When Should I Sell My Miner?

How to optimize your Bitcoin mining investment

Gm miners,

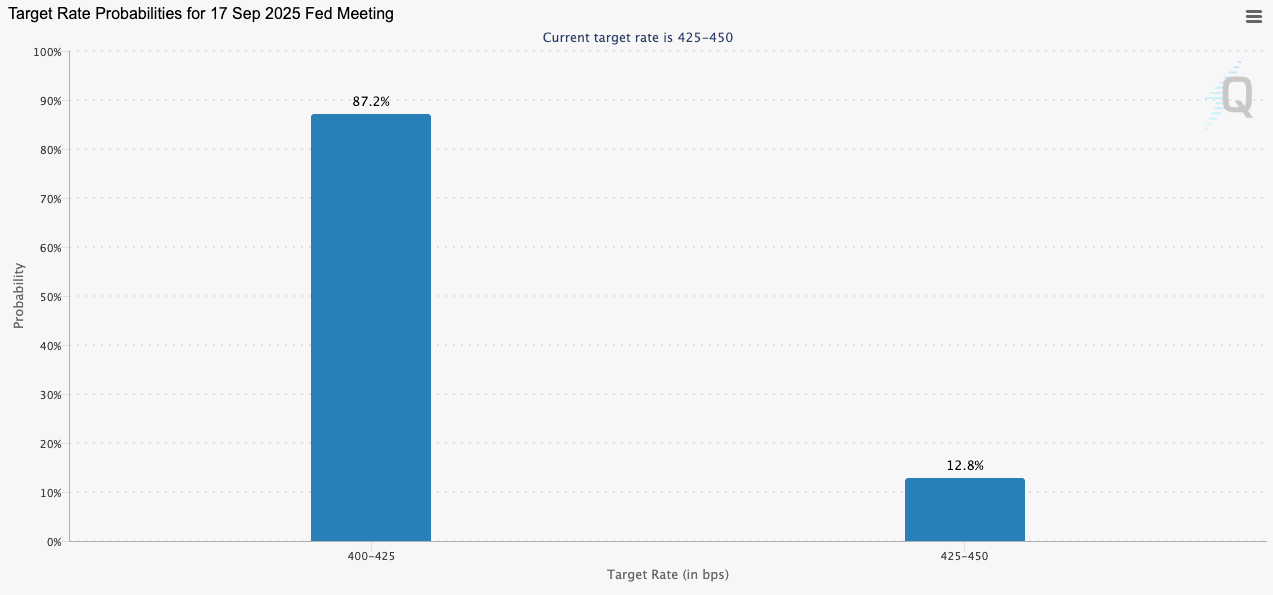

FedWatch is currently predicting 87% chance of a rate cut in 20 days.

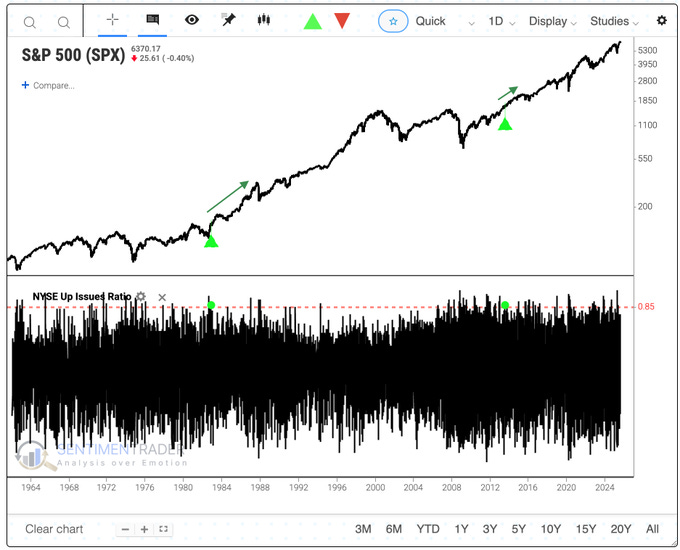

90% S&P 500 stocks recently closed higher than the day before on the NYSE.

This has never happened before.

There were two historical instances of 85%, and both kicked off multi-year bull runs.

What does all this mean?

