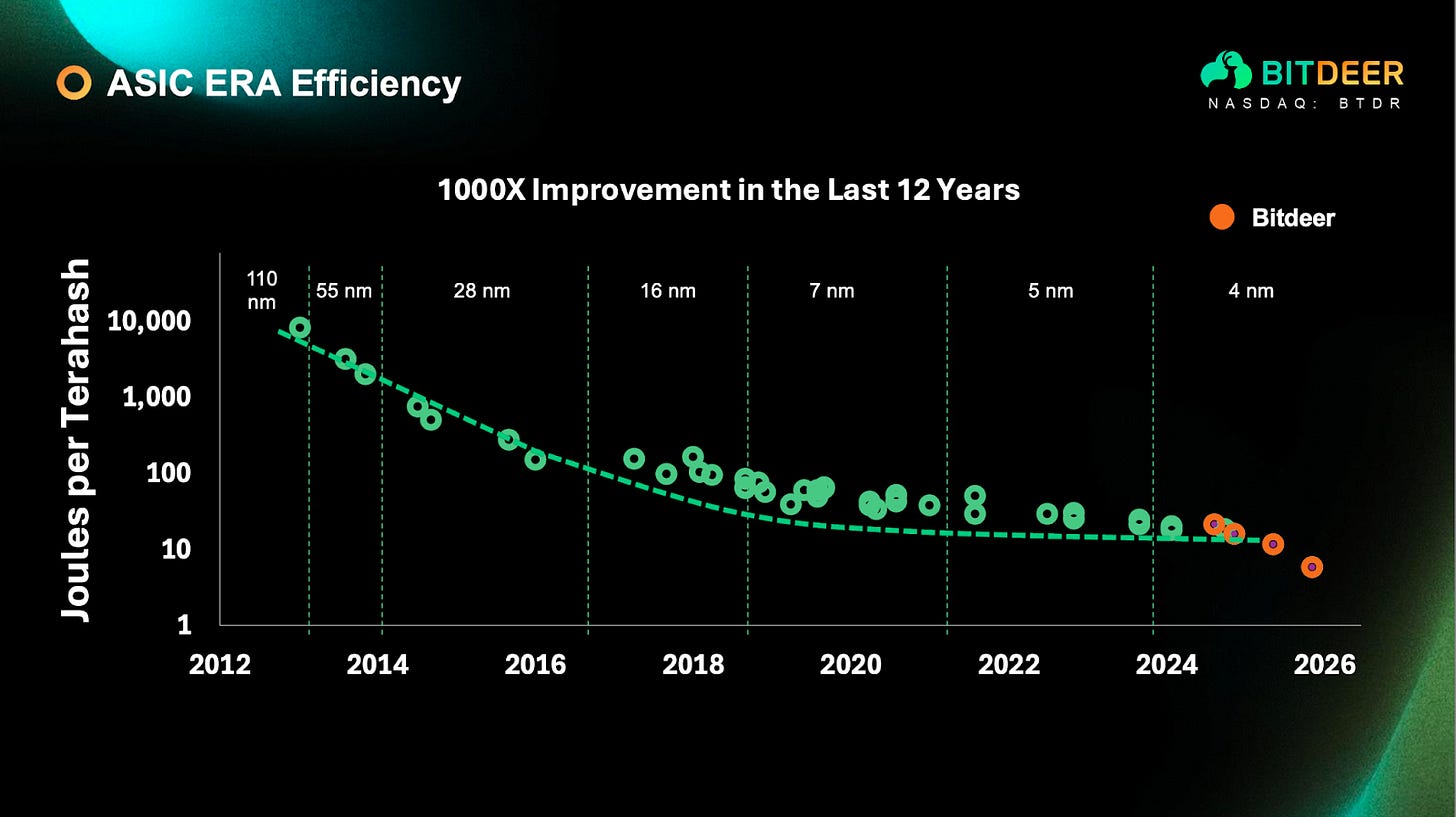

ASIC efficiency approaches physical limits.

The industry moved from 150 J/TH to 15 J/TH over the past decade.

Getting from 15 J/TH to 10 J/TH is much harder than getting from 150 J/TH to 100 J/TH.

We see this in the data.

