What is Fractal Bitcoin?

And what does it mean for miners?

Gm simple miners,

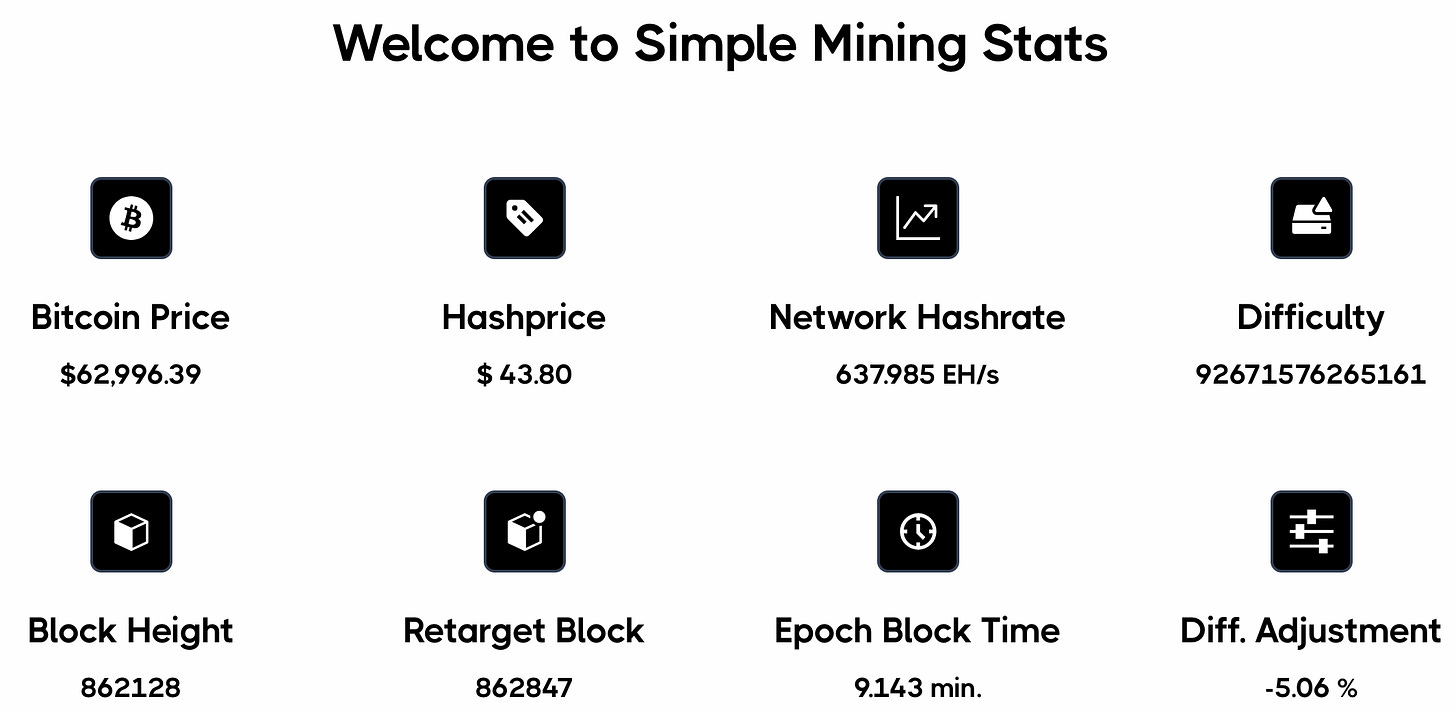

The Bitcoin exchange rate has made a pivot (as well as the Fed).

Wednesday was a significantly bullish day for Bitcoin.

The Federal Reserve announced they will cut the federal funds rate by 0.5 %.

This is typically good news as it means → investment spending is more accessible → liquidity increases → scarce assets increase in dollar terms.

As money becomes cheaper (lower interest on debt), the global money supply will increase, directly correlating with Bitcoin's price growth.

For every 10% increase in global M2 money supply, BTC pumps 90%.

Since July, M2 supply is up 5%, but BTC is down ~ 10%.

A reversal is in the cards.