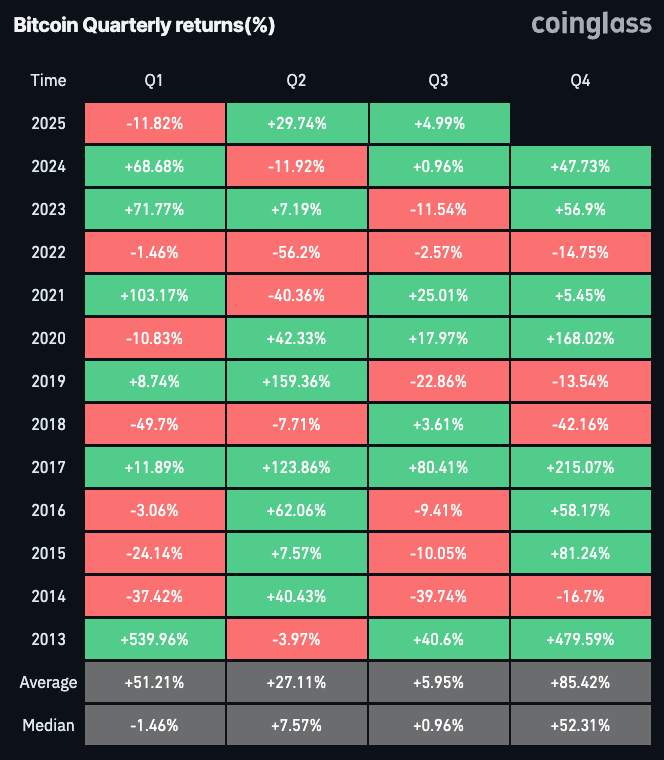

The macroeconomic environment is bullish, and Q4 is around the corner.

Q4 has historically had the highest average BTC gains.

You just bought a Bitcoin miner.

Now you're wondering how long you should run it before rotating your position.

If you’re also wondering how long your miner will last and remain profitable, refer to this letter I sent out last month:

From the data I have seen, and if you are mining at 7-8¢/kWh, it is a good rule of thumb to sell your miner before it becomes a paperweight.

Why is this?

Take the S19 as an example.

In May of 2020, an Antminer S19 cost ~ 0.22 BTC ($2100)

Since April of 2024 halving, the Antminer S19 has not been profitable.

From 2020-2024, with 2% downtime & fees, the S19 mined ~ 0.607 BTC

The cost from 2020-2024 was roughly 0.31 BTC at 7¢ per kWh

The S19 is now essentially a paperweight.

So total profit over 4 years was 0.077 BTC (0.607 - 0.53)

This could have been DRAMATICALLY IMPROVED if the S19 were sold at any point when it was still competitive and profitable:

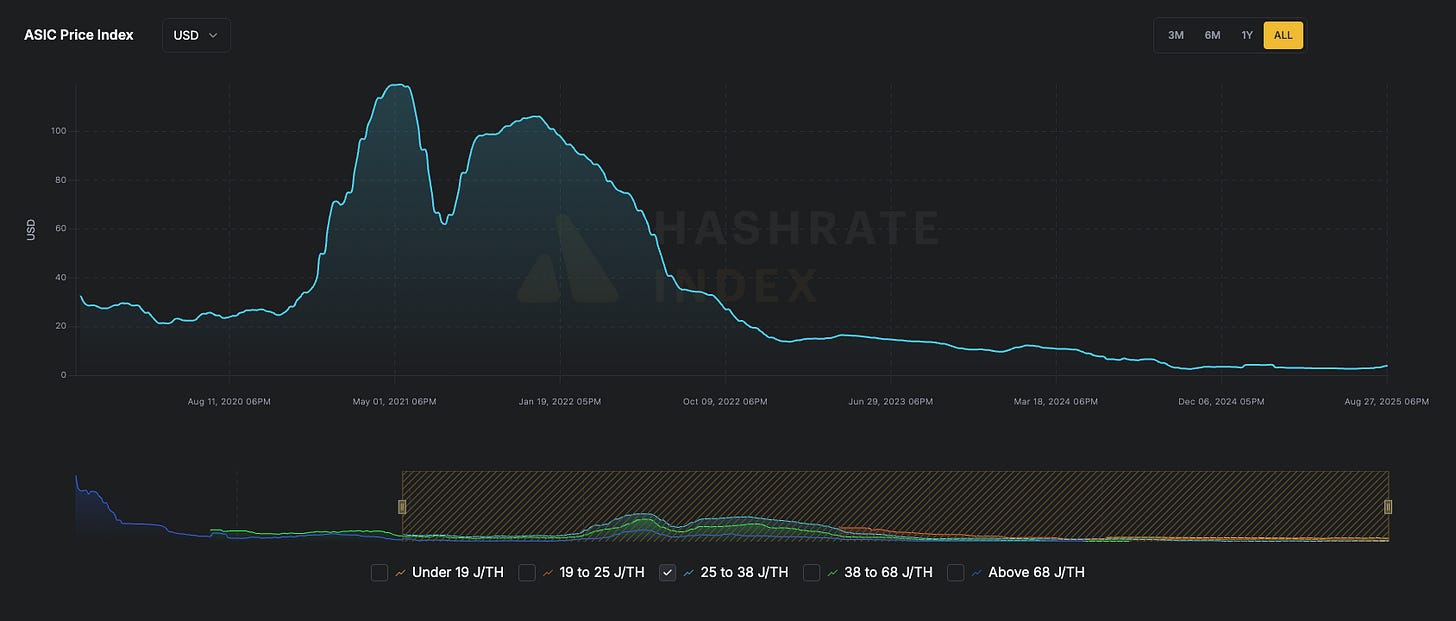

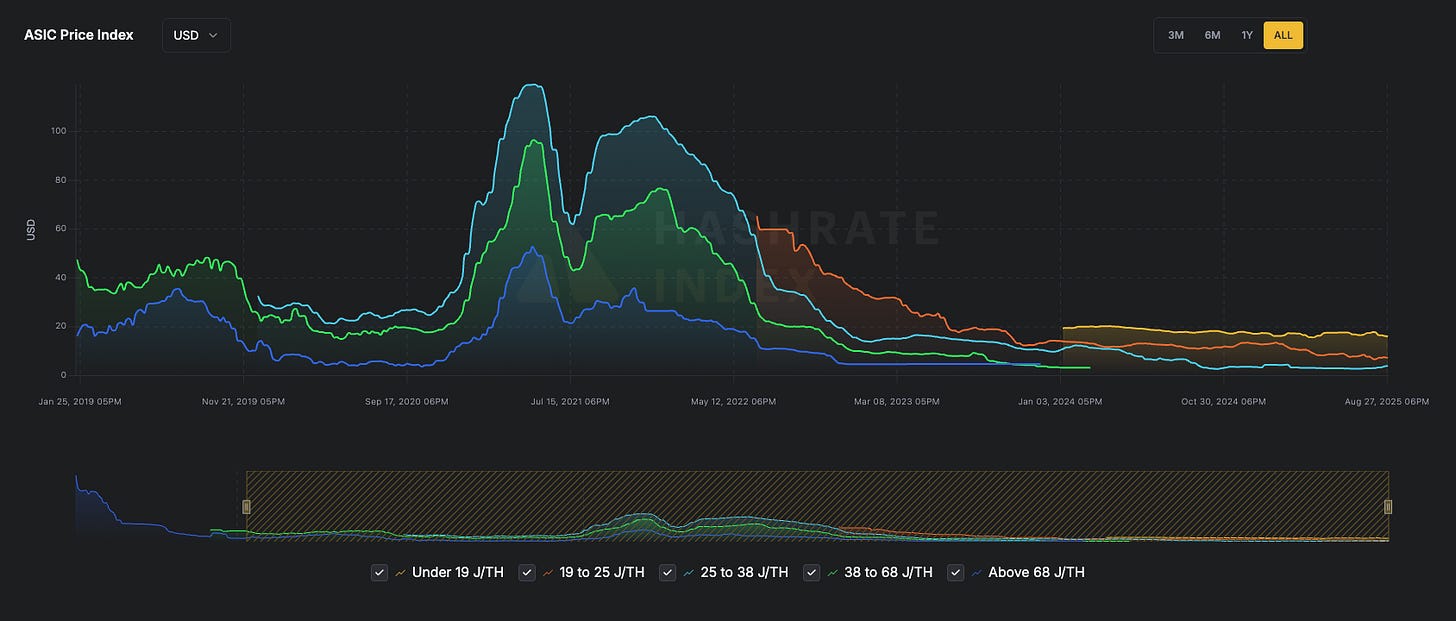

This chart shows the price per TH of the S19 since it came out in 2020.

Based on this chart, the optimal time to sell the S19 would have been between December 2020 and October 2022.

The Question That Keeps Miners Up at Night

When exactly should you pull the trigger on selling or upgrading your mining equipment?

The answer lies in understanding three interconnected forces:

Hashprice cyclicality

Miner cost basis

Four-year cycle.

Understand these, and you’ll have a much clearer picture of when to double down and when to be reserved.

Understanding the Mining Hardware Game

Bitcoin mining isn't a technology business. It's a commodity business wearing a tech costume.