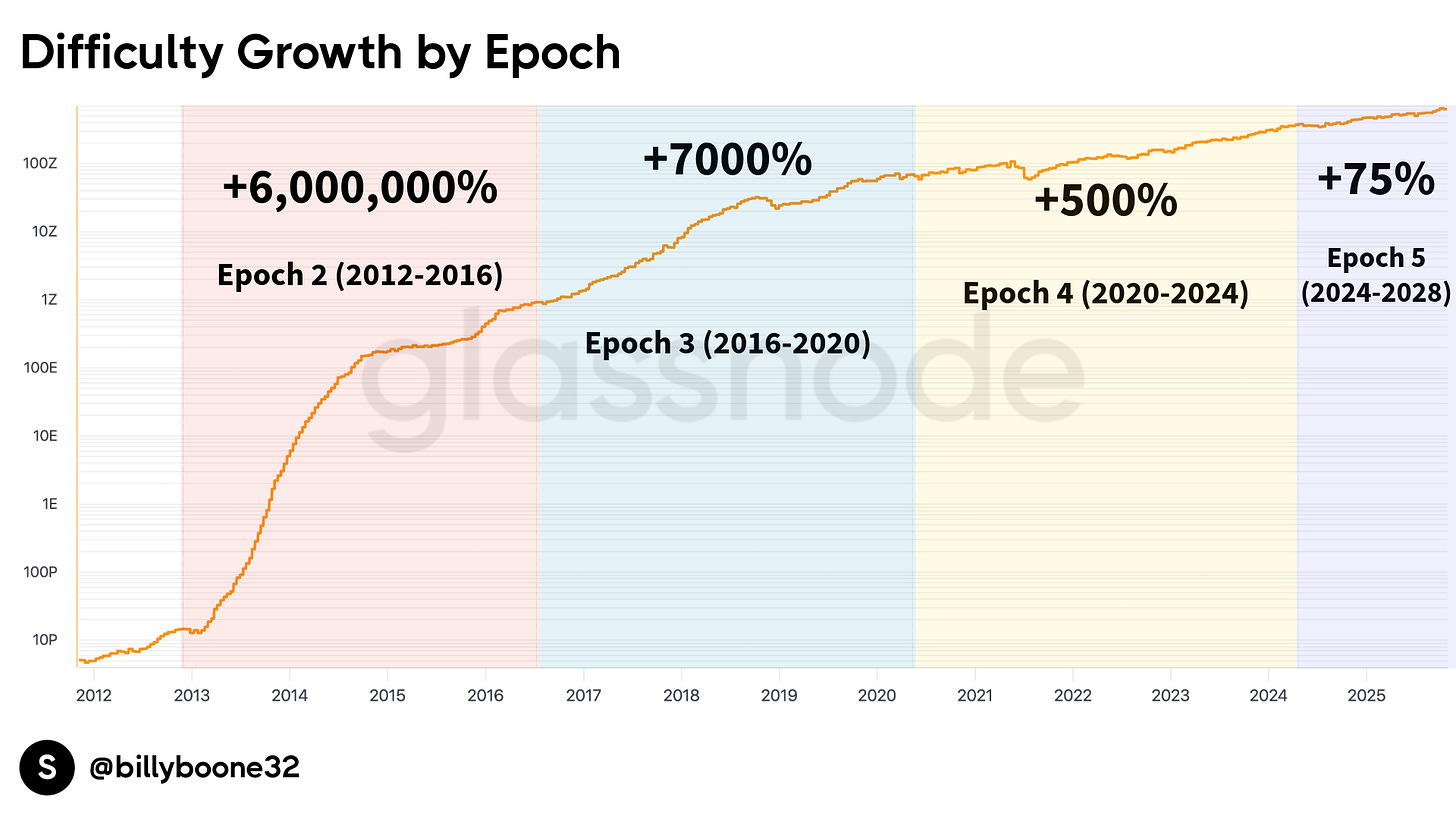

Difficulty growth rate shrinks each epoch.

Difficulty is up ~ 75% since the April 2024 halving.

If this trend continues, difficulty will increase ~ 167% total in Epoch 5, or roughly 2.1% compounding monthly.

If this trend holds, difficulty could increase 30-40% in 2026.

Compare that to a potential 86%-133% price increase.

The math starts working in miners’ favor.