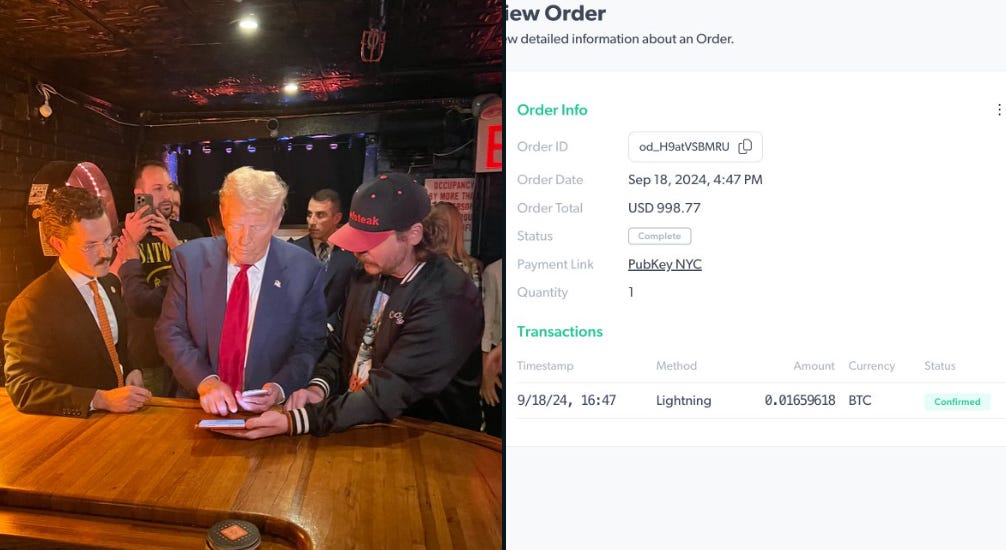

Not only was there a rate cut on Wednesday, but President Trump purchased a burger from PubKey NY… with Bitcoin.

Profitable times may lie ahead.

What is Fractal Bitcoin?

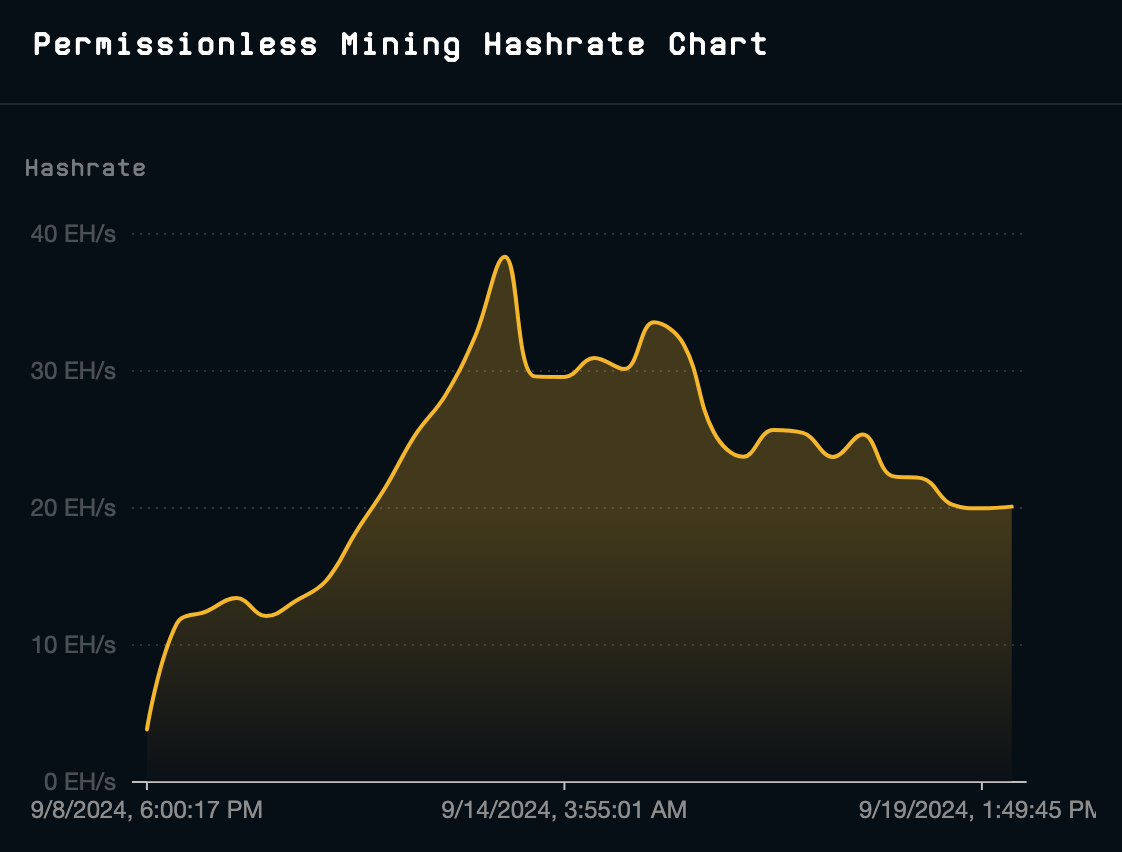

You may have seen this post regarding recent fluctuations in mining revenue:

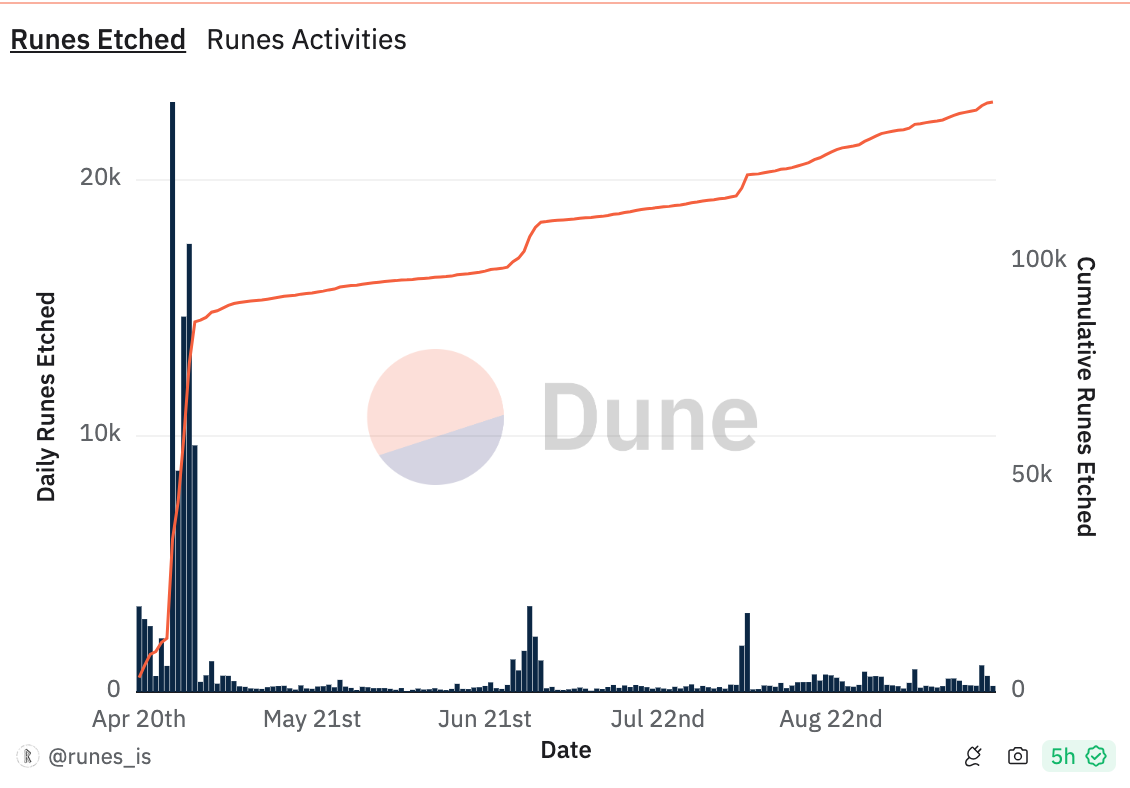

Based off these two charts, we can see Fractal captured ~ 40 EH/s from Bitcoin.

Why did this happen?

Three major Bitcoin mining pools (AntPool, F2Pool, SpiderPool) were enticed with the prospective rewards associated with merge-mining.

What is merge mining?

Merge mining is when proof-of-work from a parent chain (Bitcoin in this case) can be applied to another side chain (like Fractal chain).

Namecoin was one of the first projects to incorporate “merge mining”.

Here’s how it’s going:

Except Fractal does utilize mere merge mining.

It’s even more “innovative”:

Questionable Technical Design

Fractal Bitcoin uses a "Cadence Mining" system where only 1 in 3 blocks are merge-mined with Bitcoin, while the other 2 are mined solely on Fractal.

This is not ideal as it is attempting to incentivize miners to switch to Fractal to mine 2/3rds of the Fractal blocks.

This design is vulnerable from the start, as it may not attract enough distributed hashrate to prevent attacks.

The chain data is also growing at an unsustainable rate, potentially reaching 1 TB in size by the end of 2024.

This spells out centralization issues and high barrier to entry, as running a full node becomes increasingly difficult for average users.

