The Common Bitcoin Critics pt. I

"BiTcOiN HaS nO inTriNsiC vALuE"

Good morning readers,

Bitcoin mining is getting less difficult in ~ 5 days:

And you don’t have to miss out on this lowered difficulty.

We currently have S21 and S21 Pro machines for sale.

These pieces of hardware are currently profiting $1.85 and $3.29 per day, respectively.

The macro-environment may seem dreary, although times like this have historically been a great time to enter a mining position.

This irrationally foolish sentiment rollercoaster means people don’t know how to value Bitcoin, which is a good thing, because that usually means it’s undervalued.

Buy when there’s blood in the streets they say.

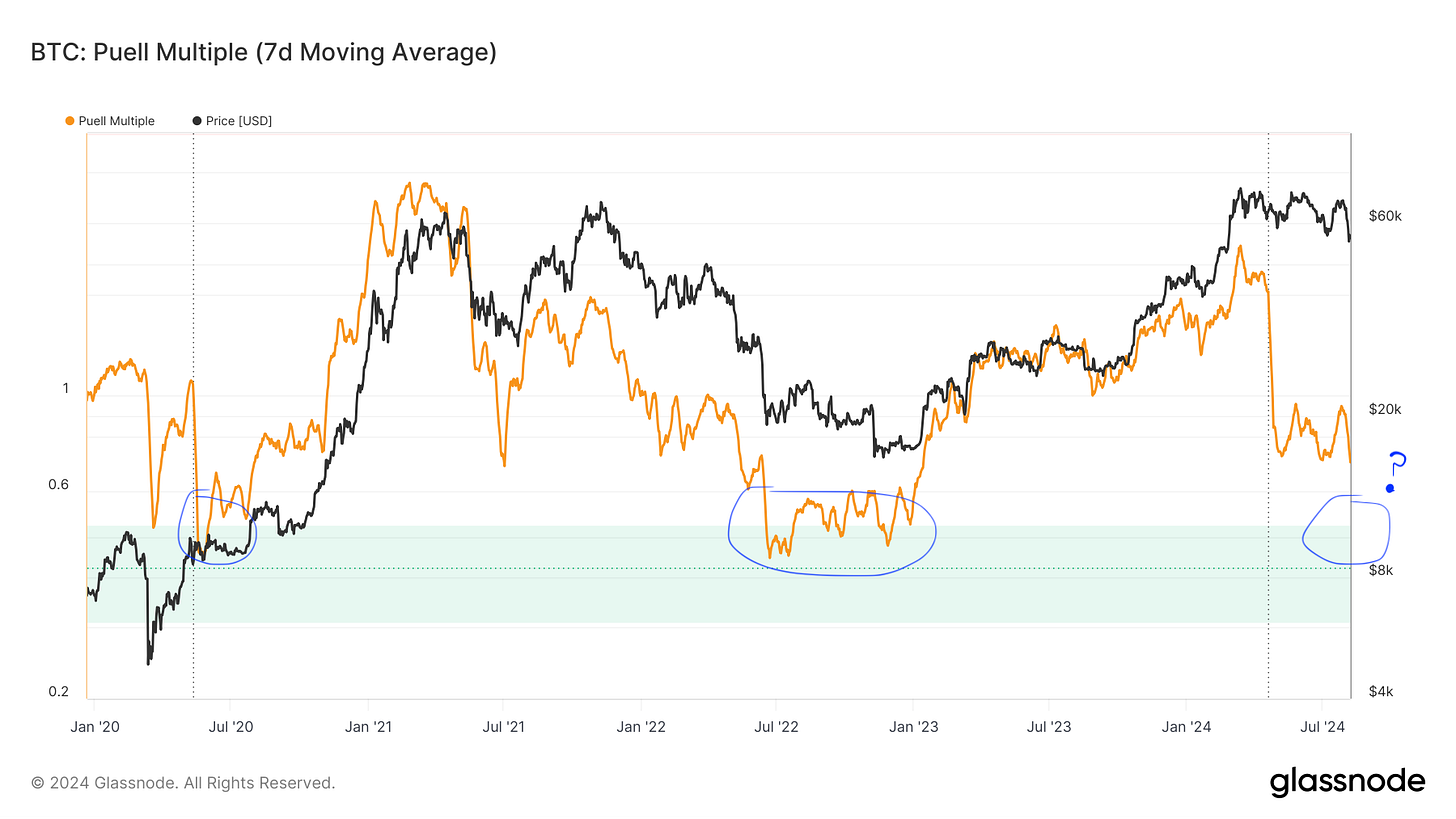

The Puell Multiple shows the daily issuance value of bitcoins (in USD) divided by the 365-day moving average of daily issuance value.