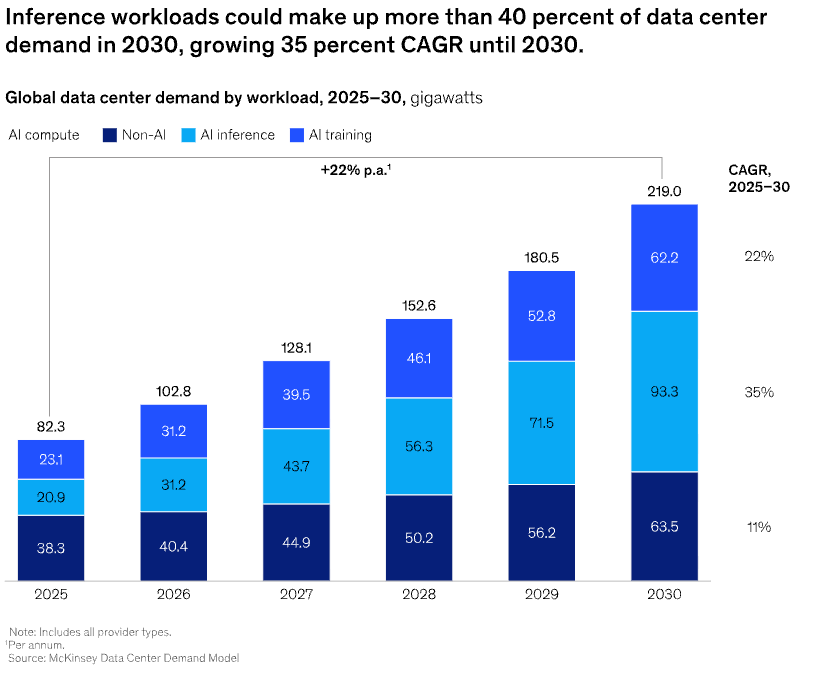

Force #3: AI/HPC Demand Competes for Power

This is the wildcard most people miss.

AI data centers need massive power. They pay premium rates. They sign long-term contracts

This creates competition for the same power that mining projects need.

Some mining projects will lose their sites to higher bidders.

Others will convert to AI/HPC entirely (IREN and CIFR)

The result?

Fewer new miners come online. Difficulty growth slows further.

The miners who secure good power positions gain a structural advantage.

What Could Go Wrong

Let me be direct about the risks.

Scenario 1: Price stays flat or drops. If Bitcoin trades sideways through 2026, the thesis breaks. Miner keep capitulating. Hashprice stays compressed. Miners on the margin exit.

Scenario 2: Difficulty spikes anyway. New chip breakthroughs or massive capital inflows could drive difficulty higher than expected. The price-difficulty dynamic stays unfavorable.

Scenario 3: Regulatory headwinds. Energy policy changes, mining bans(could be also be a tailwind), or tax treatment shifts could alter the situation for U.S. miners.

Even with these risks, and a hyper conservative outcome, it looks like an information advantage.

This seems to be an upcoming change nobody is paying attention to.

The Actionable Framework

So what do you do with this information?

If you’re evaluating mining entry:

Calculate your breakeven based on your power cost and machine efficiency

Model scenarios with various price & difficulty growth

Ask: does my position survive the downside and capture the upside?