Think of your miner like an oil drilling rig.

The rig itself matters less than the price of oil (Bitcoin) and your cost to extract it (CAPEX + OPEX).

Just as oil companies don't replace their rigs every time a slightly more efficient model appears, successful miners understand that hardware turnover is about market cycles.

The key metric here is hashprice: how much you earn per unit of computing work.

And right now? We're in a cold basement.

The Data Tells a Story

Both miner prices and hashprice sit at historical lows.

Here is the Miner Price Index:

The 2021 hashprice bull run was euphoric. Miners made a killing.

But what is the current situation?

Flat and declining.

Machines are trading at discounts not seen since the 2018-2019 “crypto winter.”

Why is this the case?

1) April 2024 halving 2) Hashrate/difficulty is at all-time highs 3) Price is lagging

This is the most telling chart:

16 months after 2020 halving Bitcoin price was up 444%

16 months after 2024 halving (today) Bitcoin price is up 75%

If this epoch were on pace with the performance of last epoch, the Bitcoin price would be well over $300k.

So we know things are not overheated.

We also know we’re not at rock bottom (rampant miner capitulation).

CoinShares reported the average miner cost basis in Q3 2024 was around $55,000 per coin.

It is now likely closer to $65K.

When Bitcoin trades below $65K, miners start bleeding.

Machine prices collapse as operators liquidate to cover costs. When Bitcoin climbs above this threshold, especially well above it, miner prices surge as profitability returns and FOMO kicks in.

Past Cycles Reveal Future Opportunities

Mining hardware has historically followed a “predictable” four-year rhythm tied to Bitcoin halvings:

Year 1 Post-Halving (where we are now): Hashprice crashes as block rewards get cut in half. Weak miners capitulate. Hardware prices bottom out 6-12 months after the halving. This is the accumulation window.

Year 2-3: Bitcoin typically enters a new bull phase. Hashprice recovers despite increasing network difficulty. Miner prices surge 3-10x from their lows. This is the distribution window.

Year 4: Approaching the next halving, uncertainty creeps in. Smart miners start rotating out of older equipment that won't survive the next reward cut. This is the rotation window.

If this pattern continues, we're currently in the accumulation zone following the April 2024 halving.