This is a good signal for when miners are facing more resistance relative to year-over-year conditions and has typically been an optimal time to secure a position before an upward trend in price action.

You may want to bookmark this weeks edition because this information can be very useful when dealing with noob Bitcoin critics.

Any time you are discussing Bitcoin in a social setting, there is a high probability you will get hit with one of these responses.

Here are the TOP 10 BITCOIN CRITIC ARGUMENTS:

Bitcoin has no intrinsic value (it is not backed by anything)

Bitcoin is for criminals and money laundering

Bitcoin uses to much electricity

Bitcoin is too volatile

Bitcoin is bad for the environment

Bitcoin will get banned by the government

Bitcoin supply distribution is centralized

I can’t buy anything with Bitcoin

Bitcoin will be replaced

What if the internet goes down

Today we’ll dismantle no intrinsic value, money laundering, and too much electricity and understand why these misconceptions are wrong.

Bitcoin Has No Intrinsic Value

Bitcoin is energy money.

This is not a new idea, but rather the first fruition of the idea.

Bitcoin is the world’s first decentralized, secure, scarce, permissionless, energy money.

Nikola Tesla and Henry Ford imagined it 100+ years ago.

Energy money, by design, uses energy.

Lots of it.

It’s called proof of work. It’s fundamentally opposite of proof of stake fiat currencies and cryptocurrencies.

“Intrinsic” comes from the late latin word, “intrinsecus” which just means “inwardly”.

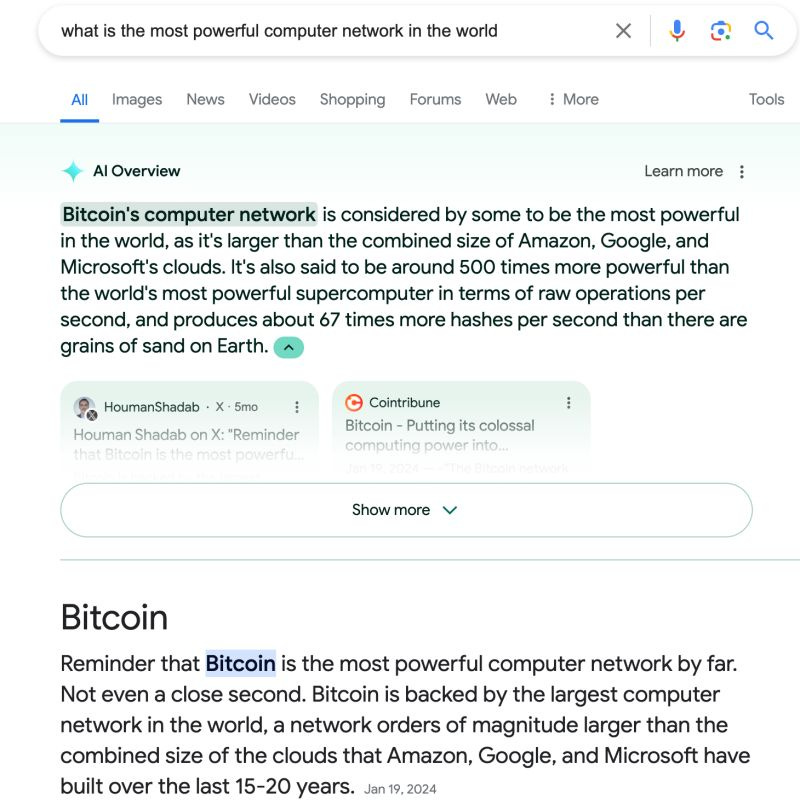

When someone says something has no “inward” value, when it in fact secures billions of dollars of peoples value and represents the most powerful computer network in the world, they have not done their research.

Bitcoin is for Criminals and Money Laundering

It is ironic that Jeff Epsteins banker is ranting about money laundering.

Bitcoin is the greatest OPEN-source technology in the world.