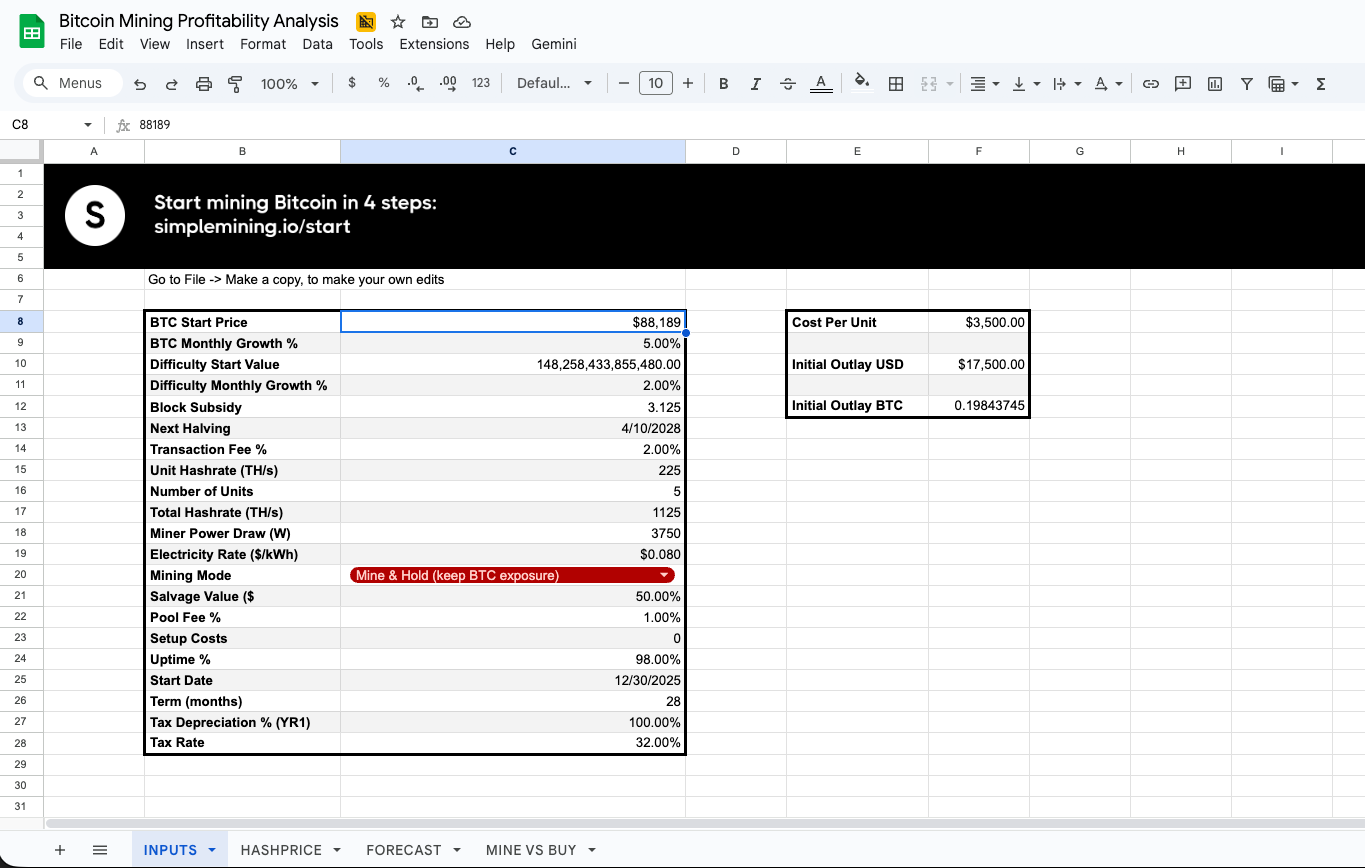

I made a tool for this:

Bitcoin Mining Profitability Analysis

Fill in the inputs (the most important for FORECAST will be “BTC Monthly Growth %” and “Difficulty Monthly Growth %”)

HASHPRICE dynamically calculates profitability.

FORECAST shows a month by month breakdown, with Mine & Hold and Mine & Sell scenarios for the term.

You can also compare Mine vs Buy.

If you want a demo how to use this modeling tool, feel free to email me at billy@simplemining.io

If you already mine:

Consider expanding your fleet

Upgrade to sub-15 J/TH machines if your capital allows

Maximize uptime. Every percentage point matters for payback period.

Use the tool to determine mining term.

The entry point framework:

Hashprice low = potential value entry

Hashprice elevated = pay a premium

We’re at all-time lows.

Could it get worse? Yes.

But on-chain data shows clean bounces off the average acquisition price of active investors (True Market Mean)

This level acts as strong support.