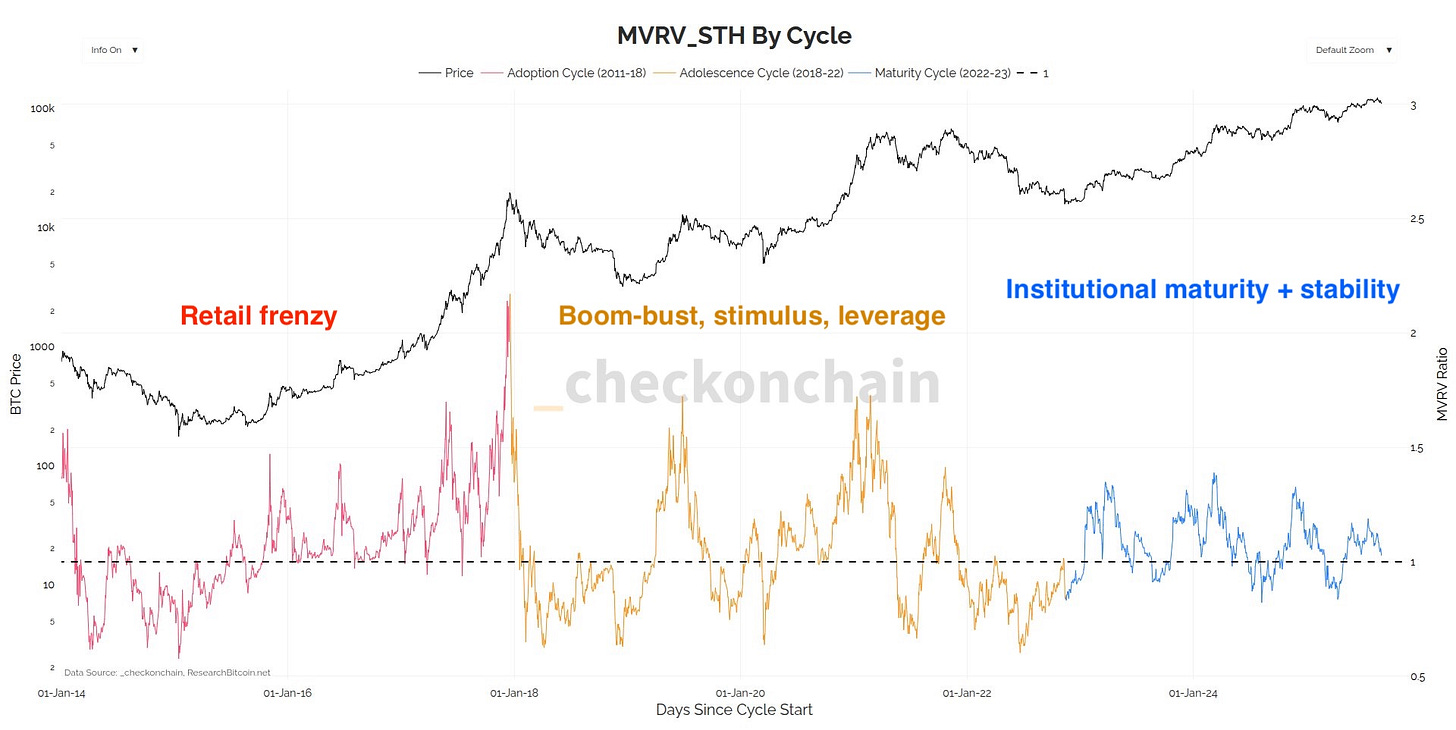

Here is an interesting chart h/t James Check (Checkmatey) :

This would suggest that Bitcoin “cycles” are not based around halving epochs.

Bitcoin price performance is more impacted by adoption trends, global liquidity, and capital markets structure.

But we also can’t completely ignore the halving effects.

The halving certainly has a part to play in the supply/demand dynamic of Bitcoin.

Logically, fewer daily Bitcoins issued combined with increasing demand, the price goes up.

The Macro Picture Changes Everything

Bitcoin mining hardware is really a leveraged bet on three things:

Bitcoin price appreciation

Hashprice long call option (bet hashprice will go up)

Fiat currency debasement

In this era of fiscal dominance, the setup for miners improves dramatically over a 4-10 year horizon. Short-term hashprice pain masks long-term structural advantages.

Consider this:

Every previous cycle, people declared mining "unprofitable forever" at the exact bottom. They extrapolated current hashprice into infinity, ignoring that price appreciation continues to outpace upward difficulty adjustments.

Your Action Framework: Two Scenarios

Scenario 1: You own older generation miners (S19 series or older)

Your machines are right on the profitability margin at 7-8¢ power cost, barely above water.

If you should sell/upgrade depends on how you want to be positioned for bullish price action.

You may have already recouped your CAPEX, and any mined surplus is pure profit.

This will increase with hashprice, but will not have as much leverage as a new-gen machine (you will mine more Bitcoin with a more powerful unit).

Under current market conditions, it is difficult to try to sell these older S19 machines.

At Simple Mining, there is a “Miner Swap & Save” program.

You can trade in your older equipment hosted with Simple Mining and receive credit towards the purchase of a new machine.

If you’re interested in this program, email sales@simplemining.io

Scenario 2: You own current-generation miners (S21 series, hydro miner)

These machines are deep “in-the-money.”

You can mine profitably all the way down to $60K Bitcoin price.

And we know hashprice nor miner price index is overheated compared to historical numbers.

With tailwinds ahead, you want to be plugged in and hashing.

Only sell if:

You need immediate liquidity

Someone offers you 2x what you paid (unlikely at current prices)

You want to upgrade for more leverage

Say for example, you have an S21 200T and you decide to sell to upgrade to S21+ hydro 395T.

The S21+ hydro would return double the daily BTC revenue vs the regular S21.

Otherwise, this is your accumulation period. Consider buying more machines at these depressed prices.

Tools for Timing Your Decision

Track these metrics to keep a pulse on mining profitability:

When this increases, miner profitability increases.