Cash is closed-source. The USD facilitates far more criminal activity than Bitcoin ever will.

Bitcoin is pseudonymous, not anonymous.

Every Bitcoin transaction is recorded on a public ledger , which is visible and verifiable by anyone.

Addresses are not directly tied to personal identities, but they can be traced to individuals or organizations through on-chain analysis.

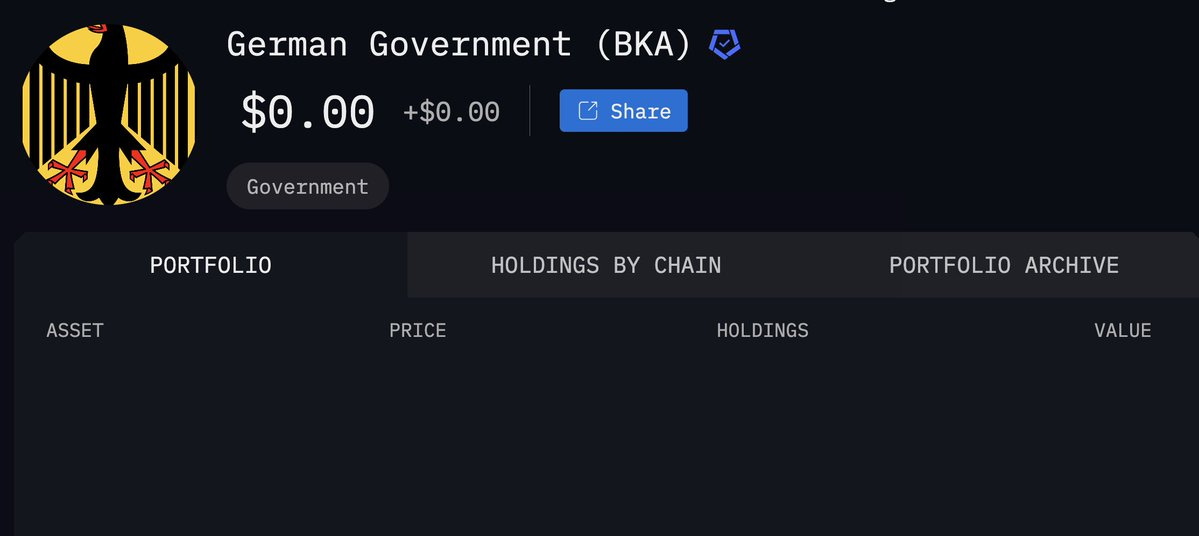

(This is how we know Germany sold their entire BTC stack)

This transparency actually makes it easier for law enforcement agencies to track illicit activities compared to cash or other traditional means.

This is how we know the actual percentage of BTC transactions associated with criminal activities is miniscule. According to studies by Chainalysis, illicit activity accounted for less than 1% of all Bitcoin transactions in recent years.

To what extent are criminals using fiat? I guess we’ll never know.

We do know that the people pointing the finger are in fact playing the game they are criticizing, “Major banks have been implicated in facilitating large-scale money laundering operations, sometimes involving billions of dollars, yet these institutions continue to operate with little impact on their overall reputation.”

The bankers do not have an off switch to the lies spigot.

Privacy is not a crime.

This does not mean you can’t protect your privacy with Bitcoin.

With proper UTXO management, you can minimize the relationship between your IRL identity and your sats.

Bitcoin Uses Too Much Electricity

As of January 2024, Bitcoin uses approximately 141-160 terawatt-hours (TWhs) of electricity annually.

Bitcoin uses far less electricity than the systems it aims to replace or capture market share from.

Traditional finance(bank branches, ATMs, data centers, etc.) and gold mining consume vast amounts of energy. Bitcoin, as a global monetary system, provides sound money services with far less infrastructure and personnel.

This is still against the point.