The Bigger Picture

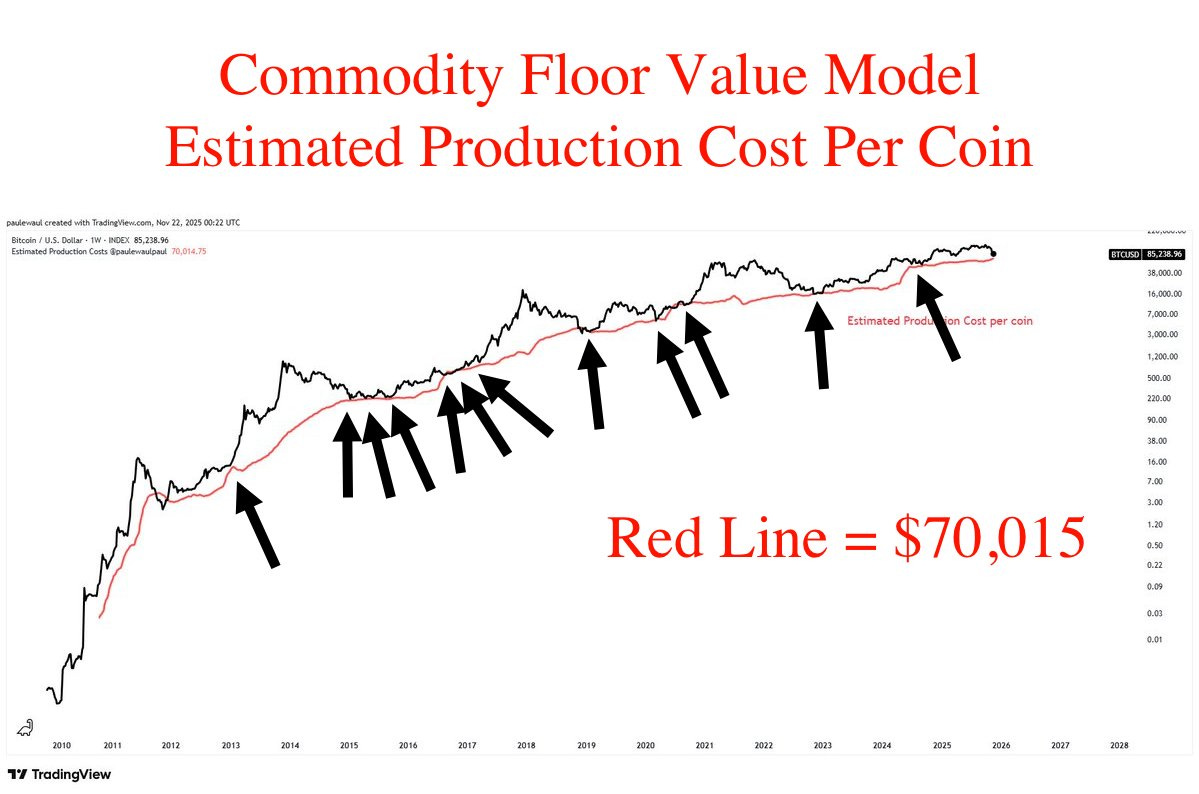

Bitcoin’s production cost creates a floor.

The Cambridge Electricity Consumption Index estimates global average miner cost around $80,000 per BTC (5 cents per kWh, 30 J/TH efficiency, excluding overhead)

Miners above and below this exist.

But the network has a cost structure. Price tends to respect it over long horizons.

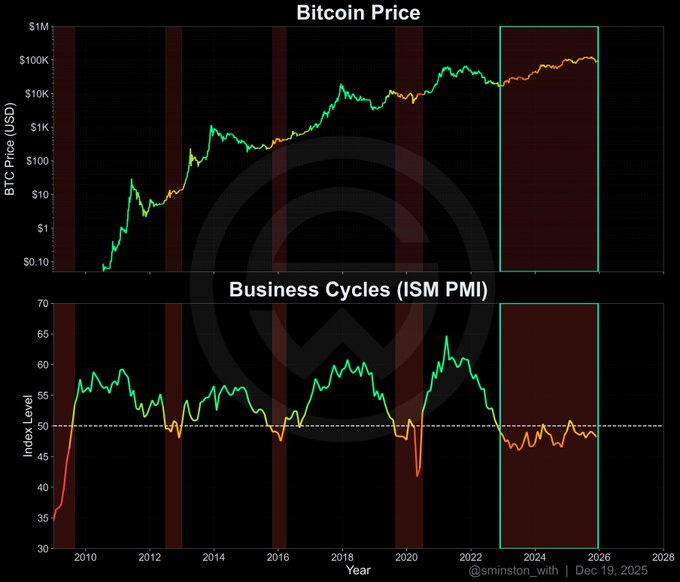

Add the macro context: PMI below 50 suggests economic contraction.

Yet Bitcoin rose 400% from 2023 to 2025 through a flat business cycle.

The asset decouples from traditional correlations.

2026 setup:

price appreciation meeting slower difficulty growth, AI/HPC constraining new mining capacity, and broader macro tailwind in the business cycle.

The conditions for a golden window are forming.

TLDR

Mine vs Buy depends on price growth vs difficulty growth

Three historical windows (2019, 2020-2022, 2023-2024) are the blueprint

2025 shows the opposite: difficulty up 36%, price down 6%

These compression periods historically precede expansion

2026 price projections: $164k-$205k (86-133% growth)

Difficulty growth slowing due to ASIC efficiency limits

AI/HPC demand constrains new mining capacity

Hashprice suggests value entry point

This tool helps you model these scenarios

The best time to buy a miner was before the last hashprice run.

The second best time is the day before everyone else realizes the next one is starting.

Have a good weekend

- Billy Boone