Unnecessary Token and Premine

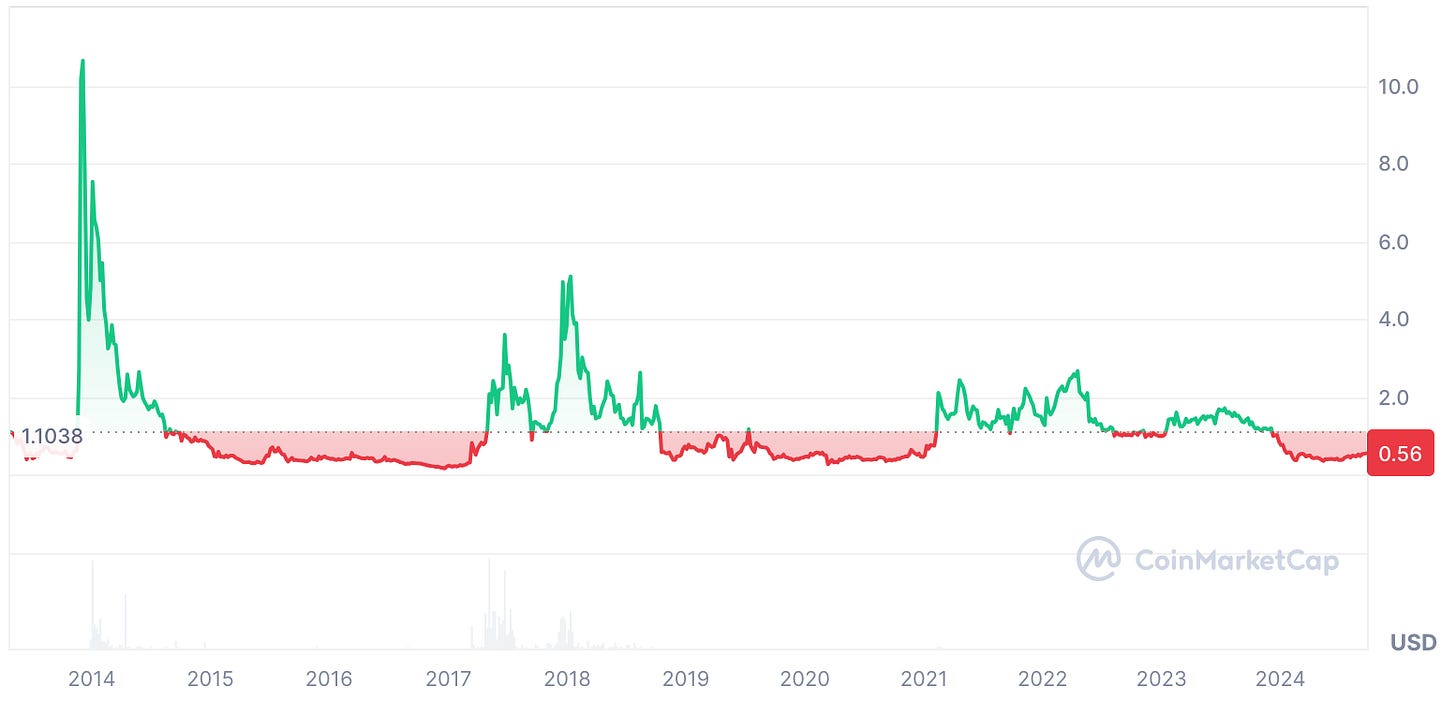

Just when you thought things couldn’t get more shady, Fractal Bitcoin introduced it’s own token, $FB.

FB token is not pegged to the value of a Bitcoin whatsoever.

But wait, I thought the entire purpose of Fractal was to “to ease network congestion on Bitcoin, enabling wider adoption”?

It is hard to fathom how launching a 50% premined token will contribute any portion of benefit to transacting on Bitcoin base layer.

This might ease the network congestion ( by distracting current users to the novel sidechain), but does not seem to increase Bitcoin adoption in any meaningful way.

The $FB token appears to primarily serve as a speculative asset, with its price rising 300% within 72 hours of launch. This is price speculation, not technological innovation.

Comparison to Lightning Network

Unlike the Lightning Network, which is a Layer 2 solution built directly on Bitcoin, Fractal Bitcoin is a separate blockchain with its own token. The Lightning Network offers:

True scalability without compromising Bitcoin's security model

Instant, low-cost transactions

No need for a separate token or premine

Fractal Bitcoin, in contrast, moves transactions to a separate chain with weaker security guarantees and introduces a casino token.

Main Issues

Centralization risks: The rapid blockchain growth is a hinderance to nodes. When there is low incentive to secure a node, decentralization is lost.

Security concerns: The Cadence Mining system introduces vulnerabilities not present in Bitcoin's proven consensus mechanism.

Regulatory uncertainty: A new token and chain may attract regulatory scrutiny that Bitcoin has largely navigated.

Distraction from Bitcoin development: Resources and attention diverted to Fractal could slow progress on Bitcoin's core protocol and proven scaling solutions like Lightning.

While Fractal Bitcoin has gained initial hype (like many other tokens of its kind), its long-term value proposition compared to Bitcoin and Layer 2 solutions like Lightning is not a serious consideration.

The profit incentives may be there for miners, as was the case with Runes.

In my opinion, it is best to avoid the Bitcoin enhancements that are obfuscated with technical jargon, and focus on the Bitcoin improvements that will have lasting impact.

Have a good Friday✌️