The Power Law

Never sell your Bitcoin

Gm miners,

We will have a pro-Bitcoin president in 4 days.

How do we know Trump is pro-Bitcoin?

While you should take everything a politician says with a grain of salt, it’s difficult to ignore the bullish sentiment carried by the Trump administration.

For example:

“Make American the world capital for Bitcoin”

“American will become the world’s Bitcoin mining powerhouse”

It may be safe to presume we have a pro-Bitcoin president.

With such a catalyst, you may start to think about some price scenarios.

2025 price predictions range from $100,000 to $500,000 per BTC.

It is my opinion nobody precisely knows the future BTC/USD exchange rate.

It’s a rapidly changing market with an ocean of variables.

This doesn’t mean models are not useful.

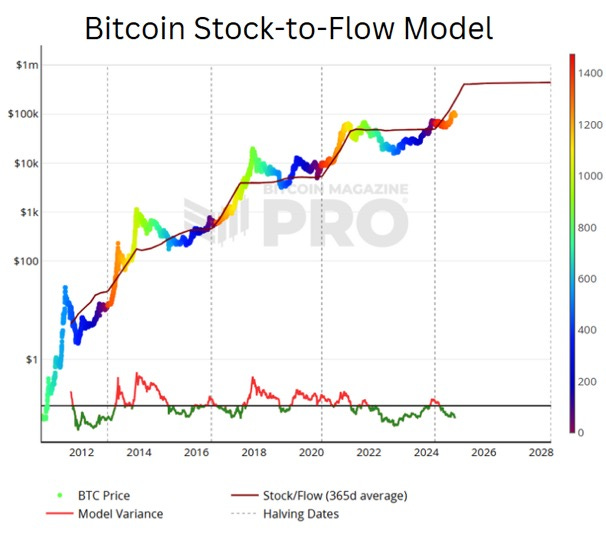

The S2F(Stock-to-Flow) model uses a formula based on BTC supply issuance and scarcity to forecast value.

The trend is insightful, but Bitcoin demand is not purely decided by the halving.

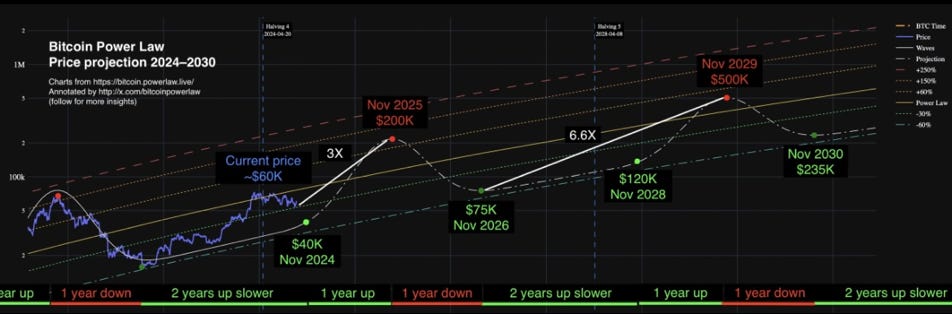

Another model is the Bitcoin Power Law:

I’ve also seen this version:

Per the creator of the Power Law Model:

Bitcoin has historically disrespected the “buy back lower” logic, regardless if you are using a model.

Is the Power Law special?

Let’s take a step back and assess what a power law is.

A power law is a relationship between variables where one quantity varies as a power of another.

The changes in each variable are proportional.

Power laws appear in nature:

Earthquake magnitudes, wealth distributions, city sizes, and the internet all follow a power law.

If we apply this to Bitcoin, the power law aims to model the network’s adoption and price trajectory.

Bitcoin’s value grows proportional to network size and time.

This model was introduced by Giovanni Santasi.

The theory builds on the several principles:

1. Adoption Drives Value: Bitcoin’s network effects (Metcalfe’s Law) create value as more users join.

2. Mining Feedback Loop: Increased price incentivizes more mining, increasing security and drawing in more users.

3. Difficulty Adjustment: Bitcoin’s built-in mechanism stabilizes block times as more miners join.

4. Bubble and Reset Cycles: Bitcoin’s price often overshoots due to speculative bubbles, then resets to align with adoption fundamentals.

5. Growth: Unlike an S-curve, Bitcoin’s adoption grows steadily, proportional to the cube of time.

The model predicts a “floor price”, often corresponding to the mining break-even cost, while also defining a best-fit line and resistance.

As you can see, the model has accurately defined the Bitcoin price range.

To be fair, the range is wide.

2025 has a range of $50,000 to $500,000.

The range can be helpful to gauge bubble behavior Bitcoin is known to exhibit, but it has limitations:

• Simplicity: The model ignores external factors like regulation, macroeconomic conditions, and technological shifts.

• Conservative: Predictions such as $1M by 2032. If a Strategic Bitcoin Reserve happens in the next 5 years, the price could move well past the range.

The Bitcoin Power Law should be used as a valuable tool to understand Bitcoin price dynamics and adoption trends, not a crystal ball.

If you ask the best investors how they are so good, they will not claim they can predict the market.

They will claim they can recognize patterns and trends.

Bitcoin has a long term trend of hyper monetizing, meaning it would never make sense to sell any.

Mathematical models can be extremely useful to organize frameworks and physical laws.

They are useful, not perfect.

Modeling markets like natural law is inevitably flawed.

Physics is more precise than economics.

Models following physics instead of correlation tend to be more accurate.

Filtering Bitcoin through the Power Law is mathematically a good description, but it does not paint the complete picture.

Bitcoin is a global asset anyone can exchange at anytime.

When Bitcoin becomes the foundation of a new global monetary system,

“all your models are destroyed.”

Have a good weekend✌️

I am kinda of curious if one would give one a loan if they sell their Bitcoin based on a price point set in the near future? If we know BTC will to a higher price; then what hard assets can be comparable for trade?

Nice piece!! Some great insight and value here.