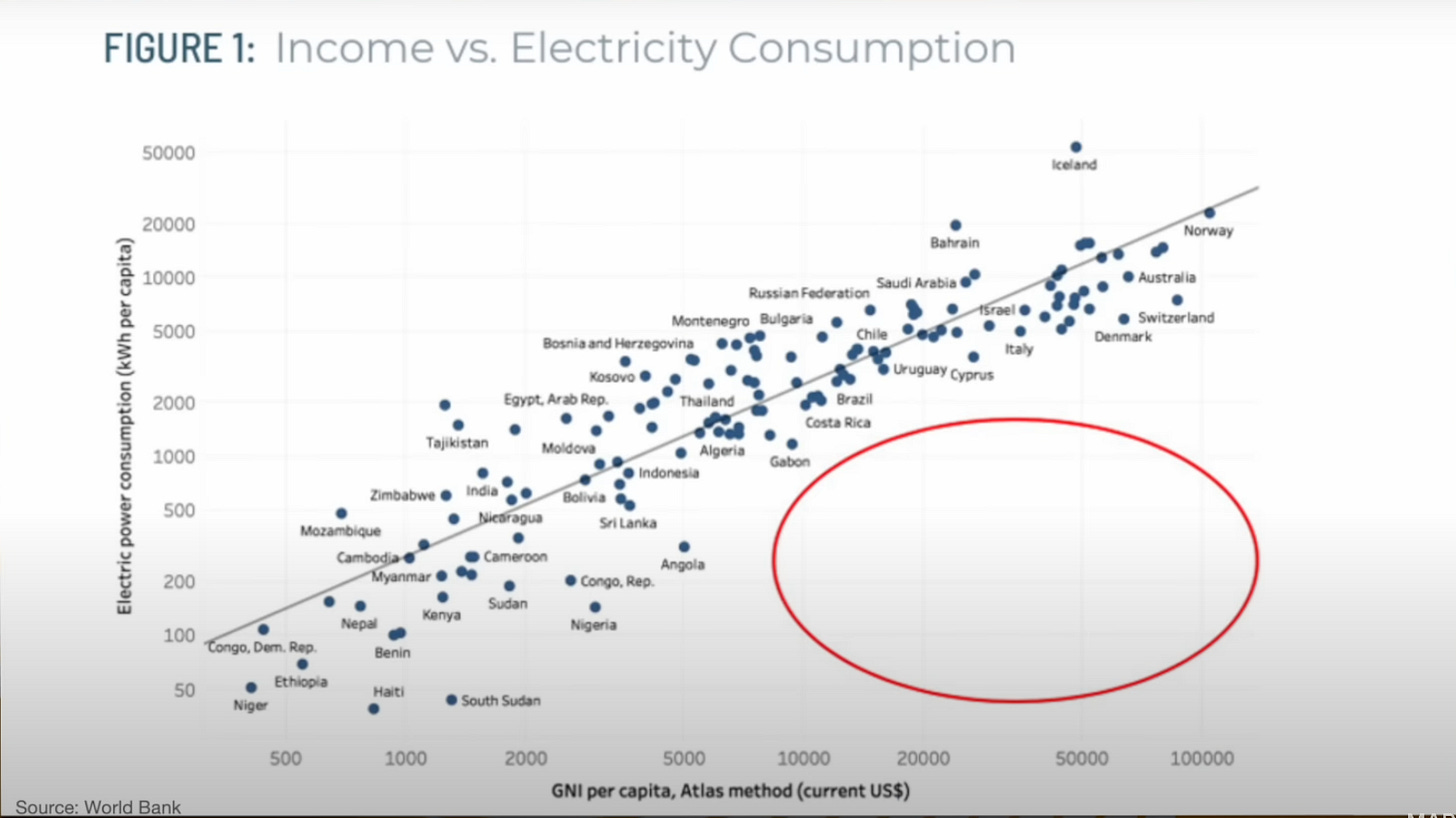

The real question is not that Bitcoin consumes too much electricity but why electricity consumption = bad.

The more electricity a nation/society can produce and utilize, the higher the quality of life.

Electricity generation is what allows for a higher division of labor and increased productivity and innovation.

Bitcoin miners are not stealing the energy that would be have used by a single family home.

They are using the electricity that would have otherwise been wasted. (Wasted electricity = cheap electricity)

Electricity consumption = good

It advances civilization and shifts time preference towards higher order goods.

These trivial misconceptions don’t end well for critics:

It is far more productive (and profitable) to put in the work to understand how Bitcoin REALLY works and not listen to the MSM story.

The best Bitcoin critic was a Stanford professor of economics who has compiled a complete list of its failures and weaknesses.

The complete list is as follows:

🦗

Be sure to stay tuned for the subsequent editions.

Have a good weekend✌️