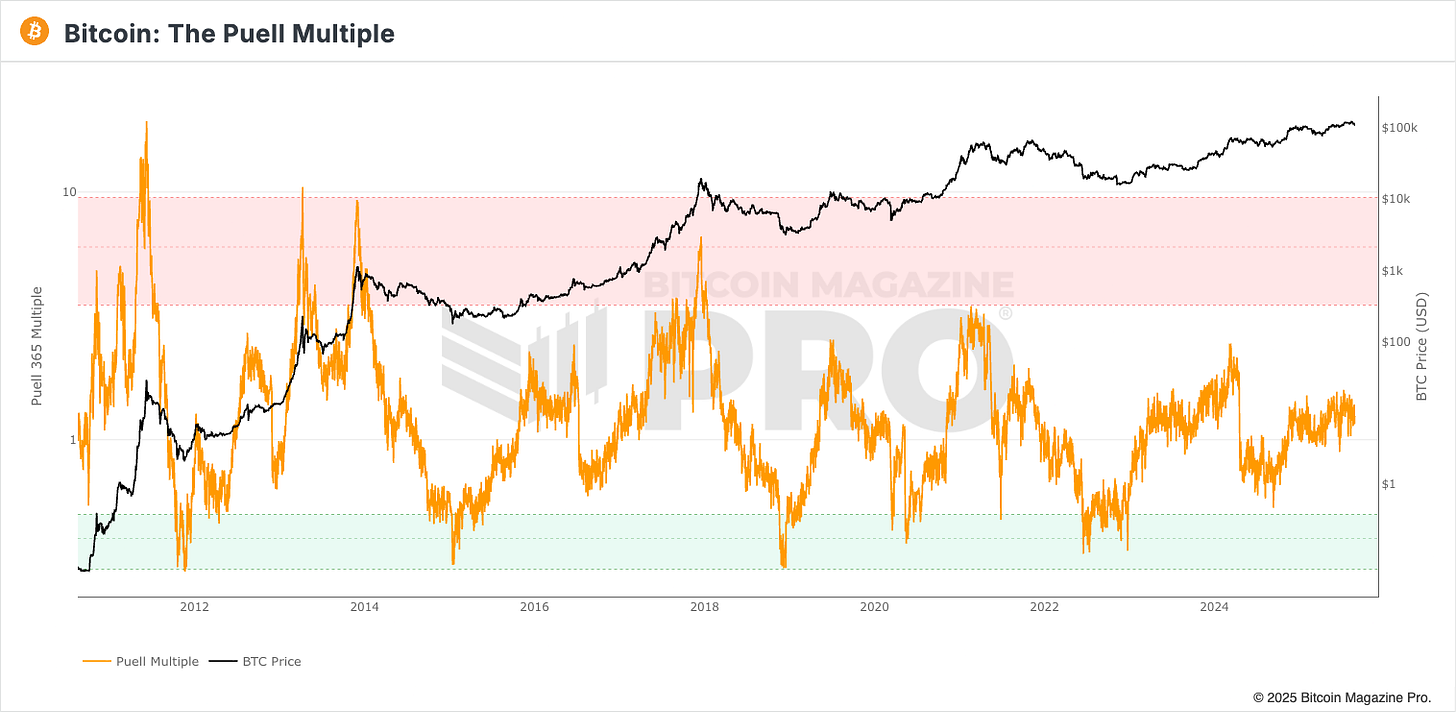

This indicates miner revenue extremes.

Red means miners are earning a high multiple compared to their 365-day average.

Green means miners are earning a low multiple compared to their 365-day average.

Green has historically been a good time to buy, red a good time to sell.

Your own cost basis per Bitcoin mined (know your breakeven).

Depending on your miner model and cost of power, this could vary.

Keeping a healthy profitability margin helps you maintain long-term exposure.

The Bottom Line: Patience Pays

Right now, we're in a buyer's market for mining hardware. Hashprice sits in a valley. Miner pricing is weak.

History shows this is precisely when future mining fortunes built positions.

Your Next Move

The miners who win don't chase the latest technology or panic during hashprice drawdowns. They understand market reflexivity and get greedy when everyone is fearful.

TLDR

Macro signals are bullish

You can end up with more BTC by selling your equipment before it dies.

Hashprice, cost-basis, and market cyclicality determine when you should sell.

Current prices are depressed (not a good time to sell unless upgrading)

This is because mining difficulty is up, and price is lagging (vs historical)

Monitor miner price index, hashprice, and Puell Multiple

It seems we are in the accumulation phase.

In mining, the money isn't necessarily made by having the newest machines. It's made by having the right machines at the right time.

This is the way I think about managing my mining position.

It’s not perfect, and timing the market is easier said than done (and maybe shouldn’t be done at all)

But if you are serious about accumulating as much Bitcoin as you can, it’s food for thought.

Have a good weekend✌️

Very coherent thanks for sharing

Hello 👋 guys, I am living in the Philippines 🇵🇭 and I want to sell or transfer my Bitcoin mining funds 1.349 , Binance and coinbase are been not very helpful in their support, anybody way to help me to sell or transfer this btc, Bitcoin so I can buy a car, thank you for the update